Cash Transactions in Savings Accounts: What You Need to Know

Understanding income tax rules for cash deposits and withdrawals in savings accounts is crucial. These regulations ensure transparency and discourage financial fraud.

Cash Deposit Limits in Savings Accounts

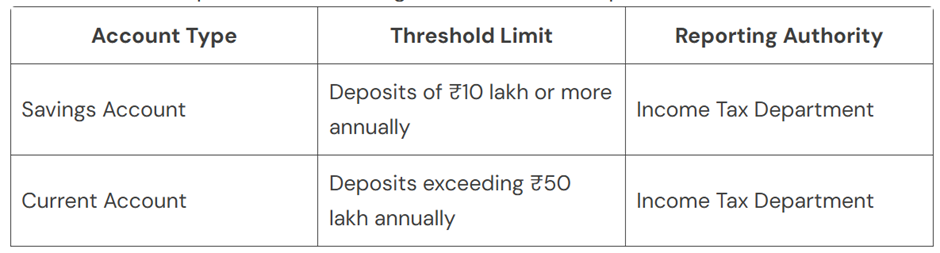

The Income Tax Department has strict guidelines on cash deposits:

- Banks are obligated to report high-value transactions to the Income Tax Department.

- Exceeding these limits may trigger scrutiny or inquiries.

Rules for Cash Withdrawals

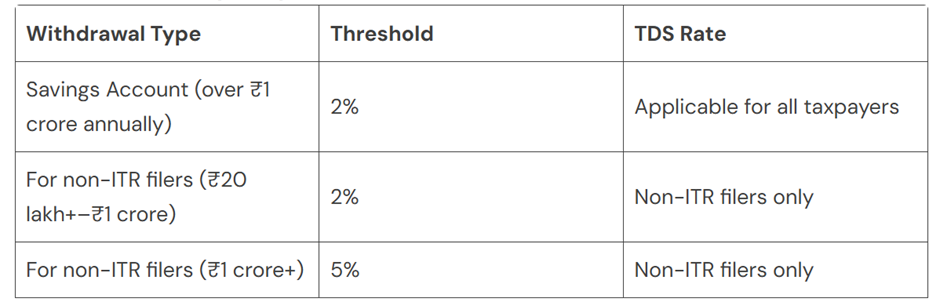

Here are key rules regarding cash withdrawals:

- TDS under Section 194N can be claimed as a credit during ITR filing.

- Regular tax filers face fewer restrictions compared to non-filers.

Did You Know?

Depositing more than ₹2 lakh in cash in a single financial year can result in penalties under Section 269ST.

Importance of Following These Rules

These measures aim to:

- Prevent illegal activities like money laundering.

- Ensure financial transparency and tax compliance.

By adhering to these rules, you’ll avoid penalties and maintain a healthy financial record.