RBI’s New CIBIL Rules: Shocking Changes You Must Know for Easy Loan Approvals!

Maintaining a good CIBIL score is now easier! The Reserve Bank of India (RBI) has introduced new rules from January 1, 2025, that make the credit process more transparent and consumer-friendly. These changes ensure faster updates, better notifications, and quicker complaint resolutions.

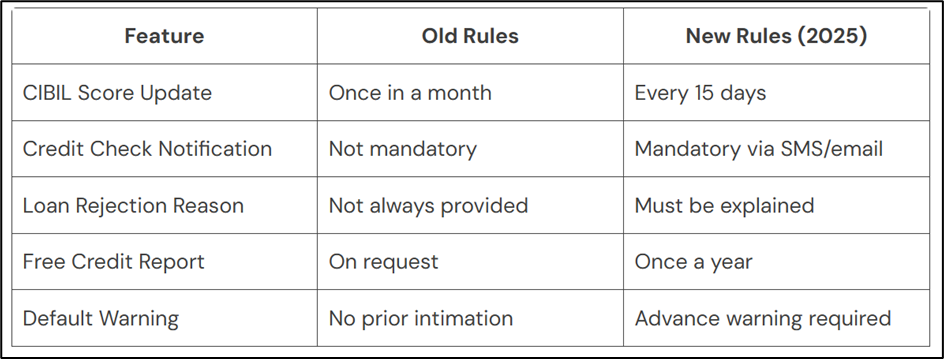

Key Changes in RBI’s CIBIL Rules

- CIBIL Score Updates Every 15 Days

Earlier, credit scores took weeks to update. Now, your CIBIL score will be refreshed every 15 days, ensuring lenders see your latest credit behavior. - Alerts for Every Credit Report Check

Whenever a company checks your credit score, you will receive an SMS or email notification. This keeps you informed about who is reviewing your financial history. - Loan Rejection? Know the Exact Reason

If a bank rejects your loan, they must now provide a clear reason. This transparency allows you to fix issues and improve your creditworthiness.

Quick Comparison of Old vs. New Rules

Why These Changes Matter

- Faster Updates: Your financial behavior will reflect in your CIBIL score sooner.

- Better Awareness: You’ll know whenever a bank checks your credit history.

- Easier Loan Approvals: Transparency helps you address issues and secure loans faster.

Did You Know?

A CIBIL score above 750 increases your chances of getting a loan at lower interest rates!

With these new RBI rules, staying creditworthy has never been easier. Keep an eye on your CIBIL score and enjoy hassle-free loans!