Why Filing ITR in Loss-Making Years is a Smart Financial Move

Why Filing ITR Matters Even During Losses

Filing an Income Tax Return (ITR) is not just a legal obligation—it’s a financial strategy. In India, taxpayers who incur losses often wonder if they should file ITR. The answer is a definite yes. Filing ITR during loss-making years ensures compliance and offers several benefits. Let’s explore why this practice is crucial.

Key Benefits of Filing ITR in Loss-Making Years

- Boosts Loan Approval Chances

Banks often request ITR documents during loan applications. Filing ITR, even with losses, demonstrates financial credibility and increases approval chances. - Simplifies Visa Applications

Countries like the US and Canada demand ITR proof for visa processing. Filing ITR reflects financial stability, expediting approvals. - Enables Loss Carry Forward

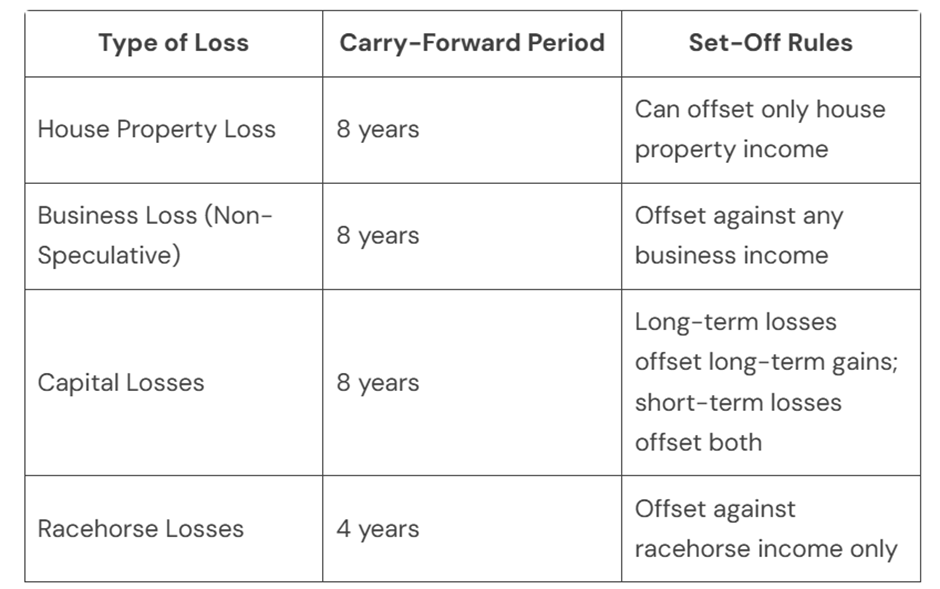

Did you know losses reported on time can offset future profits? Carry-forward provisions help reduce taxable income in profitable years. - Enhances Financial Standing

A consistent record of ITR filings boosts credibility in financial dealings, such as business partnerships and investments.

Understanding Loss Adjustment Provisions

Tips for Filing ITR in Loss-Making Years

- File Before the Due Date: Most losses can only be carried forward if ITR is filed on time.

- Maintain Records: Accurate records simplify reporting and prevent errors during audits.

- Seek Expert Advice: A tax consultant can help optimize your tax benefits.

Final Thoughts

Filing ITR during loss years is a proactive decision. It not only fulfills legal obligations but also strengthens your financial future. Start filing now to unlock numerous benefits.