Namashkar, my name is Rupesh Jadhav & welcome to Rupeshfinancialexpert.in

Where i unlock the knowledge of finance rather than locking it, in this blog i am going to talk about, what are the options of taking a loan if your CIBIL Scores are low? I have already made 4 blogs on the CIBIL Score, in the 1st blog I have written what are the basics of CIBIL Score, In the 2nd blog, I have written how we can see our credit score for free/check our CIBIL Score, online? In the 3rd blog, we get to know about how we can calculate our CIBIL Score & in the 4th blog, we have seen, how we can improve our CIBIL Score if it is low. You can read all 4 blogs. Their CIBIL Score will be improved in 1-2 years, but their loan requirement is urgent, what we can do in this is, in this blog, I will give you 9 tips, if you have any home loan, personal loan, or education loan requirement, then how you can do it, what will be the alternatives, even if you have a low CIBIL Score, then there can be some options available & you can take a loan, Read the blog till the end.

What will be the effect of CIBIL Score on the capacity of taking a loan, Effect of CIBIL Score on Loan Eligibility, the statistics are, it is shown how much loan accounts fall in which %, 19% loan accounts fall in the 815-900 range, the CIBIL Score are from 300-900, 20% of loan accounts fall in 800-824 range, 21% fall in 775-799 range, Another 21% fall in the of 700-774, Only 19% of loan account falls in the range of 300-699, As you know that only few loans are issued, if the score is between 300-699, In the case of a bank, They disperse about 80% of loan to the score of 750 or higher, That’s why we have to maintain a good credit score, If your score is 800 or more than most banks and NBFC’s provides loan to you easily. CIBIL Score of more than 800, At best interest rates, suppose the lowest home loan interest rate is 8.5%, you can avail of it easily if your score is above 800, If talk of 700-799 range, most banks and NBFC’s offer loan to you, CIBIL Score of More than 750, but below 800, But interest rates maybe a little bit higher 0.25-0.50% or max 1% higher interest rate, You can get interest rate upto 8.75 to 9% at the place of 8.50%, Now if score is 775-799, CIBIL Score of More than 700 but below 750, Then it is concerning, Most of the banks and NBFC’s does not offer loan to it, Some of the banks and NBFC’s offer loans, But at higher interest rates by 0.5-2%, If you getting a loan at 8.5% with a score of 800, Then you can get a loan of interest 10-11% in 750-799 range, It become difficult if your score is below 700, CIBIL Score of Less than 700, Most of the banks and NBFC’s does not offer loans to you, It generally happens when you default on past loans.

I already written a blog on how the CIBIL score is calculated and its basics, how you can improve your CIBIL score, you can also read those blogs on website. Now, if your score is 700 below, and you are not getting a loan, or you didn’t have a credit history at all right, Then how you can get the loan in that case, And see what alternate you have, firstly, If you want a home loan especially, you should get on spouse name, How to Take a Loan in case of a Low CIBIL Score? husband or wife whose CIBIL score is good or you can apply for a joint loan, In a joint loan, CIBIL score of both is considered, In that you are better-off, chances of getting loan is higher, It is useful in home loans and bigger loans, when you getting in loan on spouse name or joint loan. Point Second, you can add a guarantor, if you not greeting a loan at own name or on not having a credit history, Maybe you go for higher studies and does not have any job, that mean you didn’t have a credit history, In that case, you can add your parents, brother-sister, or any relatives as guarantor, If you didn’t have a credit history or a having low score, You should make a person guarantor whose credit history is good, A guarantor is generally useful in getting an education and personal loans, Thirdly you can approach alternating lending institutions, Alternating lending institutes like cooperative banks, Rural banks, microfinance companies, NBFC’s, Microfinance companies, These types of small companies or cooperative banks, Didn’t check the credit score.

Therefore, you can approach this for a loan, especially in cooperative and rural banks. If you are familiar with someone, there then you can get a loan easily, you can take help from the guarantor, if you know someone who already has a loan account banks, saving, or another account in a cooperative and rural bank there, Then they can act as a grantor to you, and you can get a loan this way, Remember one thing interest rates in these loans can be higher, Suppose the best rates get on a home loan in a joint loan case, suppose the best rate is 8.5% in the normal case, Then you have to pay an interest rate 12-15% in that case, It is not bad at all if you didn’t get a loan from any banks, It may be a nice option for you, Option fourth, Loan against securities, This means if you have F.D in a bank, any L.I.C policy, life insurance policy, gold, mutual fund or shares, You can get a loan against these securities, especially In a case of L.I.C or life insurance policy (Endowment/whole life), In which money come back, these loans are not available against the term insurances., Where money-back guarantees are there, or endowment policy or whole life policy. we can get loan against them, or against gold security or against PPF, we have talked about mutual funds and shares, or against credit cards, in fact, we can get instant loans in credit cards in today’s date, but yes you don’t get loans for a big amount.

Then, overdraft facility is also available on salary account or saving or current account, but in this we have to keep in mind that, interest may vary from normal home loans, but it will be lesser than personal home loan, so when we talk about home loan, where we can get 8.5% interest on loan, then we can find that it will be 1 or 2% will be more, then you have pay average 10% average rate, but it is very cheap in the case of personal loan, You can get up to 14 to 20% rate, Then loan against security is a good option, Where your credit scores are not check, and the second merit of this is that, It will help in improving credit score, because let’s consider, If u take loan against FD, and u have less credit score, If we pay our new loan payment on time, It will help in improving credit score, Then you should be alert, that when you have security, and if you take loan against it, then it will be very profitable, you can get loan against it, plus your credit score will also improve.

Then my fifth tip is, that you can take loan from friends and family, many people know that you can sign a proper loan agreement, in which, how much will you make the interest payment, how will be the payment terms, that you either pay monthly, quarterly, annually, or a lumpsum amount. It is up to you, that interest rate can be 0% or at the market rate. assume up to 0% to 10% or you can decide any interest rate, because it will be agreement between friends and family, then there will be no problem to anyone, second thing is that many didn’t know about the tax benefits in this, For example, if take home loan, let say from own parents, let’s consider at 0%, then also you can take tax benefits specially in under section 80c, when you make principle payment, under section 80c you can get tax benefit, I will make a detailed blog on this topic in future, so you can take this tax benefits, even if you take a loan from friends or family, but yes for proof u need to sign loan agreement, Then If you are salaried class, then it may be possible your companies have tie-ups with some banks, because there relationships are good with the banks, Then you can approach a bank that has a corporate account of your company, because they give too much business to the particular bank, So, any bank can give loan easily to the employee, of any reputed company in such case, they will not check credit score, they will basically give loan on the company reputation, and you can approach to HR, and you can take letter from them, Generally, there are no problems to the companies for issuing such type of letters, Generally, this is beneficial for small loans, you can’t take, big loans from this, But let’s consider there is requirement of some small loan, up to 40 or 50 thousand or 1 or 2 lacs requirements. Then, you can also approach to corporate tie-up banks.

Then now 7th tip is, that u can also approach to private lenders, private lenders are especially very popular in a rural and semiurban area, and infects private lending are mostly common in India, but only disadvantage of it is that interest rate will be more. So, local financer in every local area in fact in the cities, they will charge rate of up to 2 to 3% monthly, then the annual interest rate could be 24 to 36%, which is very high interest rate, In the other options we have talked about, you can get low interest rate in them, up to 10% or 12% or 15% but in case of private lending interest rate will be higher, Plus they will give the option to mortgage to the property of the gold of yours, then only they give loans, For a small amount loan, consider it for the lesser duration, because you should not take this for a longer duration, Because the interest rate will be much higher, when you calculate it, You will find that within 2-2.5 years your, borrowed amount will be equal to your interest amount, Let’s consider you take amount for 3 years at 36% rate then 36*3 it will cross 100. Then, let’s consider you take loan for 2 lacs for 3 years, then you are going to pay more, than 4lacs., Then for sometimes, suppose 4 or 6-month requirement, then u can also consider this option, otherwise, if you want for a longer period, then u should consider my other tips.

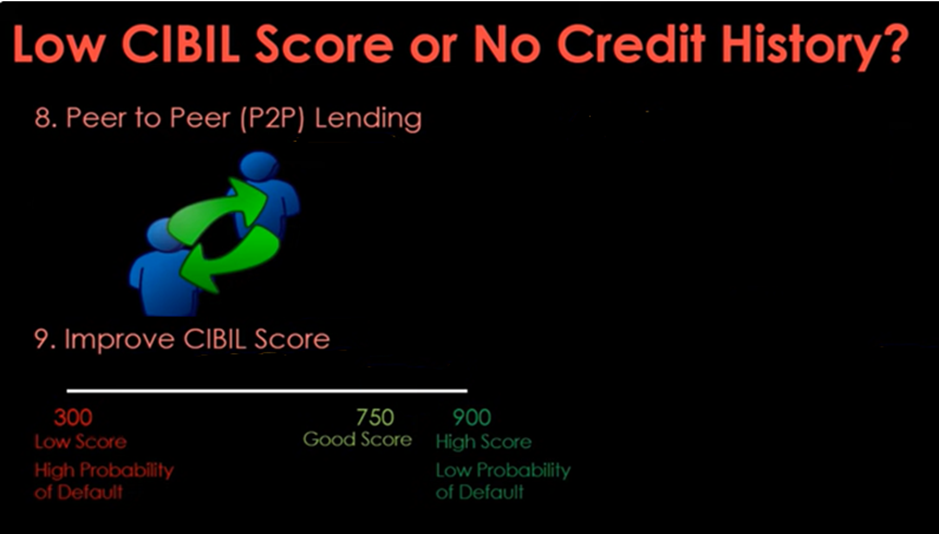

Now, my 8th tip is, In today’s date new peer to peer lending institutions have come, Which is a new concept and many people are unaware of this, This is basically an organized way of private lending, we have talked about private lending in which individual financer, Who has a small amount of money, generally deal in cash/give money, But in peer to peer lending in today’s date, there are many organized companies, which take money from investors where investors invest their money, If u want to invest then, u can invest with peer to peer lending institutions from there, your money is given to other, In between they will take their commission and lend money to other, Just like that, u can take a loan from p2p institution, I’m not telling about names of any institution, This is not a sponsored post, but if u search u can find many p2p lending institutions. interest could be 15 to 30%, and now considering private lending individuals this is better than that, you can build trust because here company is investing its own reputation, as a stack at its own risk, Then, the loan tenure could be somewhat of 6-36 months, u should not consider it as a home loan. Basically, if there is requirement of personal loan, then u can consider p2p lending, and here also credit score is not considered, but in some cases, it may be considered. But maximum p2p lending institution will consider every factor, Let’s consider your credit score is less, but your salary or income level is good, you are frequently an investor, u have saving habits then u can get loans easily, and yes second thing, is that these institutions are not regulated RBI has no regulation on this, as on date may be possible in future RBI to regulate them, because for banks and NBFCs there are regulations of RBI, But for now, there is no regulation for p2p landing, So basically this will not impact your credit score like if u have borrowed any amount from p2p as a loan, and if u pay the payment on time it will not affect your credit score, Then u should keep in mind that if u want to improve your credit score, then you can take loan against security, it will improve your credit score.

Now let’s talk about the 9th tip, i.e. you should improve CIBIL Score, Because there is no real alternative way of improving CIBIL Score, if you have less CIBIL Score then, there could be problems in future, Your target should be to always maintain more than a 750 score, and if are able to maintain more than 800 score, then it will be best, because you can get best rate for every loan, You should make good credit history, But if you have a score of more than 750 before, and now it became less than 600 or 650, Then it will not improve immediately for reaching that level again it could take 1 or 2 years, That is why I always told you that you should make payments on time, and also EMI always make full payments, like if u use a credit card, then don’t make minimum due pay and always make full payments, Because that will also lower your CIBIL Score, I have also made written blog on improving CIBIL Score, you can also read that blog.

I think I have covered every tips and alternative in this blog, If your CIBIL Score is less or you have no credit history, this is how you can take loan, In this blog, I have tried to cover all the major points, If you find any point missing, then you can comment down in the comment section, LIKE & SHARE THIS BLOG, My intention is to share detailed & informative finance blogs every day, See you in the next Blogs, till then keep learning, keep earning & be happy.