Discover the Pros and Cons of EMI Conversion

Introduction Managing high credit card bills can be stressful. Converting them into EMIs might seem like a smart move, but how does it affect your financial health? Here’s a detailed look into the benefits and drawbacks, tailored for Indian consumers.

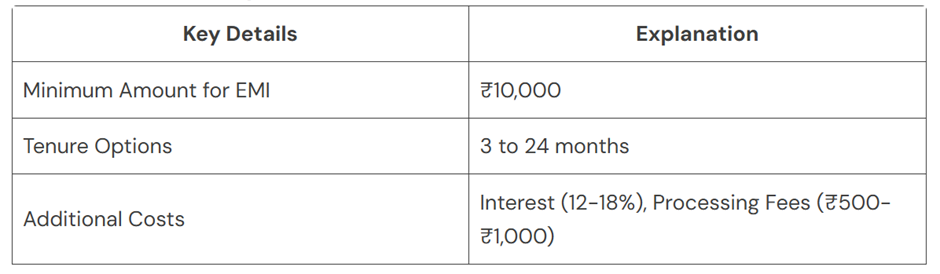

What is EMI Conversion? EMI, or Equated Monthly Instalment, is a repayment option where your outstanding credit card bill is divided into smaller monthly payments. This facility is usually available for bills exceeding ₹10,000 and comes with interest and processing fees. The tenure typically ranges from 3 to 24 months.

How Does It Impact Your Credit Score?

- No Immediate Negative Impact Opting for EMI doesn’t lower your credit score immediately as it’s seen as a planned repayment strategy.

- Timely Payments Boost Score Paying EMIs on time improves your credit history, boosting your creditworthiness.

- High Utilisation Ratio Your credit utilisation ratio remains high until the EMI is cleared, potentially lowering your score.

- Missed Payments Harm Credit Missing EMI payments has severe consequences for your credit score, reflecting poor repayment ability.

Advantages of EMI Conversion

- Immediate Relief: Splitting bills into smaller amounts reduces the immediate financial burden.

- Lower Interest: EMI interest rates are lower compared to paying minimum due amounts on credit cards.

- Planned Payments: Fixed monthly payments allow better budgeting and financial control.

Disadvantages of EMI Conversion

- High Costs: Interest rates and processing fees increase the overall expense.

- Credit Limit Blockage: Your card’s credit limit is reduced until the EMIs are cleared.

- Long-term Commitment: EMIs can strain your budget over extended periods.

Did You Know? Missing just one EMI payment can lower your credit score by up to 50 points!

Conclusion Converting credit card dues to EMIs is helpful in financial crunches but requires careful planning. Evaluate your repayment capacity before opting for this option to avoid long-term issues.