Namaskar, my name is Rupesh Jadhav & you are welcome to Rupeshfinancialexpert.in

Where we unlock the knowledge of finance rather than locking it, In this Blogs, I am going to tell about Promissory Note, It is a type of an informal loan or an informal loan document, For example, if there is a buyer who wants to purchase something from a particular seller, But the buyer doesn’t have money immediate money available, but the requirement of goods is urgent, Then he can issue a Promissory Note to the seller in which he will promise to give the money in the future, Or whenever the seller will demand, the buyer will give the money at that time. Similarly, sometimes we borrow money from friends, colleagues or relatives or give them the money, but many times, due to non-receipt of money or due to non-payment of money, the relations get spoiled, in such a situation, we can use Promissory Note. which is a proper financial legal instrument, we will understand the working of Promissory Note, concepts, details that should be written, I will also give an illustration, that how to write a Promissory Note, we will also see some templets & what are the things we should keep in mind, read the blog till the end.

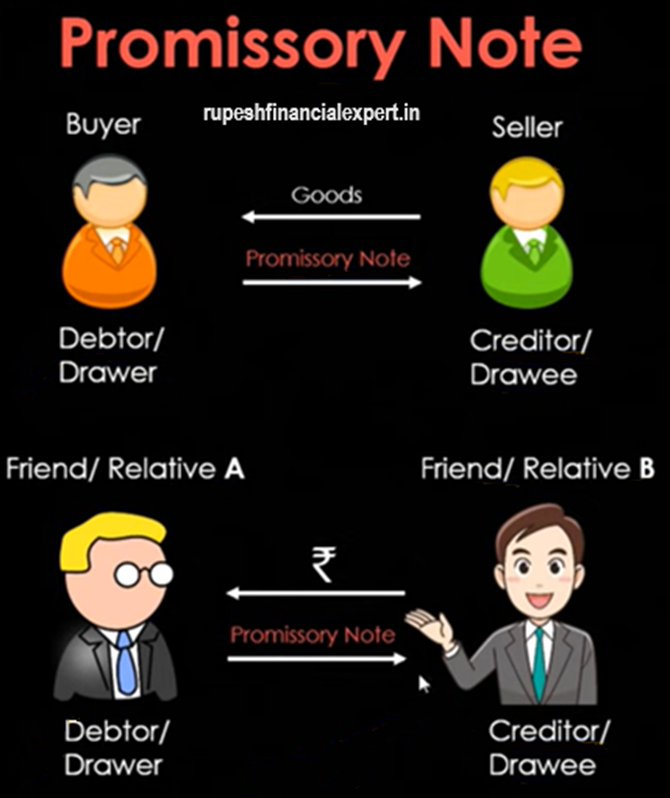

I will take an example, there is a buyer who wants to buy goods from a seller, now buyer tells that, I will buy the product, but I don’t have money to give you immediately, Because my cash cycle is of 2-3 months, whenever I will have the money, I will give it to you, Now it may be that the buyer & seller has a very old relationship, So seller trusts him and the buyer says that, I will give you a promissory note in return, That is my kind of promise, that I will give you money, So the seller says ok I transfer your good, the seller transfers it to the buyer, And the buyer issues a promissory note. This note is a promise from the buyer to the seller, that I have purchased this many goods from you, And I will give you this much amount, on this particular date Or whenever you will demand the money, I will repay you, So these types of financial instruments are called Promissory Note.

This is a type of an Informal loan, The seller is giving a credit to the buyer, so the seller is a creditor & the buyer is a debtor, As the promissory note has been issued by the buyer, we will call it as Drawer, So, the drawer has drawn this promissory note, And the seller is the drawee/beneficiary of the promissory note. So, this is a relationship of the buyer & the seller. It is also used in different relations, where you give/take any type of informal loan. For example, there are 2 friends/relatives who keep giving credit to each other, So here promissory note can be issued & used, Because in many cases, the relationship gets spoiled, if something is not in writing. So, it becomes hard to believe & because of which people are afraid to give money to anyone, So even in such cases where you want to give/borrow money to friends, relatives, colleagues, you can use it, for example, in this case, friend B gives money to Friend A, So A issues a promissory note to B, So A becomes drawer/debtor. So, A draw a promissory note in favors of drawee B, who becomes creditor in this case, So, any type of relationship in which any type of informal loan has been given or taken. In such a case, a promissory note is signed.

If I give you a technical definition, then It is defined under Section 4 of the negotiable instrument act 1881, The exact definition of this, as per the act is, A Promissory Note is an instrument in writing (not being a bank-note or a currency note) Containing an unconditional undertaking, which means there should be no condition in returning the money, i will also tell you, which type of conditions can be there & which type should not be there, Signed by the maker, maker is the Debtor/Drawer to pay a certain sum of money, which means exact amount should be clearly mentioned, Or to the order of, a certain person, So he will clearly mention someone’s name either creditor’s or someone else to give money, The creditor can say the name of any Third person & says to give his money to this third party, So this becomes endorsement which we also call negotiable, So this is a type of negotiable instrument which is why this is covered in the Negotiable Instrument Act, So the seller can say that, you may give money to this third party which he has endorsed. Similarly, this can happen in the case of a friend, the money can be transferred to the third party, A will give the money to C rather than B, Or to the bearer of the instrument, which means give the money to whoever may have that instrument, So this is a definition written in the Negotiation Instrument Act, So we can call it type of an informal or semi-formal loan but it is not exactly a loan.

A promissory note is not a loan agreement, in a proper loan agreement, Basically, within a loan agreement, you can foreclose, foreclose means that there can be recovery of that loan, so suppose their mortgage of some type, Pledge of any kind of property and, gold, So the loan can be recovered by selling it. But there are no provisions for this type of foreclosure in the general promissory note. This is a very simple type of statement written, so what parties get involved in it. As I mentioned first, whoever is issuing the promissory note, we call him Drawer, or you can call him payer, or is the Debtor because he has borrowed. We call him maker because he makes the promissory note, He is promising, so we can also call it promisor, So, he is issuing a promissory note we can also call it issuer. Similarly, in whose name it is issued, we can call it Drawee/ payee/Lender/Acceptor of the promissory note, so there are the main two parties apart from them there anyone can be an endorsee, as i mentioned third party, So, the endorsee could be on the name of third party. If the promissory note is issued in a given name. Or in a promissory it is clearly mentioned, on my order, you can give to other, if “or to the order of ” is written on it. So, whoever (buyer/drawer) does the endorsement, will have to pay money to the third party.

How many types of promissory notes are there? Basically, there are two types if we broadly say then, On-demand and usance, On-demand mean, whenever seller or creditor asks for money, the drawer will have to pay, so we call it on-demand, whenever the creditor demand money, he will have to pay, Second is usance, in which a clear future date is written, for example, it has been written that, You have to pay money within two months, 2 months is the maximum date, You have to pay money within 2 months, Then we call it usance promissory note. If money is given in installment, then it is called payable in installment or payable in lumpsum. I can define types of promissory notes. Interest bearing or the interest free, Interest is charged sometimes, if the period of time is short about 2 to 3 months. may be interest is not charged. But if it is a long period then mostly people charged interest on it. That time we sign interest bearing promissory note. Single, joint borrowers or multiple people can also sign promissory notes. It can be negotiable or non-negotiable, if or to the order of is not written then it is non-negotiable. If the name of the seller is mentioned then the payment is to be made to him, not to the third party. it is called non-negotiable. If it is negotiable, then you have made payment to the third party that is party C. These are the basics of promissory notes.

Now let’s check its legal requirement, firstly should be in written form, it should be unconditional to pay, means I will only make the payment if others will give me. If someone gets married or death of someone, then only I can be able to make payment. Such conditions are not valid in promissory notes, there should be no conditions on making payment, there can be condition of interest or making payment to third party. But the debtor or the drawer of the promissory note, he can put any condition. The drawer should be clearly mentioned. but the company cannot issue the promissory note, The exact name of issuer should be mentioned and the sum payable also. Then interest in case of interest-bearing promissory note. If the interest-bearing is Pronote. then the exact amount and the interest should be mentioned. Then drawee name and creditor should be mentioned, then date of issue and place of issue, then date of issue should be mentioned, if it is not on the demand. If a fixed date is given, then the maturity date should be mentioned.

In the Negotiable Instrument Act, it is mentioned to stamp the promissory note. Generally, you can have a 1-rupee revenue stamp, I will also show you an example. Or you can use stamp paper to make the promissory note. Then, it is important to sign it by drawer, drawee sign is not important, this means whoever is giving money, their sign is not important. So, the acceptance of drawee is not important, payee is not required, these are the main requirements of the promissory note. What to do, if the money which has been given is not given back on time? You can do a legal case, because it is a proper legal financial instrument. You can case up to 3 years from the maturity date, which means if it is a fixed date promissory note, That the money should be return in this specific time. the money has to be returned till XYZ date, so, you can case up to XYZ + 3 years, but if it is on-demand promissory note, then you have to take the date from the date of execution. You have to take the date from when it was signed, of 3 years, because sometimes in an on-demand promissory note, date/maturity date is not mentioned. So, if maturity date is mentioned, then you can case from there to 3 years, If it is not mentioned, then you can case from when you signed till 3 years, If you want to know these requirements in more detail, then you can find them in the limitation act. So, you can refer to the Limitation act.

Now I will check some Illustrations on, how we can write a promissory note & how we should not write it? Illustration as per section 4 of Negotiable instrument act 1881, We will see some illustrations/some examples. for example, if someone writes, I promise to pay B or order Rs. 50,000, This means; I am promising to give 50,000 to B or to the one whom he will order, you can write this, in the promissory note, The second example is, I acknowledge myself to be indebted to B in Rs.1,00,000 to be paid on demand, for value received. I acknowledge that I have taken money of 1,00,000, to be paid by myself, whenever B demanded, I will pay for the value I received that is 1,00,000. Language is different but, then if the guy says that He writes “Mr. B I O U Rs 1,00,000” inside the promissory note, I O U is short form of I owe you, I owe mean, that I have borrowed so much from you, So I owe you Rs.1,00,000. But it is not clearly written that, I am promising you that I will give you back this money, so this is not a promissory note, there is no promise of any kind here. Then if it writes “I promise to pay B Rs.50,000 and all other sum which shall be due to him”. So, what is all other sums, it is not clearly mentioned, as amount not clearly mentioned so it is not a promissory note. “I promise to pay B Rs.50,000, first deducting thereout any money which he may owe, it will deduct some money.

What amount he owed, how much money will be deducted is not clear, Then this is also not the correct way to write a promissory note, Then the guy says that ” I promised to pay B Rs.50,000, seven days after my marriage with C, When will the marriage take place, it is not the exact date, If there is no exact date then this is also not the right way to write a promissory note. Here condition come, when he marries, then it will return the money, so such conditions cannot be imposed. Next, “I promise to pay B Rs.50,000 on Ds death, again condition is imposed, it depends on Ds death, provided D leaves me enough to pay, now if their D is not left money, then it will not pay, again condition, so this is also not a promissory note. I promise to pay B Rs.50,000 and to deliver to him my black on 1 January Next, what’s next here, next of what, date is not clear, so it is not a promissory note.

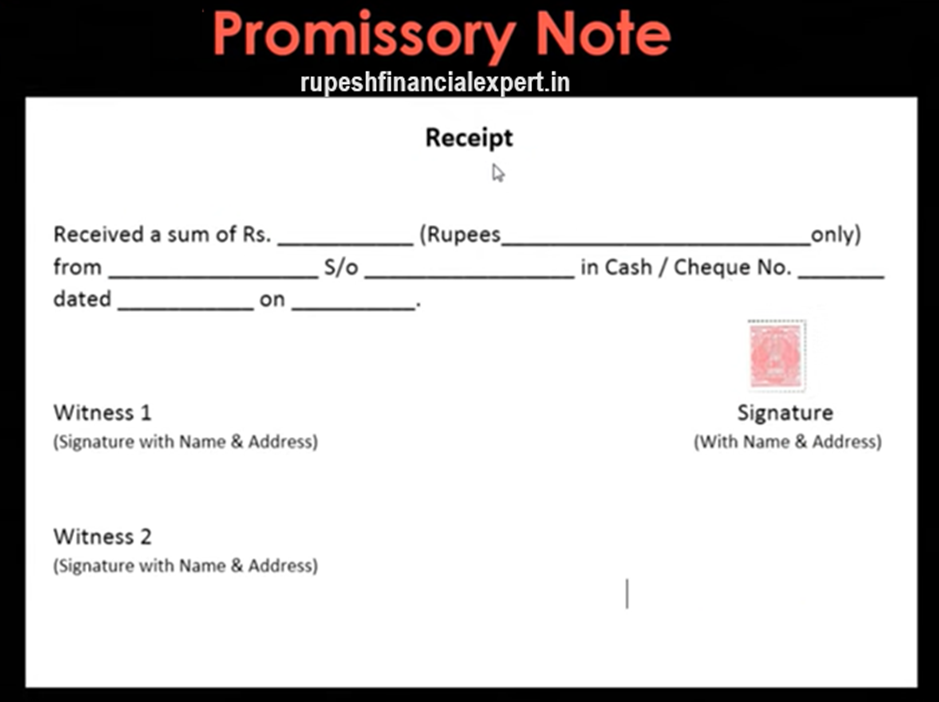

First two ways are the correct way to write a promissory note, you can write this But, there is no condition of any type, and clearly mention whom to pay, what amount to pay, how to pays, there will be a future date or on-demand. So, with this we can write a promissory note, now let us see some examples. so, this way you can issue a Promissory Note. This template is given, you can also use the same template, I drawers name means issuer, S/O he’s father name, promise to pay name of drawee(who lend money) drawee fathers name, Or order means it is negotiable instrument, it can be issue to third party, if drawee say to pay third party, then drawer has to pay third party, On demand, basically, it is demand promissory note, when creditor demand drawer has to pay. The sum of rupees Exact sum (in figures) amount in words, With the interest at the rate of, for ex-10%, he has to pay with 10% interest from date of these present (when it sign), date will be written there, so from this date 10% interest will also be charged for as much as the money is issued For value received in cash/cheque no., if amount is received by cheque, then cheque no. and date will write their, otherwise cash amount come there, the drawer sign their signatures by across them. you can attach a stamp of Rs.1, revenue stamp, Drawer’s full address come there, So, it is a simple format of promissory note, promissory note is generally signed in this format.

Basically, it is on demand promissory note, you can also put a fixed date instead. If you put a date there, it becomes a Usance note, drawer has to pay on that date to creditor, so this is the format of the Promissory Note. Along with If want a safe side you should get signed receipt, if you get signed receipt is better, because in receipt you can get a witness’s sign. If any problem arises in future, in legal hassles. You have a upper hand if you present witness. So, in way your extra evidence gets created, extra receipt if you sign is better for you, then see this way.

Tt is a promissory note of old time, I have taken out this from Internet, This was issued in 1946, So this is also an on-demand Promissory Note for the same, it is written here On demand, we promised to pay at imperial bank of India Rangoon, To so and so company(whom to pay is exactly mentioned) or order (payable to third party). For the value received the sum of Rs. 20,000 only with interest, basically it is an interest bearing instrument, Thereon from this date at a rate of 6.50% (interest rate ) per annum. Basically, it is is similar to the promissory note, as I show format to you.

So, I think I have talked about all the concepts related to the Promissory Note, and I have also seen the format together, I have also seen the illustrations, and together, I have also seen an exact definition according to the Negotiable instrument Act.

So that’s all in this Blog, if you want to share your thoughts related to this website,Then you can do in the comment section down below. In fact, you can suggest a topic for future Blogs, and if you like this Blog, then definitely comment and share it. I share these kinds of finance and informative blogs on this website every day. Then see you in the next blog,

Till then keep learning, keep earing and be happy.