The ITR filing season is here, and if you’re looking to claim House Rent Allowance (HRA) exemption, you need to keep certain documents handy. HRA is a significant tax-saving tool for salaried individuals living in rented accommodations. To ensure a smooth process and avoid issues with the Income Tax Department, ensure these four documents are in place.

1. Rent Receipts and Agreement

Rent receipts are crucial proof of your rent payments. You must also have a valid rent agreement with your landlord. Ensure both documents are consistent and reflect accurate details. A rent receipt should include:

- Name of the tenant and landlord

- Rent amount

- Month for which rent is paid

- Landlord’s signature

Pro Tip: If possible, ask your landlord to issue receipts regularly to avoid last-minute hassles.

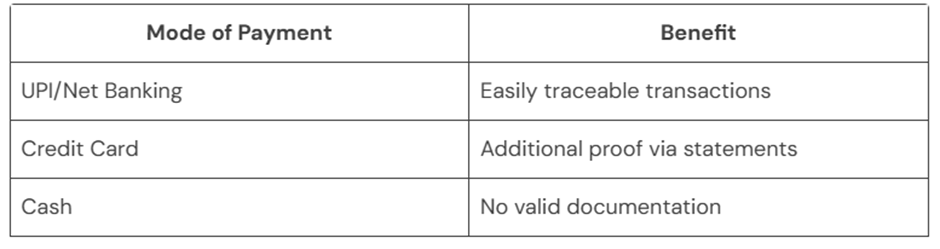

2. Bank Statement of Rent Payments

Even though no one usually asks how rent is paid, it’s advisable to make payments online. A bank statement acts as solid proof in case of scrutiny by the Income Tax Department. Avoid cash payments and opt for UPI, net banking, or credit card transactions.

Did You Know? If you pay rent exceeding Rs 50,000 per month, TDS must be deducted by the tenant.

3. PAN Details of Your Landlord

The landlord’s PAN is mandatory if your annual rent exceeds Rs 1 lakh. Without this, you may lose out on the exemption. Ensure you request this information in advance. If your landlord doesn’t have a PAN, you might face limitations while claiming HRA.

4. Rental Agreement

A valid rental agreement is non-negotiable. It should include the following:

- Complete details of both landlord and tenant

- Terms of rent, including TDS deductions

- PAN details of the landlord

Having a clear and well-structured agreement ensures compliance with tax rules and avoids unnecessary legal complications.

Conclusion

Keeping these four documents ready will simplify your HRA tax exemption claims. With proper preparation, you can save taxes and stay stress-free during ITR filing.