The concept of a value-added tax (VAT), the basis of GST, was developed by French economist Maurice Lauré. France was the first country to implement it in 1954. Over 160 countries have since adopted a GST or VAT system, adapting it to their specific economic needs.

The journey of GST in India is as follows:

2000: The idea for a unified GST was first proposed by the Atal Bihari Vajpayee government, which formed a committee headed by Asim Dasgupta to design a suitable GST model for India.

2004: The Kelkar Task Force recommended a comprehensive GST based on the VAT principle to mitigate issues in the existing tax structure.

2006: Finance Minister P. Chidambaram proposed a target date of April 1, 2010, for the implementation of GST in his budget speech.

2009: The Empowered Committee of State Finance Ministers released the First Discussion Paper, outlining the dual GST model (Centre and States both levy the tax).

2011: The Constitution (115th Amendment) Bill was introduced in Parliament but lapsed due to political opposition and the dissolution of the 15th Lok Sabha in 2014.

2014: The newly elected Narendra Modi government reintroduced the bill as the Constitution (122nd Amendment) Bill.

2016: The Constitutional Amendment Bill was passed by both houses of Parliament and, after ratification by the required number of states, received Presidential assent on September 8, 2016, becoming the 101st Constitution Amendment Act, 2016.

2016: The GST Council, a joint forum of Central and State representatives, was constituted to make decisions on rates, exemptions, and administration.

2017: The Central GST (CGST) Act, Integrated GST (IGST) Act, Union Territory GST (UTGST) Act, and GST (Compensation to States) Act were passed in April. On July 1, 2017, GST was officially launched nationwide at a historic midnight session of Parliament, replacing a complex web of central and state indirect taxes.

The implementation of GST aimed to create a unified national market, eliminate the cascading “tax on tax” effect, and simplify the compliance process through a single online portal (GSTN).

Major pre-GST taxes like central excise duty, service tax, VAT, and Central Sales Tax, Entry Tax were subsumed into the new regime.

A person is required to register under GST (Sec 22) when the aggregate turnover exceeds Rs 20 lakhs in the financial year except some special category of States where the turnover requirement is 10 lakhs for services and Rs 40 lakhs in the financial year except some special category of States where the turnover requirement is 20 lakhs for goods

The registration can be taken State wise or business vertical wise. For SEZ units, it is mandatory to take separate registration as a distinct business vertical.

Every person should apply for registration (Sec 25 read with Rule 8) within 30 days from the date the person is liable to registration.

Compulsory registration (Sec 24)

- Person taking inter state supply

- Casual taxable dealer, person making taxable supply as an agent

- Person required to pay tax under reverse charge

- Non-resident taxable persons making taxable supply

- ISD, E-commerce operators for specified services and required to collect TCS u/s 52, person required to deduct TDS u/s 51

- Person supplying online information & database access.

Difference between an ISD and normal registration:

ISD means an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office

ISD can only distribute GST related to service and not goods & can only distribute to taxable persons having the same PAN.

When service related to more than one State is procured for one company, the PR/PO should be raised from ISD registration and not State wise registration.

For goods separate PR/PO needs to be raised from the State where consumption of goods are taking place.

In case of service acquired for both which may be related to more than one State- PR/PO cannot be made on ISD as ISD cannot invoice to any other taxable person having different PAN. E.g. IT services, marketing services etc.

The e-Invoice System is for GST registered person for uploading all the B2B invoices to the Invoice Registration Portal (IRP). The IRP generates and returns a unique Invoice Reference Number (IRN), digitally signed e-invoice and QR code to the user.

With effect from Aug 23, any registered person having an aggregate turnover of more than 5 crores have to raise their invoice through e-invoicing.

Earlier it was 100 Cr which was reduced to 50 Cr and then to 20 cr. And finally, to 5 cr.

When a registered person who is required to issue the invoice under E-invoicing fails to do so, the invoice other than e-invoice is not a valid invoice and the recipient of goods and service cannot avail GST credit based on such invalid invoice. [Rule 48(5)]

If any taxpayer wishes to modify the data already mentioned in the e-invoice, then he/she shall cancel the same and generate a new e-invoice. Cancellation is only allowed within 24 hours. Any cancellation done after 24 hours cannot be reported in the IRP. Debit Notes & Credit Notes are covered under E-invoicing

Many vendors are issuing e-invoice generated from the IRP system itself without any signature of their own. The requirement of signature is not done away with and thus invoices generated from IRP (not own accounting system) will require valid signature and stamp.

The e-sign comments appearing on e-invoices generated from IRP system alone is not valid unless signed and stamped by the vendor.

The following persons are not required to issue E-Invoices: [ Notification No. (Central Tax ) 61/2020 dated 30-07-2020]

- An Insurer,

- Banking Company, or Financial Institution including NBFC

- Admission to the exhibition of Cinematograph Films in Multiplex Screens

- Goods Transport Agency (GTA)

- Passenger Transport Service

- SEZ units

E-way bill is a documents that evidences a movement of goods. Where the value of consignment is more than Rs 50,000 (Rs 1 lakh in some States for intra-State movement), E-way bill is required to be made. (Rule 138 of the CGST Rules)

The validity of the E-way bill is based on the distance that must be travelled. Currently distance is automatically picked up based on PIN codes.

The prime responsibility of generation of E-way Bill is that of registered supplier because he is in known of entire details of supplying along with transport details. However, a registered recipient can also generate E-way Bill based on details provided by the supplier. The third person who can generate E-way Bill if he is the Transporter based on information supplied by the supplier / recipient as the case may be

In case of goods sent to job worker to another State. E-way bill has to be generated irrespective of the value.E-way bill can also be generated voluntary irrespective of the threshold limit and is doing the same.

- Where an E-way Bill has been generated, but goods are not being transported as per the details furnished, the E-way Bill may be cancelled electronically , within 24 hours of generation , provided that an E-way Bill cannot be cancelled if it has been verified in transit.

- As per Rule 138B of the CGST Rules the authorized officer can intercept any conveyance to verify the E-way bill.

- As per Section 122 (xiv) of the CGST Act,2017, a taxable person who transports any taxable goods without the cover of E-way bill shall be liable to pay a penalty of Rs.10,000/- or an amount equivalent to the tax evaded

- Rule 129 : Where any person transports any goods or stores any goods while they are in transit in contravention of the provisions of this Act or the rules, all such goods and conveyance used as a means of transport for carrying the said goods and documents relating to such goods and conveyance shall be liable to detention or seizure and after detention or seizure, shall be released:

- On payment of the penalty equal to one 200% of the tax payable on such goods and, in case of exempted goods, on payment of an amount equal to 2% of the value of goods or Rs 25,000, whichever is less, where the owner of the goods comes forward for payment of such penalty;

- (b) on payment of penalty equal to 50% of the value of the goods and, in case of exempted goods, on payment of an amount equal to 5% of the value of goods or Rs 25,000, whichever is less, where the owner of the goods does not come forward for payment of such penalty

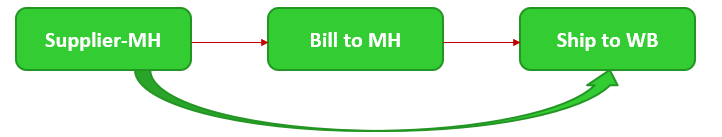

- Section 10(1)(b) of IGST Act covers supply before or during movement of goods by transfer of documents or otherwise.

- In case of such sale, it shall be presumed that the final recipient’s place is place of supply of goods. Thus, if supplier and final recipient are in different States, the supply will be inter-state even if goods are delivered in the same State on direction of final recipient (third party).

- In GST Regime , the place of supply of goods is an important factor to determine the transaction as interstate or intrastate and accordingly, the applicable taxes can be levied.

The Supplier would raise a CGST & SGST invoice, even when goods move to another State.

- In the example two supplies are involved and two tax invoices are required to be issued:

1. Invoice -1: From Supplier-MH to Bill to Customer-MH (CGST & SGST)

2. Invoice -2: From Bill to Customer-MH to Ship to Customer-WB (IGST)

- E-Way bill will either be generated by MH-Supplier or Bill to Customer-MH. Since the movement of good is once, one E-Way bill needs to be made.

- The definition of ‘Job-work’ under GST is covered under section 2(68) of the CGST act, 2017 states

“Any treatment or process undertaken by a person”‘ on goods belonging to another registered person”.

Therefore, a job-worker is the person (registered or unregistered) who is processing or treating the goods of another registered person and the owner of the goods is called the Principal in this respect. - The supply of the inputs to the job-work shall be returned to the Principal within a year, the date is being counted from the date of receipt. In case of processing of capital goods, the time limit for returning the processed goods within the premises of the owner is three years.

- In case capital and input goods are not received within 3 years and 1 year respectively. These goods will be considered as supply from the dates and the tax will be applicable on such deemed supply and the challan issues will be considered as the invoice for such supply.

- The goods can be directly sent to the premises of the job worker or from the premises of the Principal. In both cases GST credit would be available.

- Where goods are sent from one job worker to another job worker, the challan may be issued either by the principal or the job worker sending the goods to another job worker

- While returning the goods to the Principal by the Job Worker or goods sent to another Job Worker by the Job Worker, the challan issued by the principal may be endorsed by the job worker, indicating therein the quantity and description of goods.

- In case the goods after carrying out the job work are sent in piecemeal quantities by a job worker to another job worker or to the principal, the challan issued originally by the principal cannot be endorsed and a fresh challan is required to be issued by the job worker.

- Challan shall be issued according to the provisions of rule 55 of the CGST Act. Rule 55 (2) requires to prepare the challan in triplicate.

- The 143 requires from the Principal to intimate each supply made to Job Worker, supply made to another Job Worker and goods returned by Job Worker to the Principal. The responsibility for keeping proper accounts for the inputs or capital goods sent to the Job Worker and the same returned from the Job Worker or supplied made from the place of Job Worker shall be lie with the principal. Intimation about job-work is furnished in GST Return Form ITC 04. [Rule 45(3)]

- Where Any waste and scrap generated during the job work may be supplied by the job worker directly from his place of business on payment of tax, if such job worker is registered. But if the job worker is not registered then such waste and scrap shall be supplied by the Principal.

- When raising a job work PO, separate PO’s needs to be raised for service of job-work and for goods that may be required for the job work. Single PO can be raised but bifurcation of goods and service needs to be prominent.

- For service portion of the job work the vendor will raise invoicing with SAC & for the goods portion with respective HSN’s.

- A specified amount is retained as performance guarantee in projects and released after a significant period of time on completion of the project.

- Under GST , when any amount is not paid to the vendor within 180 days, the input credit already availed has to be reversed with interst.

- •Unlike under Service Tax regime where the department came up with Circular No. 122/03/2010- ST dated 30-04-2010.

- •The Circular specified that when the substantive law i.e. section 67 of the Finance Act treats such book adjustments etc. as deemed payment, there is no reason for denying such extended meaning to the word ‘payment’ for availment of credit. The form of payment is not indicated in the same and the rule does not place restriction on payment through debit in the books of accounts. Therefore, if the service charges as well as the service tax have been paid in any prescribed manner which is entitled to be called ‘gross amount charged’ then credit should be allowed under said rule 4(7)

- Any Company is continuing with the erstwhile stand taken under the Service Tax regime and not reversing GST for performance retentions

- Indirect Tax, always recommend to get Bank Guarantee instead of performance retention clause from vendors in order to reduce the litigation risk in the future.

- Future negotiations with vendor’s shall be on the line of providing bank guarantee rather than retention of amount as a guarantee to performance. The PO needs to be made/amended accordingly.

Common Issues:

- PO raised on vendor of a different State, but goods/services supplied from other State- Wrong tax gets charged resulting in manual correction

- Common PO for goods to be consumed in different States- Cannot be done irrespective of the fact we avail GST credit or not- Corresponding invoice from the State where PO has been made is not done to the consuming State resulting in non-compliance of GST provisions.

- Common PO for services to be consumed in different States– ISD registration not used.

- PO clause states payment of GST on advance for goods- There is no GST payable for advance made to procure goods but because of the PO clause the vendor demands such amount and enjoys the same without depositing the GST to the Government.

- Common PO – Their are separate companies and common PO for both the companies cannot be made for any supply.