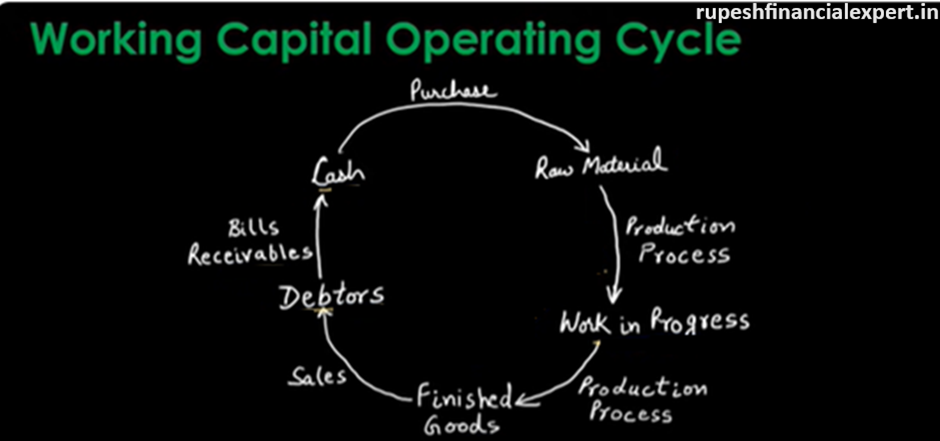

So, if you are in a manufacturing industry then you first procure the raw material, let’s say it takes 30days to buy and store it, then you do the manufacturing, then the time of work -in- process, let’s say is about 10 days, then they become finished goods, then it take about 20 days, you keep in the warehouse for 20 days, after that, it gets sold, after that sales, the retails and wholesalers pay the money within 30 days. So, this is your total cash cycle, it becomes about 90 days, you get your money back after 3 months, this is what we call working capital, which is where your money gets stuck.

Understand its calculation, what is the formula exactly.

Before that, understand that these raw material, work-in-progress, and these finished goods, there are basically your inventory, this inventory is of different types, the cost of raw material + the inventory of work-in-progress + the inventory of finished goods, this has to be added right, this is your inventory, this is your debtors, this is what we call Accounts Receivables, so you are not getting this money immediately, rest is your cash possession, all the cash you have lying around becomes your cash possession.

The formula for the working capital, what actually is working capital?

Working capital is the amount of money that you need to run day-to-day operations for your business. now its formula is – working capital = current assets = liabilities, so Basically, current assets – current liabilities is your working capital, and what are current assets? current assets are those assets, which get converted into cash within an operating cycle, so, your cash-to-cash cycle was of your 3 month, within 3 months that asset is basically converted into your cash, or gets converted into cash in a maximum of a year, if any asset takes more than a year to get converted into cash, then we don’t take it as a current assets, we take it as a fixed assets,

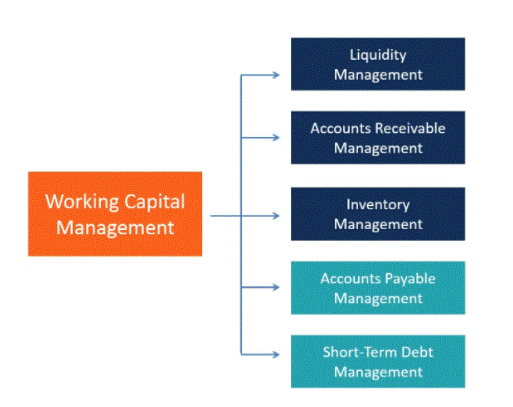

What comes into your current assets ?

in current assets, one is the cash, the hard cash which you have or the cash which is in your office or in the company’s bank account. The second is your account receivables, so basically, these debtors, whom you’re given goods on credit to retailers or wholesalers, these are accounts receivables, because you are not getting the money immediately, but will be given. It will be converted into cash in 30 days or 25 days. Whatever you time period is, whatever time you’re given them credit for, then comes your inventory, you have to first calculate the raw material inventory separately, work-in-progress’s stocks and the finished goods, whatever the total values comes, will have to be added, you’ll get your current assets, Then, are current liabilities which are basically your account payables.