Firstly, about NPS. Because this is very good retirement planning option. In this, you can earn ore return than PPF & EPF. And this comes under Exempt, Exempt, Exempt Category, that means a lot of toy tax saved. And the most interesting thing are you don’t have to be an employee of an organization. You can start an NPS account form you end as well.

So if your age is between 18-65, you wish to plan your retirement. You wish to save your tax and you don’t want to take a heavy risk in the stock market, then NPS is a very nice option for you.

While opening the account, you will require a minimum of Rs.500/- and the minimum contribution at a time is also Rs.500/-, plus the minimum contribution that you need to maintain in a year is also, Rs.500/- which needs to be done mandatory. That means every year you need to invest Rs.500/- and if you didn’t invest, until 2 years you didn’t invest Rs.500/- (twice) then you account will be considered dormant. But then you can re-activate by paying Rs.1000/-.

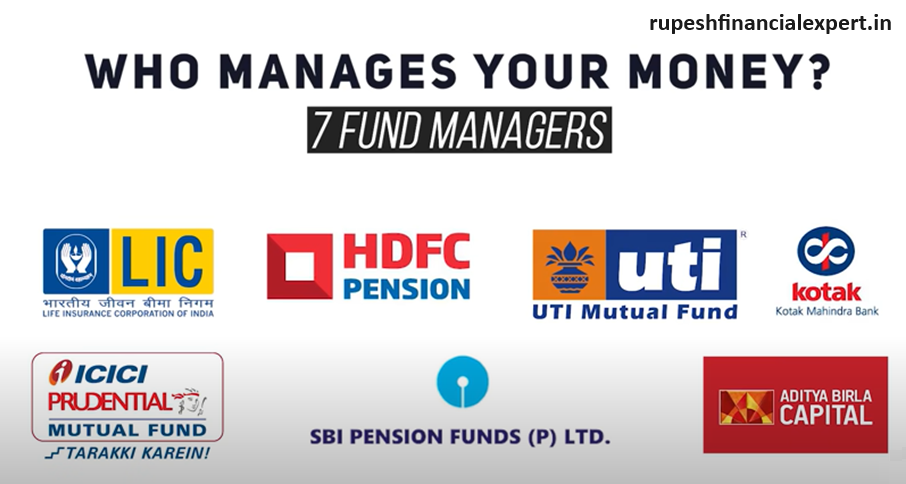

The Government of India has appointed 7 fund managers, the one’s who manage your funds invested in NPS, which are LIC, HDFC Pension Fund, UTI Mutual Fund, SBI Pension Fund, ICICI Prudential Fund, Aditya Birla Capital, Kotak Mahindra Bank. As an NPS Subscriber, you can choose among the 7, as to which fund manager will manage your money. And you can even change you fund manager in the future. So you have that freedom.

i.e., Where is invested? Then it is divided into 4 categories. 1st is Low risk, 2nd is Moderate risk, 3rd is High risk, and 4th is Very high risk. Under low-risk assets, there are government bonds, Moderate risk asset includes corporate bonds, High-risk includes equity i.e., stock market and very highs risk includes alternative investments, wherein you can only allocate 5% of your total fund. Because this is a very high-risk asset.

You have complete freedom to decide that how much % your funds should be invested in Equity, how much % Corporate bonds, how much % in Government bonds, and how much will be invested in Alternative funds. 2 options for you, choose active choice and can choose auto choice, wherein you won’t have to take so much trouble.

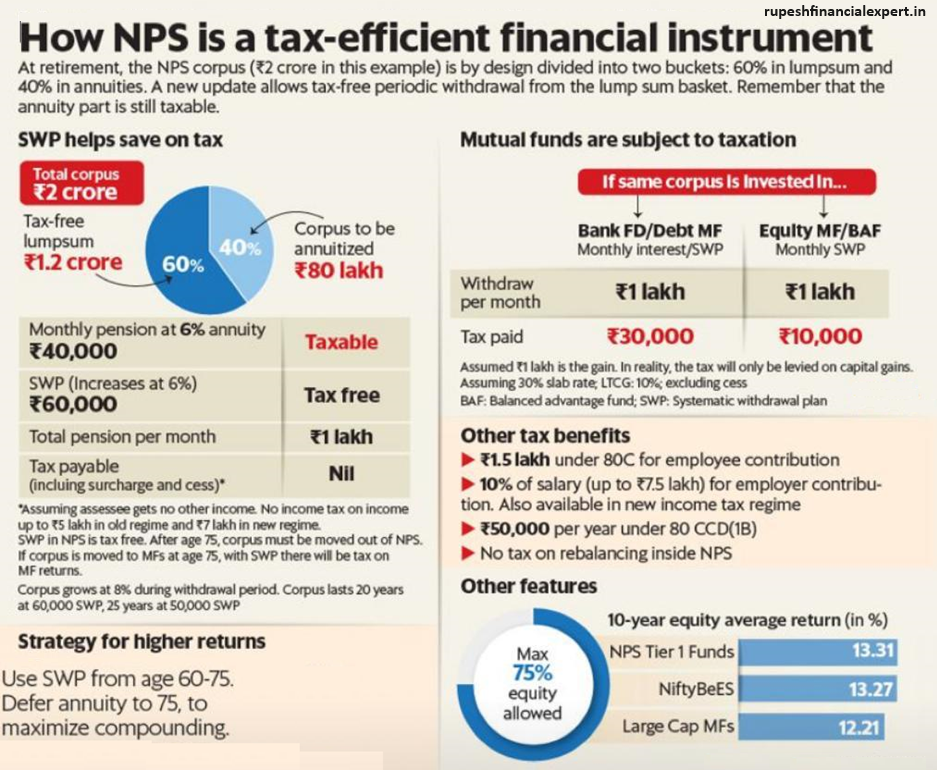

Different types of withdrawals, planning scheme. Then it’s obvious that it won’t allow you to withdraw. Before your retirement period. It won’t do. Your lock-in period is until 60-year of age. And after 60 years, you can continue until 70 years of age. Or you can defer in until 70 years of age. Means you are investing a monthly contribution in that. And to defer means that you are not providing contributions and you wish to withdraw after 70 years. Until 60 years of age, maximum of 60 % withdrawal is allowed. You can’t withdraw more than that. And the remaining 40% you need to compulsorily buy an Annuity from an insurance provide who will provide you monthly pension on that amount. And the 60% which is the withdrawal, if you wish to withdraw in 10 different instalments, that then the facility is available as well. For premature withdrawal, you need to regularly contribute for 3 years. After that, you can withdraw 25% of your own contributions. That too, up to 3 withdrawals, once in every 5 years. And that shouldn’t be without any reason, there have to be special reasons which are Serious illnesses, Children’s wedding or children’s education, to renovate or buy a house and if you wish to start a business.

Premature exit. Means? Is operational, But you wish to retire before 60 years of age and wish to start the pension from NPS account, then that option is available too. Now need to keep your account active for at least until 10 years. Then you can withdraw maximum 20% to 80% you need to annuity which will pay monthly pension to you. If you fund is less than 1 lakh, then you can withdraw 100% by taking voluntary retirement then your account will be closed, and you will start receiving pension.

It comes under Exempt, Exempt, Exempt Category. that means the contributions which is done kin this is tax-free. The return that is received on this is tax-free and finally when you withdraw the amount, then it is tax-free, Section 80CCD: under sub section 1, you can claim a deduction of Rs.1.5 lakh. Which is part of 80 C, you can claim an additional deduction of Rs.50,000/- more. Section 80CCD: under sub section 1B, means 1.5 lakh under 80C and Rs.50,000/- was additional. That means you can claim for a deduction of 2 Lakhs. Moreover, if your company provides NPS, i.e., if you are on your behalf, your employer also contributes, and you contribute yourself too. Then you can claim employer contribution as well under section 80CCD: sub section 2, which can not be more than 10% of your Basic + DA, and the contribution that the employer provides, he shows it as a business expense, and claim it as a tax for this company. That also cannot be more than 10& of your Basic + DA. The return that is earned on that & withdraw afterwards is also tax-free.

Now there are two types of account in a Pension, 1 is Tier 1 Account, and another is Tier 2 Account. Is about the Tier 1 Account. You receive tax benefits in tier 1 account only. But in the tier 2 account, you receive some benefits. No lock-in period for you. You can invest as much as you want and withdraw whenever you want. There is no minimum investment, invest Rs.10/- instead of Rs.500/-, you won’t receive any benefits on tax, this is fully taxable. That means this is similar to a Mutual Fund.

Then you visit any Bank, an open NPS account. Submit the necessary documents, and your account will be opened. The bank will provide you with a PRAN i.e., Permanent Retirement Account number, quite similar to EPF’s UAN number. And if you wish to promote Digital India, then you can open the account online, which can be opened by visiting the ENPS website.