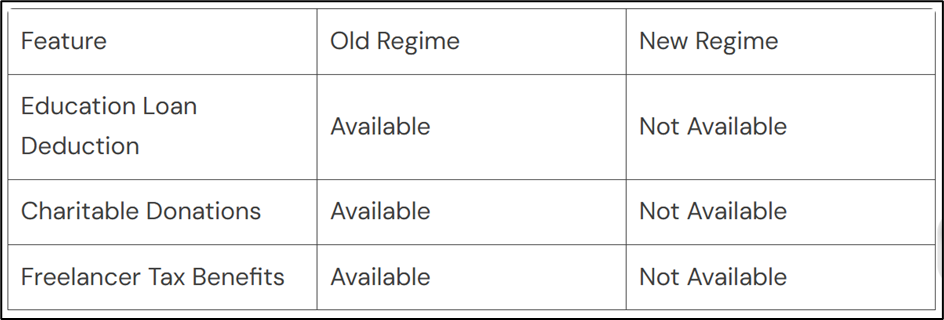

Thinking of switching to the new tax regime? It’s easier but may cost you more! Here’s why the old tax regime might be better for you.

Why the Old Tax Regime Still Works

The old regime provides multiple deductions, making it beneficial for those who invest in tax-saving instruments. Let’s break it down.

Key Advantages of the Old Tax Regime

- 80C Deductions – Save up to ₹1.5 lakh on PPF, EPF, and NPS.

- HRA Benefits – If you live in a rented house, claim tax-free HRA.

- Home Loan Savings – Deduct up to ₹2 lakh on home loan interest.

- Medical Insurance Relief – Section 80D allows tax deductions for health insurance.

Tax Regime Comparison Table

Did You Know?

Taxpayers earning over ₹24 lakh annually often save more under the old tax regime with deductions!

How to Choose the Right Regime?

Check your tax liability using the Income Tax Department’s online calculator. If you claim multiple deductions, the old regime will likely help you save more.

Before switching, analyse your expenses and investments. The right choice can lead to significant tax savings!