Hello, my name is Rupesh Jadhav And welcome to the Rupeshfinancialexpert.

Where I unlock finance knowledge. In this blog, I will be writing about how you can generate CIBIL scores for free. from the website of CIBIL, I will tell how you can generate your report, what is your score and what other information is available. This blog is a part of a blogs series, where I wrote CIBIL scores in detail. In the previous blog, I have written the concept of the CIBIL score and what it is. How a good score helps you in getting a loan. And I have also written on which factors the CIBIL score depends. And what are the four important factors, so if you haven’t read that blog yet, read that blog first. In this blog, I will show a credit report. And how you can see your credit report online for free. you can see it on the website of CIBIL, and you don’t have to pay any charges. And along with it, I will also show what other information you get in a credit report. so, you must read this blog from beginning to end.

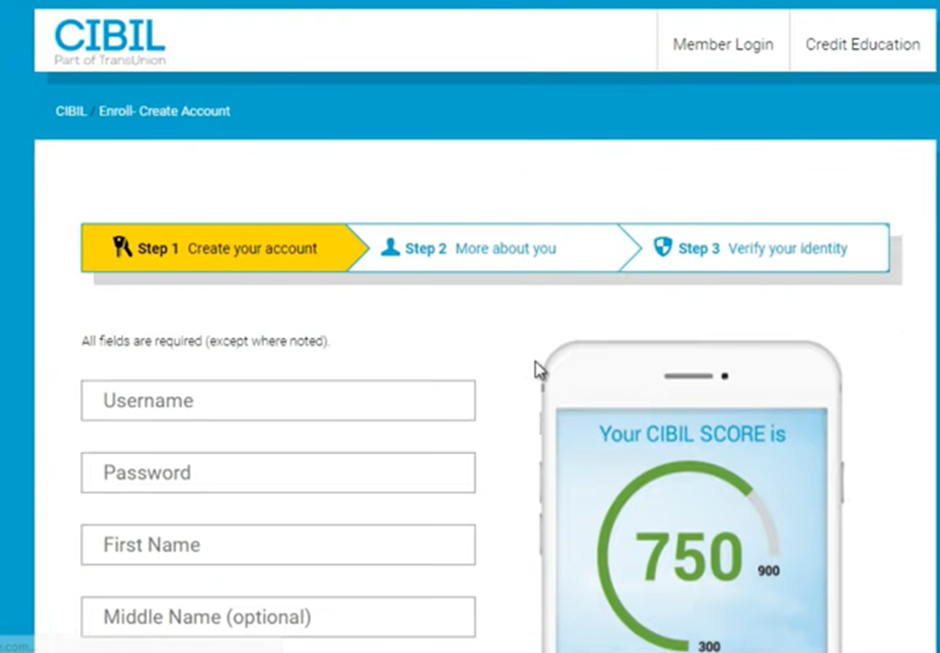

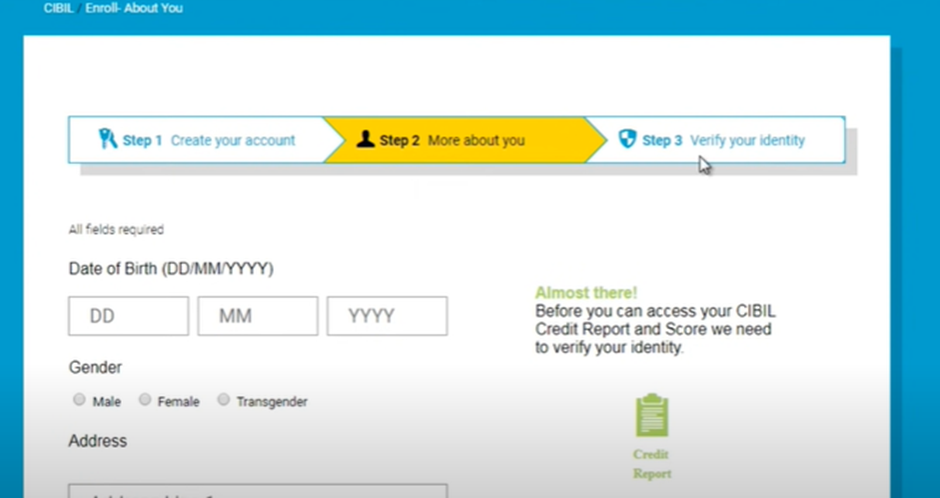

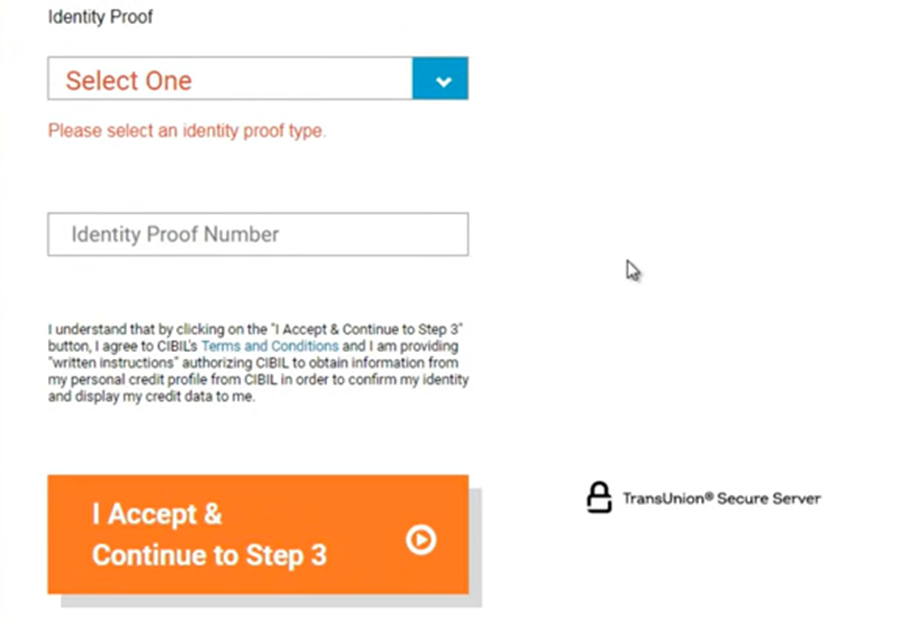

How to Check CIBIL Score? Demo To check your CIBIL score, first you will go to Google. type “CIBIL score check” on google, when you enter, you have to click on the first organic result you get. Ignore ads, this is the official website of CIBIL. cibil.com This window will open when you click on the link. After that, you have to click on “get yours now”. After this, you will have to create your profile there. So, their fill in your username, password, first name and fill in all these details. So, there I have filled in all the details as a sample. After that, you will go to Continue to Step Two. In step 2 you will get the details like date of birth, gender, address. You have to fill in all these details. After that, you have to mention your I’d proof. Accordingly, your proof will appear, and your profile will be created. After that, you will click on the “continue to step 3” In step 3 you will verify your identity. So, I have already created my profile. Once you have created your profile, you will go to the member login.

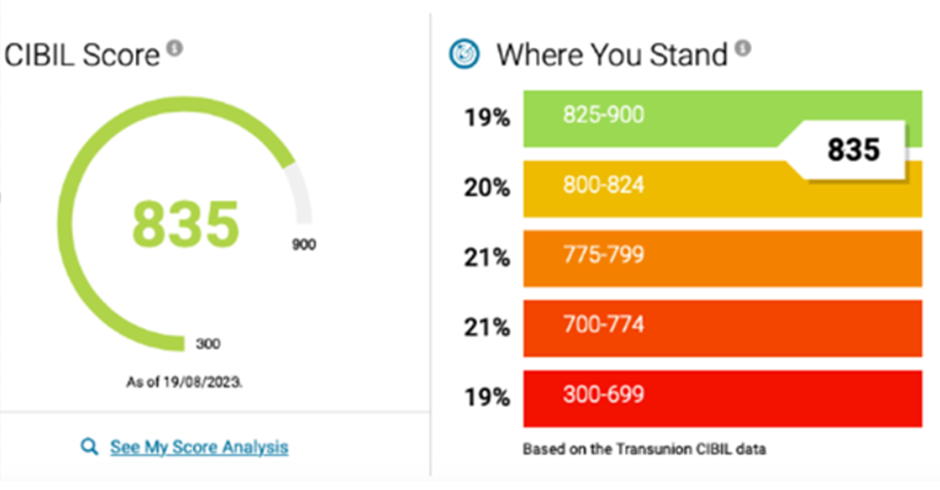

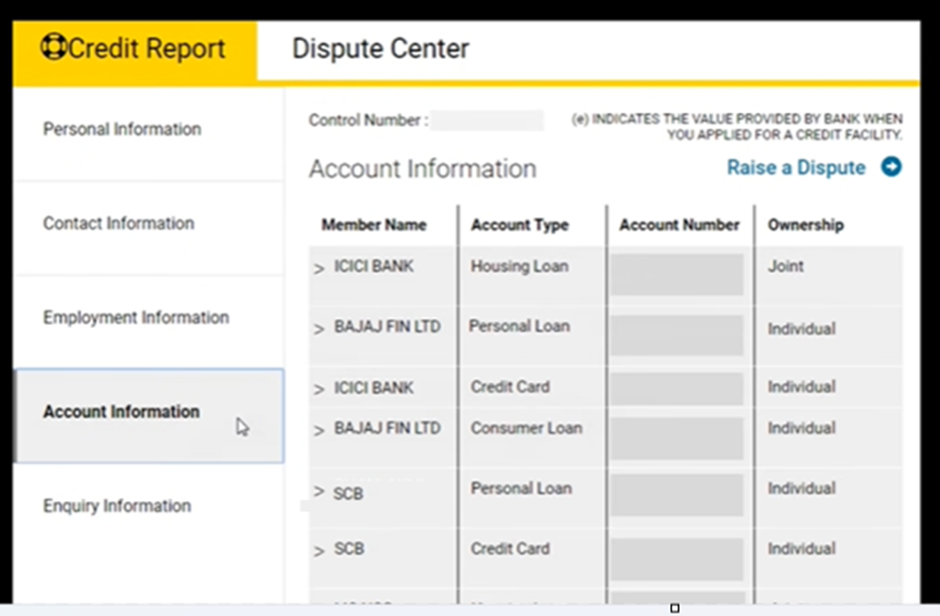

I already logged in to “member login”. My profile is visible on this side and my score is visible on this side, 835 is my score now, Which I also showed you in my last blogs, so I took the snapshot from here. Let’s see what other details are available below. A lot of things are paid here. So here If you want your credit summary, then can upgrade for this you have to pay for it. You can also buy your credit reports, you can watch the score history by upgrading. So, by clicking here you can view your credit report, let us see what other details come out in the credit report. So, let’s quickly see what information you get in your credit report. Your personal information comes first. Then contact information, employment information, And lastly account information and inquiry information. So here I will highlight the account information. inquiry information is most important. because on its basis your credit score is decided.

Now let’s I will check what details are in it. Your name, date of birth, and gender appear in personal information. your PAN and your voter ID, with whatever identification you have logged in there, it comes Then under the contact information your address details, telephone numbers, and email id. And see here, because I have changed my houses 3 to 4 times, that’s why 4 different address details are shown here. After that, your employment information comes. And maybe because I have applied for a housing loan. It’s showing a housing loan account. After it dates reported, it is generated through the last date report. Occupation ad income appear here, so this is your employment information. After account information and employment information, so pay attention here in the account information, all the details of all your previous loans or if you applied for credit cards are shown here. So, see here I have applied for Housing Loan, Credit Card, Personal Loan, Consumer Loan.

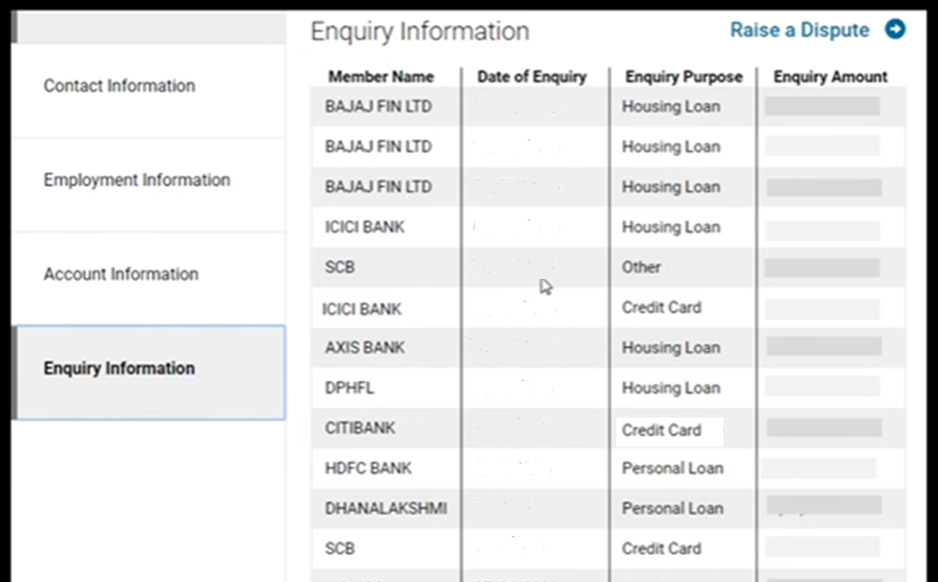

Then again, a credit card, housing loan, housing loan. because all this has been applied, so CIBIL also has all these details. Wherever I have applied, all the details are with the CIBIL. After its inquiry information. Inquiry means that whenever I have inquired for a loan or any credit, Maybe I have not taken loan and credit card from all of them, but all the inquiries that I have generated since 2013 till now, all of them are being shown here. From 2013 to 2023, today It has been almost 10 years, so there is not much inquiry within 10 years. So, as we discussed in the previous blogs, if you generate a lot of inquiries in a short period, then it can have a bad effect on your credit scores. And as inquiry is not much. I only enquired as much as I needed to do, so probably it didn’t affect my credit score.

So today, it’s showing I have an 835-credit score. Points to Note about Credit Score, A credit score above 750 is considered a good credit score. So, as we discussed in the previous Blogs, that NA and NH does not make much difference, suppose if you have not done any activity within the last few years. And you have not made any credit card payment, or you have not used the credit card. Or the loan is not paid, so it’s called NA, so it becomes no credit activity. No credit history means If you have not made an entry in your credit system. You have not used any credit card yet. Or you have never taken any loan. So, you don’t have any credit history. Or if you haven’t generated enough credit history then also it can show you NH. So, NA and NH does not make much difference.

If you want to generate your CIBIL score, then you can purchase any credit card. If you start using it, then your credit history will also start building, and then your CIBIL score also starts generating. So, in this blog, we have seen how you can generate your CIBIL score for free. And you can generate your credit report as well. And we have also seen all the details, what kind of details you get in the credit report.

Now in the next blog, we will see how your credit score is calculated. And how can you improve it If you liked this blog, please like it. And also share this blog with your friends and family members. So that they can also benefit from this blog. If you have any suggestions or if you want to give any feedback related to this blog or this website, then you can tell us in the comment section. And you can also suggest topics for future blogs as well. I read all your comments regularly. So, by commenting maximum, tell me which other topics I should cover. Because I will keep bringing such informative and finance-related blogs every day. see you in the next blog.

So, till then keep learning, keep earning and be happy as always.