Namashkar, my name is Rupesh Jadhav and welcome to Rupeshfinancialexpert.

Where I do not lock the knowledge of finance but unlock it instead, This blog is part of a blogs series in which we are covering CIBIL Score, In the first blogs, we saw what is the concept of CIBIL score, How a good CIBIL score can help you get a loan, Any type of loan or any credit facility, Then in the second blog, we saw how you can check your CIBIL score online, You can also view the credit report and what kind of information it gives, You get this complete information from CIBIL’s website. It is available for free, there are no charges for any kind. So, if you have not read both of those blogs, then you should read those two blogs first, in this blog, I will be writing how you can improve your CIBIL score, or if you already have a high CIBIL score, so how can you maintain it? You should know about that too; I have said in many of my previous blogs that if your CIBIL score is above 750, then it is considered as a good score, you can get a loan very easily, Now it is out of 900 and if your score is more than 800, then you get a loan very easily For this reason, you need to maintain a good CIBIL score, So in this blog, I will check on what parameters the CIBIL score depends, And how you can improve it, so you must read these blogs from beginning to last. So, that you do not miss any important parameter.

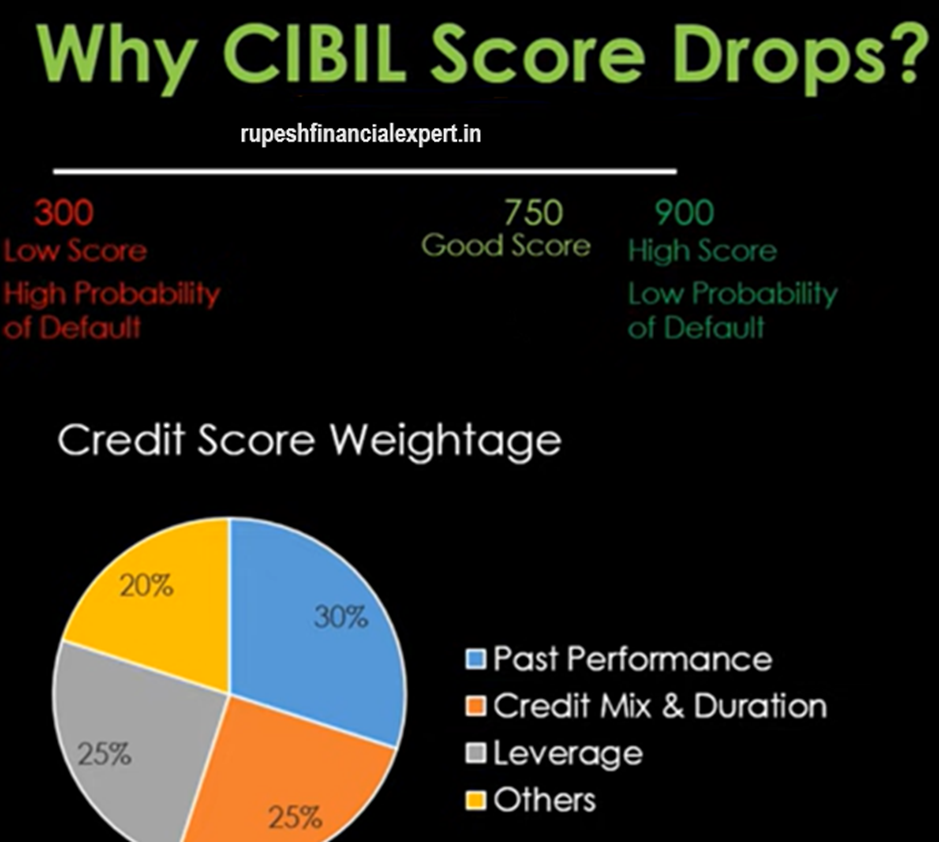

So, before we learn how to improve our CIBIL score Why CIBIL Score Drops? First of all, we have to understand why our CIBIL scores drop, I have made a blog on the calculation of CIBIL score, and in that, I have written, what kind of weightage is there? So, if you haven’t seen that blog then check it, I will summarize it all once. Our CIBIL score range from 300 to 900, It calculates the probability of, that what is our default probability, that if we take a loan or credit card, we will make its payment on time or not, So 900 would be your maximum score, And we consider a score above 750 as a good score, on which we get loan easily, Then the weightage of the credit score includes, the score of 30% in it depends on your past performance. Whether you have made repayment of loans in the past or have you did some defaults, Second is your credit mix and duration, What is the mix of your unsecured and secured loans, Leverage is your third point, That’s also 25%, Leverage means that what percentage of your total credit limit do you use, And there are some other factors which comprise about 20%.

Let’s check why our credit score actually drops, so first of all our loan repayment can be due, or we can do some defaults. And this is the biggest reason. if you do default in any of your loan repayment or credit card repayment, So because of that our credit score drops, Now it can have different reasons It can be some financial hardship. You may not have sufficient money for that month, you may be facing job problem. Or maybe you’ve missed payments on your credit cards, It has been missed by mistake, it can happen, In some cases we get disputes, Either with the company of the credit card or you have to make a repayment in the bank, So there will be some kind of dispute, You may have had a fraudulent transaction on the credit card, Sometimes companies impose some extra charges, Maybe you don’t know clearly about the annual fees, So because of this kind of dispute, we sometimes miss this payment. And we try to settle with the credit card people, but we forget that it’s impacting our credit score, and in the future, we may have a lot of trouble getting credit or a loan. especially if you have a default of any kind, so your credit score drops very quickly.

Suppose, if you have a score of 800 than in 2-3 months, it can drop to 650, can be less than this if your default is too big, So your effort should be that there must be no default of any kind, I will give some tips related to this later, in this blogs, Let us go ahead and see what else causes our credit score to drop, if you take too much of unsecured loan, Special if you take too much of credit loan or personal loan, Specially according to your credit limit. Even then your credit score can drop very quickly, because even on this the score is 25%, So what happens in the unsecured debt is? that as there is no security behind them, Bank or any financial institution hesitates, when giving an unsecured debt. So, they always check your credit score, to see how your past performance has been. So, if your secured debt is very less, personal loans or credit cards are more, so your credit score could drop, I had talked about leverage to you, assume that your total credit limit is 50 lakhs. And if you are already using a credit limit of 40-50 lakhs, then this is also having a negative impact. If your credit card limit is Rs. 50,000, then suppose you spend 40-50 thousand Rs every month out of that, so that too would have a negative impact.

Then there are some other factors also like, if you generate more loan or credit card inquiries, in less time, in 3-4 months you apply for 3 loans, so this also has a negative impact, so about them, I have already talked to you, this credit score was talked about in the credit weightage blogs, how can the credit score be calculated? Apart from this, there are some factors, like if you have taken a joint loan, So the effect of joint loans is on all of the borrowers. For example, Husband and wife have taken a joint loan, so credit score of both will be impacted. Even if only one of them is making the payment, But the credit score of both will be impacted, if you have issued an add-on card, and the main cardholder did default on the payment. So, your score will also impact, so many people do not know these things, then if you are a guarantor in any loan, Then many times people say that, one only has to do a signature just has to become a guarantor, But you should understand that if the borrower did some default, then the credit score of the guarantor will also be affected. In fact, Bank will demand the guarantor to do the repayment, so legally you should understand that being a guarantor means, if the borrower does not make the payment, then its guarantor’s responsibility to repay.

Then if your company has taken a loan in which you are a partner, proprietor, a director or you are a guarantor in a loan. Still, your credit score will impact, now many people miss these 4 points. So is there a joint account of any kind, whether it is a credit card or if you are a guarantor, So you should know, that your credit score will also be affected by it, Then many times inaccurate information goes in your credit report, Now what can be an inaccurate information, So there may be some inaccurate open accounts, So you should check all of the open accounts you have, Whether it is closed or not, is it still reflecting wrong, or maybe you have made a partial or full repayment, But it may not be reflecting, If you have settled any loan then it may not have been updated, If all this information is not updated, then your credit score may also drop because of that. So, for this, you can also go to the consumer address forum in CIBIL, or you can also coordinate with your bank. I will be writing about it in detail now, about what steps can we take? So, these are the 6 main reasons due to which your CIBIL score drops. Now let us check what action should we take.

Tips to Improve CIBIL Score, as if our CIBIL score is low, then how can we improve it, And also, if our CIBIL score is high, then how can we maintain it? The very first thing, that I am saying from the last few blogs, is that you should pay all your loans, and credit cards on time, and make full payment, This is the biggest reason for our low credit score, So if you have missed any EMI due to any reason, or missed any credit card payment in 1, 2 or 3 months, even if your reasons are genuine, So as soon as your situation gets better, you should pay all your dues, And should pay the full amount, then another, Sometimes we miss our payment by mistake, We do not remember to pay on time, So in this situation, use automatic payment mode. In fact, my personal favorites is the electronic clearing system, just put ECS with your bank account and your credit card payment, will be done automatically There is the facility of ECS for loan repayment as well. And if you are not very comfortable with online, then you can also issue post-dated checks, you will not be worrying about making the payment on time every month.

Then if there is any dispute with your lender or credit card company, any fraudulent transaction is done or extra charges are levied by them, the annual fee may have been imposed by them by mistake, or maybe you didn’t know. So, if you have any amount due in this way, then you can settle it. lots of banks, In fact, all of the banks and credit card companies, settle them, They settle any of the disputed charges of this kind, Suppose you have any dispute of 50,000, then your credit card company may tell you to settle it for 25,000, Just give 25,000 and both have a profit, You can also increase your credit score, And you will not be impacted much, So the settlement is done, you should try to settle it as soon as possible, Then I talked to you about the credit mix and duration, If you had unsecured credit like your credit card or personal loan, etc. Where there is no security of any kind, if it exceeds 20% of your total credit limit, so your credit score starts impacting.

Now I will tell you how you can calculate your credit limit, I am telling you a thumb rule, Let’s say if you have a salary of Rs. 50,000, So the bank says that you can make EMI, or credit payments up to 25,000 every month, so you must assume your monthly credit limit is Rs 25,000, Now you multiply it by 100, then your total credit limit will come, so your Total credit limit is Rs. 25 lakh, this is the thumb rule, Now it can be less, or it can be more, Most of the banks consider it minimum, So if your credit limit is 25,000 rupees per month, As much EMI you will give, So your total credit limit becomes 25 lakhs, Now out of 25 lakhs, you should try that not more than 20%, of this should be spent on your credit card or personal loan, Or you can take from the monthly credit limit, that if Rs. 25,000 is going there, If there is a monthly credit limit, then the total amount of EMI of your personal loan, should not be more than say Rs. 5000. It should be less than Rs. 5000, if your monthly salary is Rs. 50,000, Or personal loan or credit card payment, should not be more than Rs. 6000-7000. Then you should not take too many loans in a short time, even if you have a requirement of 3 loans, also, so it is reasonable in 18-24 months, but if you demand 3 loans in 3-4 month, so it’s wrong it can negatively impact your credit score.

Then you shouldn’t show your credit hungry behavior, the credit hungry behavior is, if make payments of multiple credit cards, Assume I also talked about salary and suppose, if your total credit limit is Rs. 1 lakh, and you spending Rs. 70,000-80,000 per month from it, so that too is negative behavior, it seems to CIBIL or banks, that you have the habit of using too many credit cards, and taking too many loans, then you should use less than 30% of your credit limit, if your credit limit is one lakh rupees, then your spending should be less than Rs. 30,000. or take it according to your salary, if you have Rs. 50,000 as your salary, then you should try that you spend less than Rs. 15,000 on your credit card, so take a little care of this thing. after that, your EMIs should not be more than 40% of your monthly salary, if your monthly salary is Rs. 50,000, then you should try, so whatever your total EMI is, whether it is credit card payment, whether you took a loan, either a home loan or a car loan, so your total EMI should be less than Rs. 20,000, So if it is less than Rs. 20,000, then you will have a healthy credit score.

The fourth tip is, that you should manage your credit card properly, So first of all you, should not take any credit cards, Many people say that we revolve multiple credit cards, they make payment of one credit card with another, See it takes a lot of time to manage this firstly, And secondly, I haven’t seen a single person, who earns a lot by revolving their credit cards, Or they get a benefit from it, ultimately it became your habit of taking credits. And you keep paying their interest, so you should take fewer credit cards, 1 or 2 credit cards are maximum enough, you don’t need more than that. pay your payments in full no matter, how many credit cards you use. Many times, people think that I pay the minimum due, but what happens that you have to keep paying the interest on it, and that interest keep getting accumulated, and that payment of interest keep increasing. Simultaneously, your credit score also starts getting worse.

Then if you have a financial hardship, for 1-2 months, you really don’t have money, so at least minimum due has to be paid. Because if you do not pay the minimum due, then it will be counted as default, And the credit score drops drastically due to default count, So I am not saying that you always get the minimum due. If you have a lot of financial hardship, then only you should pay the minimum due. Otherwise, you should try that, I should pay all my credit in full, then many times if your credit score comes down, then if you have to terminate any credit card, means you have to settle. So, settle that credit card where you have defaulted, If your old credit card has a good repayment history, then it helps in improving your credit score, So if there is such a credit card where you have always paid it in full, then you keep it and you may not use it, fine, at least if your credit card’s history is good, then your credit score will be good.

Now there is a fifth tip is, Many people do not pay attention to this, many people do not know that, you can also take alternate loans and credit cards, You can also improve your credit history, Your credit score may have already dropped, And you are not getting any kind of credit in the future, So in this case you can take loans against securities like, You can get a loan against FD, against LIC policies, can get a gold loan, Loan is available against mutual funds or shares, In this type of loan, your current credit score is not checked. But your credit score is definitely based on them. So, if you make their payments on time, then your credit score will start improving. Similarly, you also get these types of credit cards against securities, like you get credit card against FD, you may not get a normal credit card, if you have a bad credit score, so in this case you can take a loan against securities, or a credit card against securities. So, it will help you to rebuild your credit score.

Moving on, monitor loan accounts in case of joint loans, like I have talked about it earlier that, if there is a joint loan or you are a guarantor in any loan, or if your company has taken any such loan, where you are a partner, director, a proprietor, or a guarantor within a loan, then monitor these types of loans. Because your credit score will also be impacted, if this leads to a default on loans, so you should always check, that the repayment of such loans is always on time, then if there is any kind of inaccuracy inside CIBIL’s credit report, then you must monitor that at least once a year, you should check your credit report at least once a year. In any way, if there is an incorrect open account, whatever open accounts you have first check them, if there is any inaccuracy in them, if anything wrong has been reported in the account, You may have closed one of your accounts, and it is still reflecting. So, if there is any such an account, then you can report it, if there is any kind of discrepancies. You have settled any loan amount, and it is not getting reported, finance related. And it may happen that you have done your full repayment, yet it is showing partial, so if there are any such discrepancies, then you can go to the consumer dispute resolution of CIBIL and report online.

So, you can report this, but keep one thing in mind that, this inaccuracy which you report will send by CIBIL to the lender, And the credit data will only be updated when the lender confirms it, CIBIL cannot correct any inaccuracy without the lender’s confirmation, so you can definitely raise the dispute within CIBIL. But the correction will be done only after the confirmation of the lender, so these were my 7 tips. Now when you take this corrective action, you will make your payments in full and on time, you’ll build your credit mix well, if there is any dispute of some kind if you report it, and after correcting them, so after that, you have to wait at least 6 to 8 months. because your credit score takes time to improve, don’t think that it will be done within 5 or 6 days, it improves slowly with time, and it takes at least 6-8 months to reach the level, at which your credit score was maximum, so take care of this thing too.

I think I have discussed as many tips as possible to improve the CIBIL score here, So if you will follow these tips, your credit score will start improving very soon, So that’s all in this blog post, I really enjoyed making this blog, If you have also liked this blog, then please like and share it, If you have any kind of suggestion, or want to suggest any topic for future blogs. Or if you want to share your other thoughts with the community, then you can comment below. Because I keep on bringing informative finance-related blogs like this almost daily, so see you in the next blog.

Till then keep learning, keep earning and be happy.