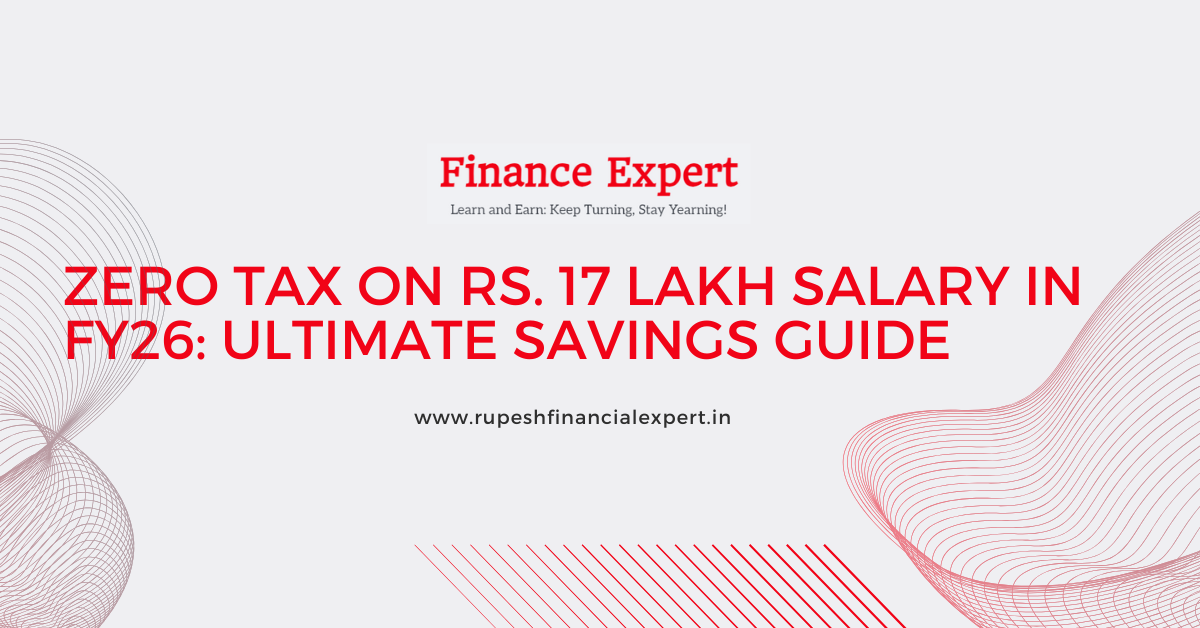

Old Tax Regime VS. New Tax Regime – Individuals – FY 24-25

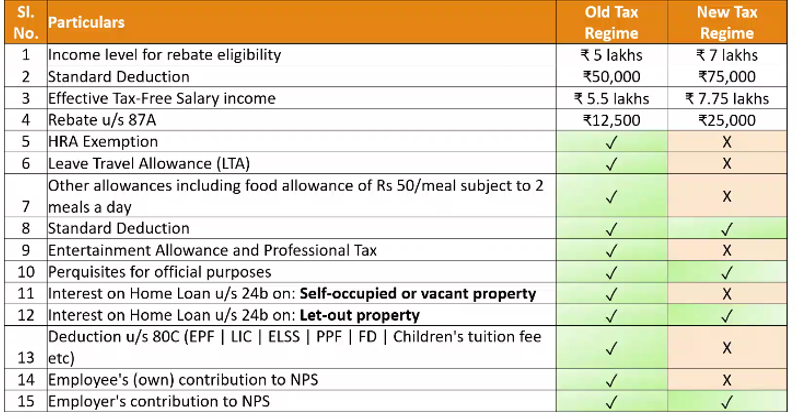

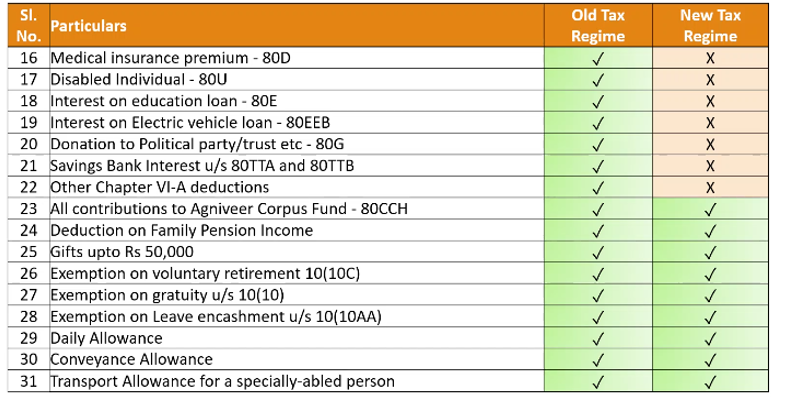

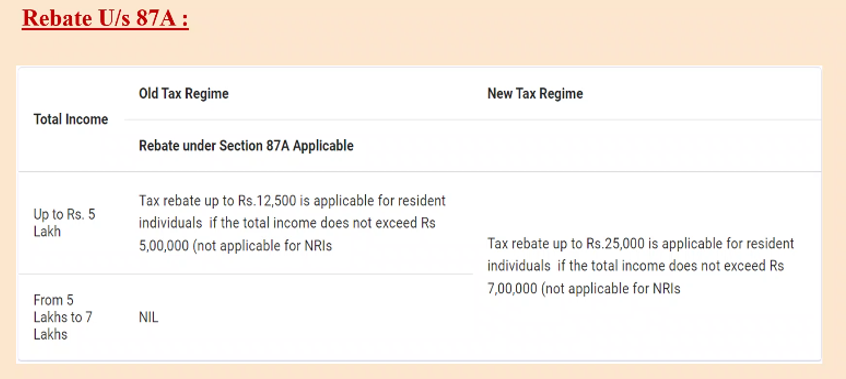

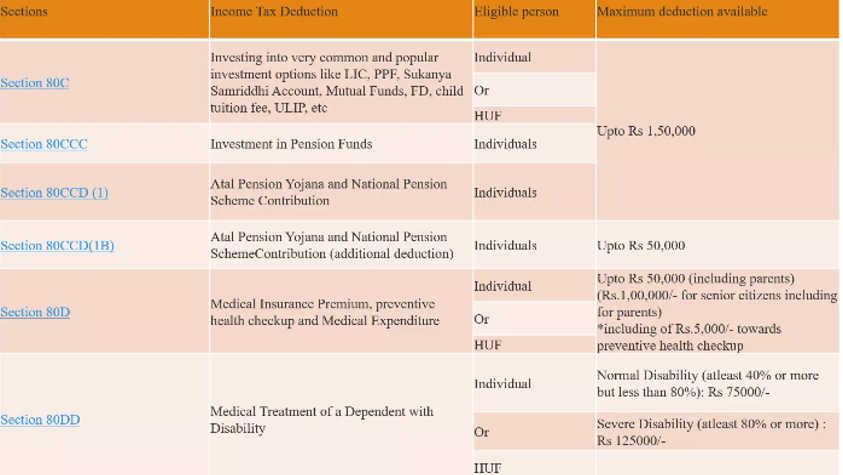

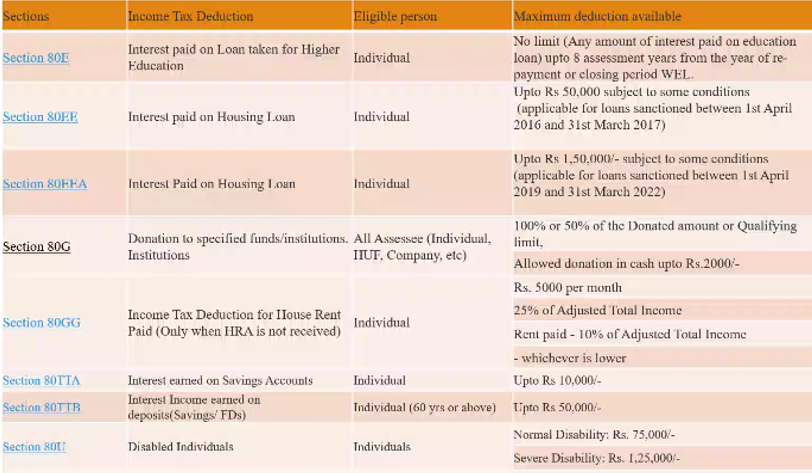

Calculation of taxable salary income (Old Tax Regime vis-a’-vis New Tax Regime of Section 115BAC)

The Income under the head salary shall be taxable on a due basis or receipt basis, Whichever is earlier. salary due from an employer to an employee, even if it is not paid during the year, shall be chargeable to tax.

Option can be exercised while filing return of income on or before due date specified u/s 139(1) of the Act.

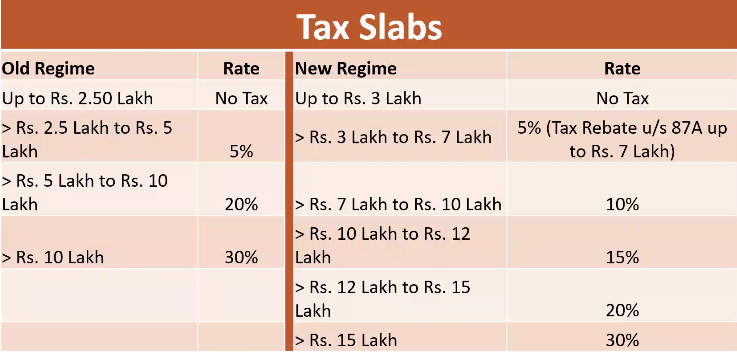

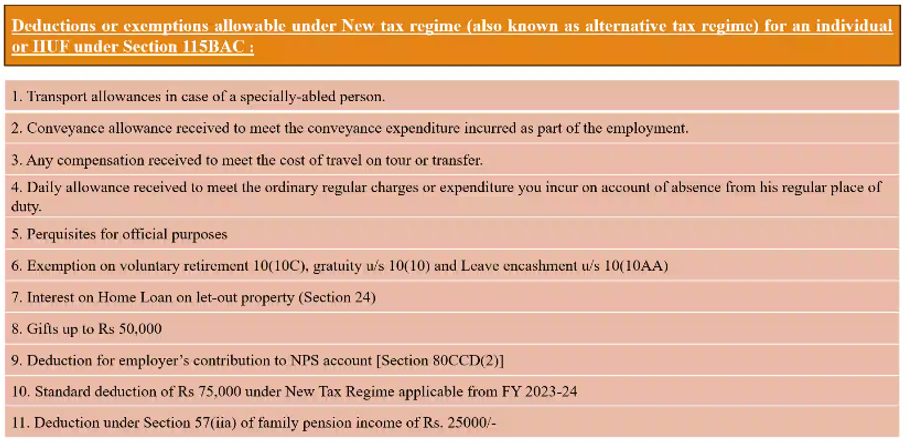

COMPUTATION OF GROSS TOTAL INCOME UNDER NEW TAX REGIME