Everybody you know how they say diamonds are a girl’s, best friend well for investors it’s a little bit different, I mean why do people want to be friends with rocks anyways for some investors gold is the best friend, which I guess is still sort of like being friends with a rock, and for other investors real estate is their best friend, and some investors are also best friends with the stock market, but I already made a Blog talking about that.

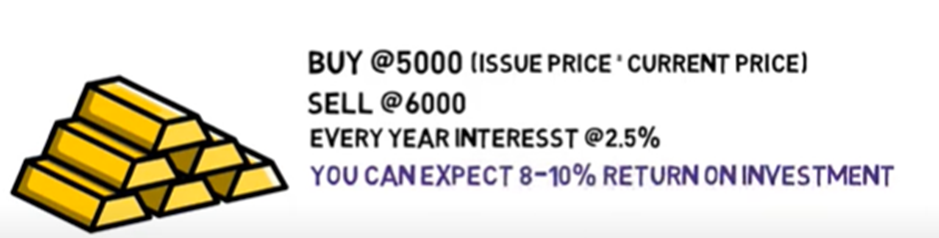

This blog I have telling you two investment options, Real estate and Gold investment. Gold you don’t have to go out, and physically buy gold bars or gold coins, I guess I mean that’s one way to do it, but there are easier ways to invest in gold. you can invest in an ETF (Exchange-Traded Funds), which is a fund that mimics the value of physical gold, through the stock exchange or you can invest in companies, that mined gold through the stock market. the first reason investors love gold is, because it’s a hedge against inflation every single day. the Federal Reserve or the Fed prints, something around five hundred and sixty million dollars’ worth of currency. Wow makes you wonder if you could just invest in a machine, that prints money like them. that would definitely be every investor new best friend.

The price of gold goes up because people buy more gold, as a hedge against inflation, second people like investing in gold, because with his blood on the streets. you know Wall Street that is people turn the gold. remember that 2008 crash when the stock market tanked well, it was a very good time for gold investors between 2007 and 2010, the stock market was sliced in half, but during that same time the value and price of gold almost doubled. Third people like investing in gold, because it’s a tangible asset most traditional investments, like stocks bonds if 401 K are all paper assets, so you don’t have any real diversification, because all your money is tied up in one asset class paper assets, physical gold is a physical asset you can see it you can touch it. you can smell it you can taste it, if you really wanted to and so this provides you with some real diversification, because now you’re investing in a different asset class not too complicated, only gold offers some diversification to investors. these are some of the biggest punches Gold brings to the fight, first gold is a hedge against inflation, second Gold provides you put protection, when things go wrong on Wall Street, and third gold is a physical asset, so you have real diversification, but before gold knocks out real estate, let’s take a look at what real estate brings to the fight by flipping the page the first punch.

Real Estate, real estate brings to the table is that it is a physical asset just like gold, real estate is tangible, you can see you can touch it you can taste it if you really wanted to again, and so this provides you with real diversification, just like how gold does, second just like gold real estate is also a hedge, against inflation if more money is printed and the price of things go up, the price of real estate goes up, and the amount of money you can charge for rents go up too, this is where things get different, because of why you buy real estate. remember people turn to gold when things go wrong on Wall Street, which is why the price of gold almost doubled between 2007 and 2010, and during that same time the price and real estate dropped almost 20%, and then it continued to drop after that again, but unlike gold the reason you buy real estate is not just to sell, your property for a big profit, you should be buying real estate to create positive passive income every single month, that’s not something you can do with gold, if you’re buying real estate with the hopes of selling this property for a profit, sometime in the near future. well then, you’re a flipper you’re not a real estate investor, a real estate investors job is to buy a property, and then create cash flow from this property every single month or every single year, so the reason why you buy real estate is very different than why you buy gold and the last major punch.

Difference between real estate and gold is.

That tax breaks you get for investing in real estate, and I do have to say that although I am a licensed attorney, I am NOT your attorney, so if you have specific tax questions, talk to a tax professional in your area real estate is a legal tax shield, because if you get regular rent checks deposited into your account every single month, you qualify for a tax break called a depreciation, deduction, where you get to tell the IRS (Internal Revenue Service), hey I made a profit from my real estate rental income, but I deserve a tax break, because my property is one year older, and yes this is 100 percent me go the second tax break, you get is when you sell real estate, if you went out and you bought $100,000 worth of gold, and this gold doubled in value $100,000, and then he decided to sell this $200,000 with the gold. because you wanted to buy I don’t know diamonds, because you changed who your best friend is, well you can’t use all of this $200,000 to buy diamonds, because you have to pay taxes on this money, I mean you had $100,000 with the profits with real estate, if you spent $100,000 on a property, and then this property doubled in value to $200,000, and you sold it you could spend all $200,000 that you made from this property, and use it to buy a bigger property while paying zero dollars in taxes on these profits, today with something called a 1031 exchange.

So, Who Wins, who wins this title match, and will be crowned champion and best friend of investors gold or real estate, well before I tell you my answer Now, and let me know who you think wins, gold or real estate. I think it’d be really interesting to compare answers, and let me know gold or real estate, and let me know why, and yeah, I’ll see you in just a second real estate real estate wins with a knockout punch, because passive income is king. I picked real estate because, when you invest in real estate, you can start taking advantage of the benefits of investing in real estate, today with passive income and tax breaks versus with gold, you don’t get to use the benefits of gold, I’ll tell you sell your gold and then you have to, hope that you can sell your gold and a profit versus with real estate, you can start creating passive income very soon, and now if you’re thinking okay, but how can I get involved with real estate, or I don’t have a ton of money I can’t go on and buy properties.

Well, I already made some Blogs, where I explain how you can get started with real estate investing and I’ll link those Blogs in the website below for you. to read right now. thank you for reading.