If someone comes to me and says, “Give me your money and I’ll double it in 2 years.” I just close the door on that person. Because, It is too good to be true, otherwise all of us would be stinking rich and. Every day in the newspaper there is some financial fraud happening somewhere. So how can I trust anyone with my money? But, if we want to get rich, we need to invest smart. If you have no clue about Mutual Funds, today by the end of this Blog, you will be 10 times smarter, financially. Because I am writing about.

1. What is Mutual Fund and the different types?

2. How to pick the best Mutual Fund?

3. Information on how to open your Mutual Fund Account.

So, I don’t care which Mutual Fund you chose. I’ll just give you the right information.

Now what is Mutual Fund and what are the different types?

Mutual Fund collects money from people like us. Rs. 1,000 from Me, Rs. 1,000 from You and creates a money pool. A Fund Manager then uses this pool to invest in stocks, bonds, assets. We don’t have to worry about where it is being invested, because the Fund Manager takes care of it for a commission of 1% to 2%. If you want to invest Long Term, Mutual Funds is a great option because instead of sitting idle, your money will go and earn for you. But how can I be sure that Mutual Fund will not run away with my money? Mutual Funds are regulated by SEBI (Securities and Exchange Board of India). So, running away is highly unlikely. However, if you chose a bad fund manager then he/she might lose your money by investing in bad stocks.

I’ll tell you what to do so that doesn’t happen. First, let’s find out the different types of Mutual Funds available. There are 3 major types.

1. Equity Funds, These Mutual Funds invest in shares, stocks of companies. They are considered High Risk, but they also give High Returns.

2. Debt Funds, These Mutual Funds invest in Debt instruments like Debentures, Government Bonds. They are safe investments, but their returns are also less.

3. Hybrid Funds, As the name suggests, they are a hybrid. They invest in both Equity as well as Debt. May be 50%-50% or 70%-30%. Their aim is to give you moderate returns at moderate risk.

Then there are Sector Funds, Gilt Funds, Tax Savings Funds…. which are easy to understand, but for now, let’s stick to the basics.

Now, how to pick the best Mutual Fund?

I think the reason why we don’t invest in Mutual Funds is, because there are so many in the market, we don’t know which one to pick! So, before you chose a Mutual Fund to invest in remember these 5 points.

1. If you want to invest Short-Term say 1 year or 2 years. then don’t chose Equity Funds. Chose Debt Funds. Because they are low risk than Equity plus, they give more returns than a bank.

2. If you want to invest Long-Term, there are 2 options.

a) Lump-Sum and

b) SIP Lump-Sum

When you give a huge amount, Rs. 1 Lakh Rupees, all at the same time. And SIP is Systematic Investment Plan where you chose to say Rs. 1000 or Rs. 2000 and every month, that amount will directly move from your Savings Account to your MF account. If you are new to Mutual Funds, SIP is the best option.

3. Now which Mutual Fund to pick? They will be categorized into 3 types.

a) Large-Cap

b) Mid-Cap and

c) Small-Cap

Large-Cap Schemes invest in big companies that are already well established. So the risk is less. MId-Cap Schemes come with Moderate Risk, but Moderate Returns. And Small-Cap Schemes, invest in even smaller companies. So, they come with High Risk but returns will also be high. If you are new to Mutual Funds, I would suggest that you pick a Mutual Fund that falls in the Large-Cap Scheme.

4. Before selecting a Mutual Fund, these are the parameters that you must check.

a) Returns: How much has that Mutual Fund made in the past. Check at least 10 Years of their track record.

b) Expense Ratio: How much will that fund manager charge you for maintaining your account. It usually ranges between 1% to 3%.

c) Entry and Exit Load: Fees for entering and exiting that scheme.

5. There is something called ‘Index Funds’. In these, you don’t need a Fund Manager in between, so the expense ratio is very less. I strongly suggests that if you are new, just buy NIFTY50 and Sensex Index Funds and personally, this is what I have invested in. So, these were the 5 things that you must keep in mind before you pick a Mutual Fund.

Now it’s time for information on how to open a Mutual Fund account.

1. Select the Mutual Fund you want to OTP for based on the 5 things that we’ve just written now.

2. Figure out how much money should you invest in SIP every month to meet your financial goal. For that, we will use a SIP Calculator.

Suppose, in the next 15 Years, you want to make Rs. 1 Crore Rupees. The average Expected Rate of Return for any Mutual Fund is around 16%. So, you need to invest around 13K every month for the next 15 Years, to make Rs. 1 Crore Rupees.

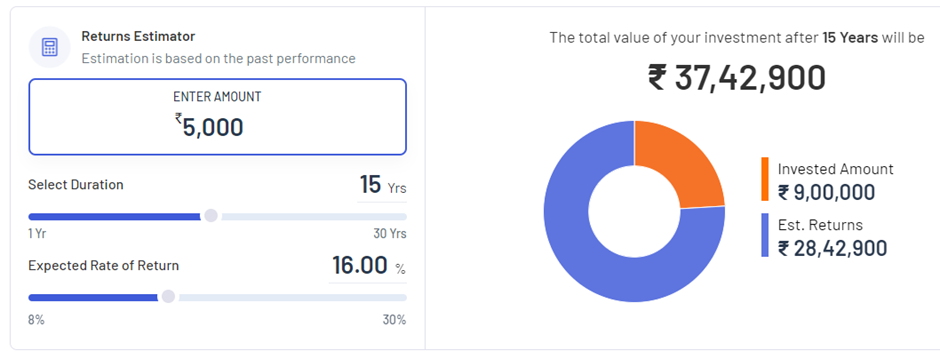

You can even use the Return Value Calculator. In this calculator, we will first enter how much money can you invest in every month. Let’s assume it’s Rs. 5,000/-, also assume that you will invest it for the next 15 Years. As we know, the average Expected Rate of Return for Mutual Funds is 16%.

This means, that when you invest Rs. 9,00,000/- your expected Accumulated Wealth will be around Rs. 37.42 Lakh. And that will happen if you invest Rs. 5,000/- for the next 15 years.

The third thing you need to start a Mutual Fund account is a PAN Card which is KYC Compliant. And finally, after doing these 3 things, you can either go to that Mutual Fund’s Branch Office or you can visit their website. You’ll just have to enter your details, your SIP amount, the duration, and your account will be set up! And that’s it. That’s all it takes to set up a Mutual Fund account.

Now I gave you all the information you need to start investing in Mutual Funds. Now your home-work is to figure out.

a) How much money can you invest in your SIP every month.

b) Which Mutual Fund is best for you.