Save More with These Income Tax Deductions!

Are you a salaried employee looking to reduce your tax liability? You can legally lower your taxable income and save money using various deductions. Here’s how you can make the most of tax-saving options in FY 2024-25.

- Essential Tax Deductions You Must Know

Standard Deduction (Flat ₹50,000)

Every salaried individual gets a standard deduction of ₹50,000. This applies to both the old and new tax regimes.

House Rent Allowance (HRA) – Section 10(13A)

If you live in a rented house, you can claim HRA exemption. The deduction is the least of:

* Actual HRA received

* 50% of salary (metro) or 40% of salary (non-metro)

* Rent paid minus 10% of salary - Popular Tax-Saving Investments

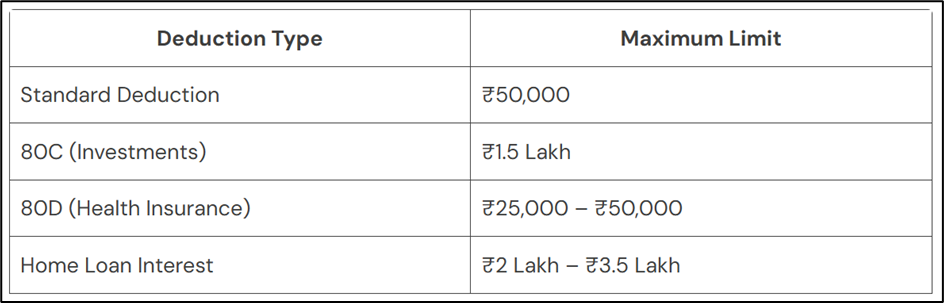

Deductions Under Section 80C (Limit: ₹1.5 Lakh)

You can invest in the following to claim deductions:

* Employee Provident Fund (EPF)

* Public Provident Fund (PPF)

* Life Insurance Premiums

* ELSS Mutual Funds

* 5-Year Fixed Deposits

National Pension System (NPS) – Section 80CCD

* Additional ₹50,000 deduction over and above the 80C limit under Section 80CCD(1B).

* Employer’s contribution (up to 10% of salary) is deductible under Section 80CCD(2). - Health & Home Loan Deductions

Medical Insurance – Section 80D

* Self, spouse, children → ₹25,000

* Parents (below 60) → ₹25,000

* Parents (above 60) → ₹50,000

Home Loan Interest – Section 24(b) & 80EEA

* ₹2 lakh deduction on home loan interest under Section 24(b).

* First-time homebuyers can claim an additional ₹1.5 lakh under Section 80EEA.

Did You Know?

You can claim an additional ₹5,000 for preventive health check-ups under Section 80D!

Final Thoughts

By utilizing these deductions wisely, you can save thousands in taxes. Invest smartly and make the most of your hard-earned money!