The forward contacts is a kind of financial derivative. With a forward contract price risk is reduced. An example of this. For example, a farmer who grows wheat. He sells all his wheat to a food processing company. So both the parties have price risks. Price is a game of demand and supply. If the price goes too low in any year, the farmer may suffer a loss. And some year if the price goes too high, so the food processing company may endure loss, in such a situation, both parties can sign a Contracts, where can fix their price, and you can reduce your risk. Its is called a forward contract.

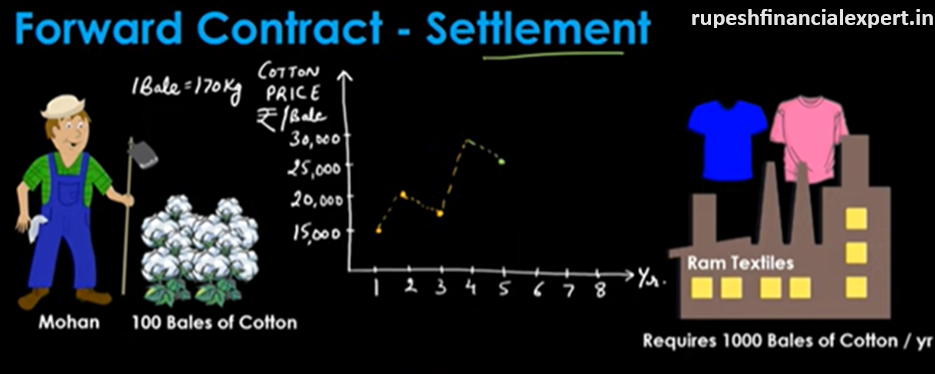

Let’s take a example, suppose this is a farmer, Mohan. He grows a hundred bales of cotton on his farm. On the other hand, there is a textile factory, by the name Ram Textiles. Their requirements is 1000 balls of cotton, with 10 farms like you Mohan, they fulfil their cotton balls requirements. The problem here is that the price of cotton always goes up and down, price may be different every year, there has been a lot of variation in the last few years, in cotton prices. The price was Rs. 15,000 in the first year, after that Rs. 20,000 per bale, 1 bale = 170 kg, in the second year, it was Rs 20,000, in the third year, it becomes 17,000 – 18,000, then in the fourth year, it increased very much all of a sudden. It reached 30,000. The interesting thing here is that here we are taking the value of Rs. 15,000. Mohan starts getting loss, it costs Mohan 16,000 – 17,000, Mohan cannot sell cotton below this. On that, he has to bear the loss, so he had to bear high losses this year. Now if we talk about Ram textile, as the cost goes up from 25,000. So Ram textile ha to bear the loss. Because suppose cotton per bale cost them Rs. 30,000, and they also have to bear the rest of their production cost, so they start getting loss on t-shirts or other products that they manufacture in their textiles. So ram textiles and Mohan agree, they say “let us sign a contract”. We fix prices for the coming years. So that neither Mohan has to bear the loss nor Ram textile, so it is written that, Ram textile agrees to buy, and Mohan agrees to sell 100 bales of cotton at Rs. 20,000 per bale at the time of harvest. So both these people fix their prices for coming years, they sign a forward contract for the next 3 to 5 years. So here the advantage of both is that the price risk of both is reduced. We call it Hedging. Whenever the price is going above Rs. 25,000 – Rs.30,000. So Mohan will be very happy that he is making a huge profit, Ram textile will be happy when the price will be Rs.15,000. Then their profit will increase. But when the company incurs a loss, so at that time, the share price of the textile company will fall drastically. They may have a bad credit history, If Mohan has to bear the loss, he may be out of business. See any company or any individual, can make less profit, but incurring a loss is a big deal. That’s why both of them reduce their price risk by entering into a contract. So this type of contract we call Forward Contract.

Where quantity is fixed, any commodity or an under-line asset. How much will it sell at what price? And at what time it be sold? So in the coming time, what quantity is being bought or sold at what price. That thing is written in this contract. But it also has some risks, the biggest risk is the defaulter risk of contractor parties. Suppose if Mohan didn’t even deliver 100 bales of cotton, so what will Ram textiles do? Suppose if they delivered and Ram textile refused to pay. They said that we will give you the market price only, we don’t want to give you Rs. 20,000. The rate becomes Rs. 15,000, and Ram textile says that we will give you only Rs. 15,000, we are not giving according to Rs.20,000, so there is a counterparty risk, the two parties who have come into the contract will have to go straight to court. There is no immediate settlement for them. The second risk is, Forward contracts are not traded on exchange, so you cannot sell this contract to any third party. Both these problems will be solved in the futures. In which more sophistication comes, if you trade forward contracts on the exchange. So it becomes the futures.

Let us see how it is settled, in the first year of the contract, that is in the fifth year. Here the market price was Rs. 25,000 per bale, where we get the actual price of Rs. 25,000, but the contract price they have signed at Rs.20,000, how will the delivery be accomplished, One way settlement can be done is by delivery, delivery means 100 bale of cotton, Reached to Ram textile, Ram textiles gave the money based on Rs. 20,000 per bale, then what will be the total amount, they paid Rs. 20,00,000, and he has delivered hundreds of bales of cotton, what is the second option? There will be no delivery here and these Rs. 20,00,000 will not be given, now see what will happens here? Cash settlement can be done. This difference is Rs. 5,000 per bale, so what will happen here now, Mohan will say that in don’t have bales of cotton right now. Take delivery from someone else, buy from the market, but i can pay you its difference, so what will happen in the cash settlement, Mohan will give Rs. 5,000 based on Rs. 5,000 per bale to Ram textiles. Delivery of cotton will not be done in this case. These are the 2 ways of settlement. Forward contracts are signed very informally, and you have to go to court for the settlement, If there is any kind of default, that is why futures are a better options.

![Simplify Your Trade Finance with [Your Bank]'s Letters of Credi](https://rupeshfinancialexpert.in/wp-content/uploads/2023/11/Add-a-heading-17.png)