“Drawing power method of working capital” that how much working capital can we take into our business, from a bank? Or how much is our requirements? How is that calculated? How is drawing power calculated?

Especially it’s applicable in a cash credit account, whenever you open a cash credit account of a business with a bank, so it gives you a limit. Working capital gets a sectioned limit. Under that, your drawing power is made that how much money you can withdraw. Many times, people get confused and think of both as the same, but they are different things. To assess the working capital, how much working capital is required in our business? Before understanding the drawing power method.

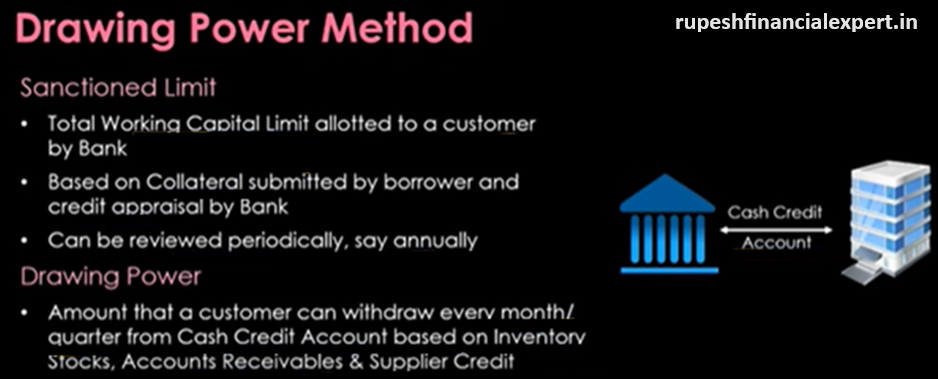

We’ll first understand what is sanctioned limit?

Its’ your company, and it goes to bank and speaks. We have some requirements for working capital. So how much maximum loan can you give us for working capital? So the bank does a credit appraisal of this company and assigns a working capital based on that. Now working capital can be a form of a cash credit account, form of overdraft or any other form of short-term loan. Or it can be any kind of credit facility, what is the sanctioned limit basically? sanctioned limit is a limit assigned to you that how much total working capital you can take, whether it’s an individual or company, so bank assigned this maximum limit, the bank won’t give you any loan or credit facility more than it, so what is it based on? It’s based on your collateral. Bank does not assign working capital collateral. Now this collateral can be anything, it can be FD, it can be a property, it can be any kind of marketable security, marketable security means, we talked about FD, it can be your stocks or bonds. So the securities which can be converted in cash under a year, it can be LIC policies, so your limit won’t be sanctioned until you give collateral. And how much collateral you give, based on a percentage of it, the bank assigns a limit of yours. And your credit appraisal is also done as well, how was your credit record in the past? Your civil score is checked. Your company’s civil score is checked. In that, it’s seen that how is your past loan repayment history. Once the credit appraisal is done and working capital is assigned, it can be reviewed periodically. It might be reviewed annually or semi-annually. So it’s not like it’s a constant limit. Can you not get more money than that? You can definitely get it. So that was the sanctioned limit.

About the drawing power. What’s drawing power?

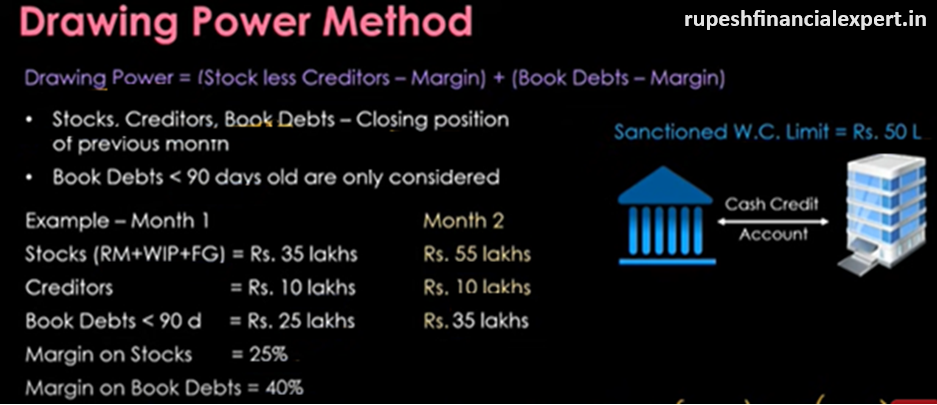

Drawing power is especially applicable in a cash credit account. It’s the maximum amount which you can withdraw, in a particular month or quarter, based on which your drawing power is being calculated. How much maximum money you can draw from your cash credit account? That kind of limit is assigned. And what is this based on? It is based on your inventory stocks; how much is the total value of your Raw Material? The value of finished goods plus, working progress stocks, what’s the value of total inventory? Plus what’s the value of your accounts receivables? Accounts receivable means the goods you’re given to the customer on credit, that money is to be returned to you. We call that account receivable. And supplier credit is subtracted from it, supplier credit means the money you have to give your supplier. So your drawing power depends on all these. So if we talk about the formula for drawing power. So stockless creditors means the total stock you have, raw material plus stock in work in progress plus, the stock of the finished goods. You subtract the creditor’s portion from it, the money you have to give your supplier and then you subtract the margin. Bank does not give you a 100% loan. Bank generally says that you put in 25% yourself, from your packet. And then in that, you book debts, account receivables, you add them and then subtract the margins. So in the book debts or account receivables, sometimes the margin is increased also. Minimum 25% is definitely kept by the bank, and it can keep up to 40%. So here margins is kept high cause accounts receivables is possible that they are risky and you might not cover the money 100%, so the banks keeps its margins. And it can increase the margin if it thinks the account receivables are risky here. So margin is basically, the bank is reducing its risk, and it wants you exposure, so you put in money from the pocket. So that was formula for drawing power. Drawing power can change each month. It basically depends on your inventory, on your debtors, now much account receivables you have, and on your creditors that how much money you have to give to suppliers. Now, this drawing power is changing each month, so it’s not your sanction limit. Sanctioned limit, let’s say changes in a year of six months. So drawing power can be more than the sanctioned limit, or it can be less. But, if in a month your drawing power limit is more than sanctioned limit, so you cannot draw more money than your sanctioned limit, from your cash credit account.

Then these stocks, creditors, and book debts, in whatever month you have to calculate your working capital, so in the previous month, whatever your closing position was, of creditors, stocks, and book debts, you’ll take those. And these book debts or account receivables, you can take these up to only 90 days, more than 90 days, bank takes them as risky so, the bank may consider them sometimes. And only then it’ll consider when the cycle of working capital is more than 90 days, your operating cycle is more than 90 days. But, generally, in this example, we’ll assume that our working cycle, is less than 90 days, so we won’t consider book debts of more than 90 days. Now let’s understand this with valued examples. Let’s assume that the sanctioned limit of working capital, for a particular company is assigned to be 50 lakhs by the bank. So if in a month you, you want to calculate your working capital and drawing power, that how much money you can withdraw from your cash credit account? i.e., assume the value of your stocks, raw materials, work in progress plus finished goods is 35 lakhs is the value. The money you have to return to your creditors is 10 lakhs, the book debts, account receivables of less than 90 days, their value is 25 lakhs. The margin on stocks, the bank will keep at 25%, and margin on book debts, account receivables we’ll keep at 40 %. Because account receivables seem a bit risky to us. Now if we calculate our drawing power, we’re talking about the second month. Because we have figures of the month and the second month is going on currently, so how much money can we take out from the cash credit account? So that’ll be basically your value of stocks, so 35 minus 10, creditors here are 10 lakhs. So 35-10, and now we’ll minus the margin here. So in the margin, it is 25%. So from 100 we’ll minus 25%. So it’ll be (1-0.25) plus you’ll take the book debts now, which are 25 lakhs. And the margin here is 40%, so it’ll be (1-0.40), so now what value we will get? So on top, it’ll be basically 25 into 0.75, 25 into 0.75, plus here it’ll be 25 into 0.6, so the total value will be is 18.75 plus 15, which is equal to 33.75 lakhs. This is our drawing power. Each month we can take out money from our cash credit account, foe the working capital requirement. And be careful that you won’t be able to take out more money than your sanctioned limit.

![Simplify Your Trade Finance with [Your Bank]'s Letters of Credi](https://rupeshfinancialexpert.in/wp-content/uploads/2023/11/Add-a-heading-17.png)