The Indian government has introduced a new income tax bill with significant changes impacting individuals and businesses. From revised tax slabs to deductions, here’s what you need to know:

- Revised Tax Slabs and Rates

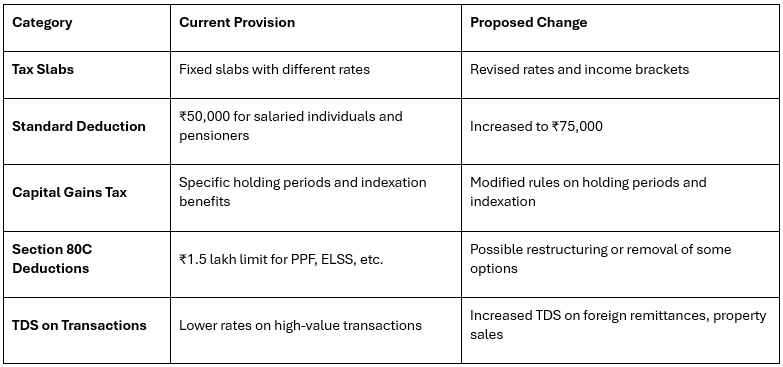

The bill proposes changes to tax slabs, affecting different income groups. While some taxpayers may see reduced tax burdens, high-income earners could face higher taxes.

Did You Know? India’s tax-to-GDP ratio is around 11%, significantly lower than developed nations, which average 25-30%. - Higher Standard Deduction

The standard deduction for salaried employees and pensioners has been increased, helping to lower taxable income and reduce the overall tax liability. - Capital Gains Tax Adjustments

Changes to capital gains tax will affect investments in stocks, real estate, and other assets. Holding periods and indexation benefits may be revised, impacting long-term investors. - Revised Section 80C Deductions

Popular tax-saving investments under Section 80C, such as PPF, LIC, and ELSS, may see restructuring. Some options could be replaced or removed. - Higher TDS on High-Value Transactions

TDS rates have been increased on foreign remittances, property sales, and luxury purchases to curb tax evasion. - Stricter Business Tax Rules

MSMEs and startups will need to comply with new tax regulations. Some exemptions may be removed, and digital transactions will face more scrutiny. - Updated House Rent Allowance (HRA) Rules

Changes in HRA calculations will impact employees claiming rent exemptions. The new structure will align with inflation and metro/non-metro cost differences. - . Incentives for Digital Payments

Tax benefits may be introduced for businesses and individuals using digital transactions, supporting India’s shift towards a cashless economy. - Wealth and Inheritance Tax Considerations

New provisions may introduce taxes on inherited wealth and high-value assets, affecting estate planning for wealthy individuals and family businesses. - Simplified Tax Return Filing

Pre-filled tax returns and AI-powered scrutiny will make tax filing easier, reducing errors and minimizing disputes.

Stay Informed & Plan Ahead

With these tax changes, individuals and businesses must review their financial plans and consult tax experts for effective tax-saving strategies.

Disclaimer :

This article provides general information and should not be considered tax, legal, or financial advice. Tax laws may change, and personal circumstances vary. Consult a qualified professional or official sources for tailored guidance.