How does this process work?

We will take the same example which we took in the starting.

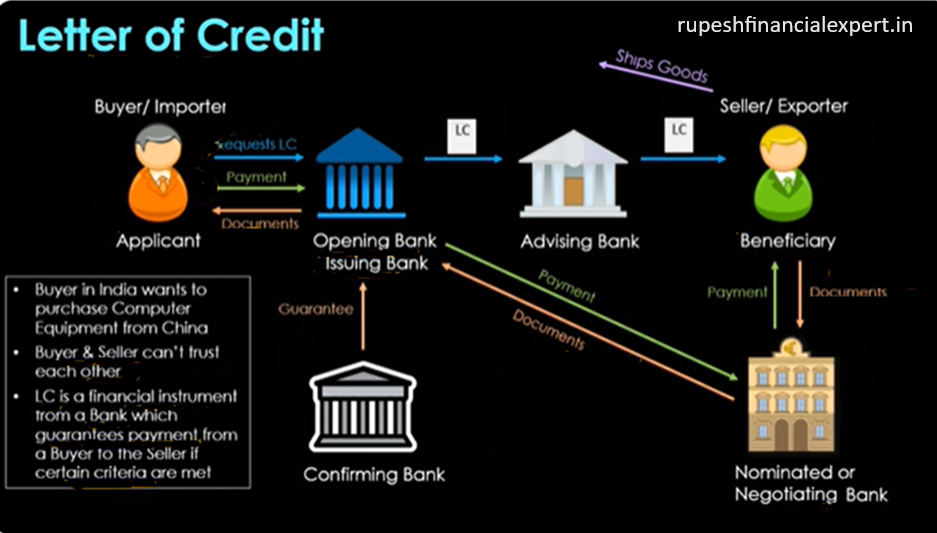

Assume you are a buyer in India, And you want to import computer equipment from China, Then you cannot trust one another, the buyer and seller cannot trust one another, The buyer and seller cannot trust one another, The buyer will think that, if I send the money first, then maybe I’ll not get goods on time, seller may think that his payment not be on time, so in these cases, the letter of credit is very useful, which is a financial instrument, a bank issues it. There is a guarantee in a way through this financial instrument, that a buyer will pay the seller. The banks pay the amount as soon as the criteria meet. So, the seller has to meet the criteria to ship his the goods, and present the documents.

So how this process is operated?

How are the banks are involved? let’s understand!

Firstly, the buyer becomes the applicant in a way, because he will issue the letter of credit. So, the applicant will go to his bank, and the bank to which be will request the letter of credit. We call it opening bank of issuing bank, so he will request a letter of credit there. This is the first part of this in the next step, There is an advising bank which is a bank of the beneficiary, Beneficiary means the seller.

The opening bank will send the letter of credit to the advising bank, in our second step, the letter of credit will reach the advising bank, then the advising bank will check the authenticity here, in authenticity, he will check all the things whether the name is correct or not, product name and all these things will be checked in the letter of credit, then advising bank will send that letter of credit to the seller, now the seller has full truest, there is a build -up trust, because the buyer has sent the letter of credit, that mean’s he is very serious about it, after that, he will ship the goods from here, letter of credit in a way built trust. That his money in not going anywhere, I’ll get the money for sure.

Because the banks are involved here. So here he will ship his goods, In the third part, we have seen that the seller got the letter of credit, In the fourth step, these gods will be shipped, these are in route, let’s say these are only shipped, they haven’t reached the buyer yet, Because it will take time to reach from China to India, but the process of documents go on, After that, the seller will get a bill of lading here, Bill of lading is the main documents when goods are exported form the country, he will take the bill of lading to the nominated or negotiated bank, a nominated or negotiating bank can be a separate bank or advising bank, both can be same, and negotiating bank can be a separate bank, the purpose of negotiating bank is to check the shopping documents, the bill of lading present in here, they will check its accuracy, of the good are shipped properly or not, according to LC. After this, the negotiating bank or the nominated bank, will make the payment to the beneficiary, so the payment to the beneficiary is done here, so this was our 5th sept, so in the 5th step, the negotiating bank checked the documents, and made the payment to the beneficiary, after that, negotiating bank sends the documents to the opening bank, and demand the payment, the demand the payment is done here, The opening bank will send these documents to the applicant, and will take his approval if all the documents re right or not, once the applicant’s approval comes, the opening bank demands the payment, from applicant and applicant make payment to the opening bank, so here are 5th step was done, in the 6th step, documents were sent and the payment was demanded, in the 7th step, approval was taken from the applicant, in the 8th step, payment was done, The applicant has done the payment to the opening bank, After that, the opening bank again makes the payment to the negotiating bank on the 9th step, LC was requested and then LC was issued, It is called the opening of LC, So the opening bank is opening the LC, Then the LC has reached the advising bank and then it is reached to the seller, After that, the movement of the documents first, it reaches the negotiating bank, after that, it reached the applicant, Payment is being made from the applicant to the opening bank, after that, to the negotiating bank, and negotiating bank has already made the payment to the beneficiary, as I have already told you that negotiating bank and advising bank can be the same, so in this way. This whole process works, And the goods that have been shipped here will be delivered, so the buyer will get his goods and the seller will get his payment, The whole transaction would end and the trust issue will be resolved, Many times one more step get involved, many times the advising bank thinks that the credit rating of, the opening bank isn’t that great, Maybe this is a small bank, then it says that bring the guarantee from a bank, that has good credit ratings, if a big bank guarantees you that you shouldn’t have a problem, in issuing letter of credit for opening bank, if opening bank, in any case, defaults the letter of credit, then it will be our guarantee, and it will be liability of the confirming bank for the payment, so in this way, another bank, confirming bank can be involved, so this was the working of letter of credit, now let’s see the important features of the letter of credit.

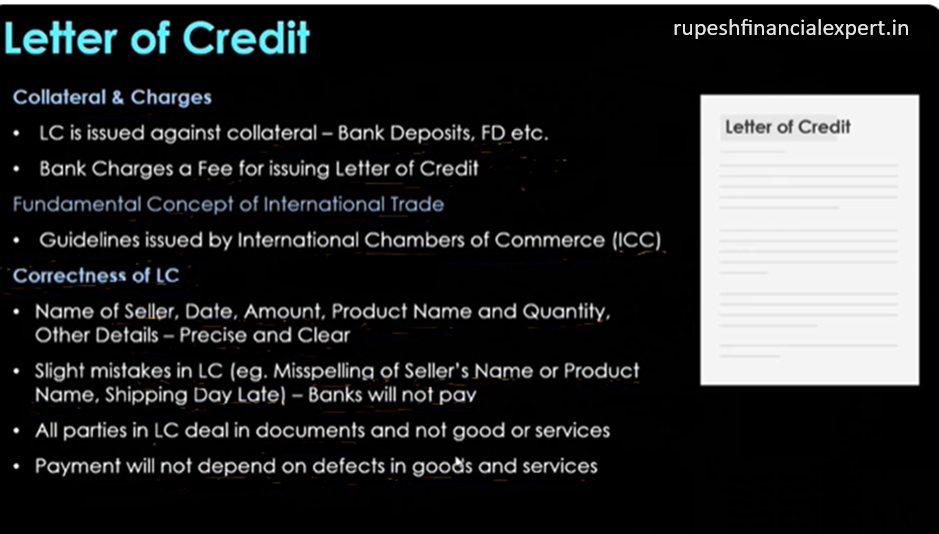

We will take about the collateral and charges,

When a bank issues LC, then it issues it against the collateral, whatever the opening of issuing bank is, collateral means keeping the bank deposits or FD as a security, The bank always changes a fee to issue a letter of credit, the fee are dependent on the type of letter of credit, so this is a fundamental concept of international trade, Because buyers and seller do not know each other in international trade, so there are trust issues and that’s why international guidelines are issued, International chambers of commerce issues guidelines for the letter of credit also.so ICC is its main body, After that, the correctness of LC is very important, Because in LC there’s only the exchange of documents, goods and services are not exchanging there, The contents given in the LC is very important, what is the name of the seller, exact issuing date, what is the exact amount of the letter of credit?, What is the product name and quantity, what are other details, they should be precise and clear, There should not be spelling mistakes, If there is any kind of minor mistake, if there are some misspellings, the name of the seller has missed “A” of there is “E” in place of “A”, If the product name has not been written properly, If the name is written half or there is a spelling mistake, or shipping has not been done on time, or the shipping date is written on the documents, The shipping was not done on that date, so far these minor things too, the bank will not pay according to LC, or we have to make a new LC, All parties in LC deal in the documents and not goods and services, As you have seen that we saw the whole process, and there is only a process of documents, banks do not care about goods and services, so basically if the documents are right then the payment will be done, Payment will not depend on whether there is a defect in goods or services, if the documents are right then the bank will do the payment, There is no guarantee for if the goods are defective or, the whole goods are not delivered, so this is not the liability of the bank, This problem will be solved by the buyers and sellers, in whatever ways they want to resolve it, so you must check all the spellings in the letter of credit, And check all the details in advance, When the opening bank is issuing the letter of credit, Or if it is opening them, So as a buyer, you should check all the details, And the seller also you would check all the details in the letter of credit, Before that, you should not ship the goods.

Advantages of LC

For a buyer or seller, First, we will take about the seller, If the buyer does payment default then it is the liability of the bank, Bank will surely pay you, After that your production of risk decreases, Assume if it is the suddenly cancelled, but if the letter of credit has been issued already then the buyer cannot do anything, he’ll have to buy goods from you, assume you have a manufacturing unit, then you’ll not have any production risk, if you have any manufacturing unit, we will take about the buyer, the goods will be received by you timely, so there’s a certainty that you will surely receive goods, After that, LC shows your solvency that you are in business, and in a way, it is showing standing your business, because then bank is ready to take credit risk on you, after that, you get a small credit you don’t have to do an initial payment, so it reduce the burden, assume if you don’t have immediate payment, so you get time.

Covered all the major points related to LC, what are the important features of the letter of credit, and what are the advantage of a letter of credit to the buyer and sellers.

![Simplify Your Trade Finance with [Your Bank]'s Letters of Credi](https://rupeshfinancialexpert.in/wp-content/uploads/2023/11/Add-a-heading-17.png)