DMart, the beloved Indian retail giant, has experienced substantial growth in its stock price over recent years. However, like any investment, it comes with a degree of volatility. If you’re considering adding DMart to your portfolio, let’s analyze the retailer’s stock trends and factors to weigh before making your decision.

DMart’s Performance: What the Charts Tell Us

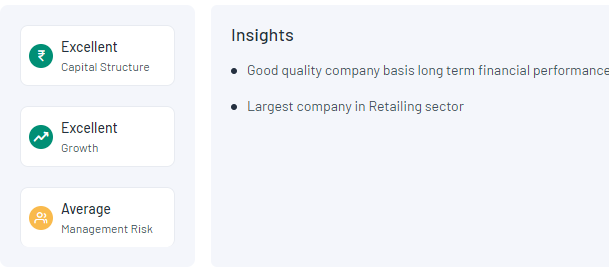

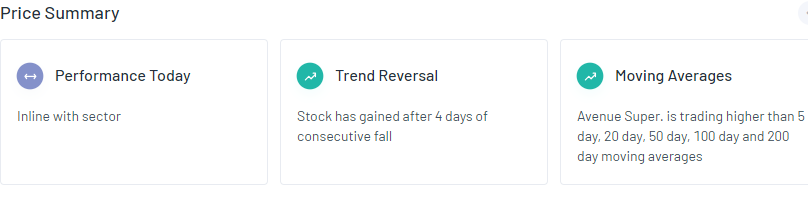

The stock chart of DMart reveals a general upward trajectory, demonstrating impressive growth. Yet, it’s essential to acknowledge the volatility present as well. This suggests that while DMart has potential, investors should be prepared for some fluctuations along the way.

Factors to Consider Before Investing in DMart

Your Investment Strategy: DMart may be a good fit if you are seeking long-term growth potential with some degree of risk tolerance.

The Indian Retail Landscape: India’s expanding retail market presents opportunities for companies like DMart. Researching this sector can give you insights into DMart’s future outlook.

Competitive Environment: As India’s retail market continues to evolve, it’s vital to understand the competition DMart faces and their potential impacts.

DMart’s Financials: Delving into DMart’s financial reports will shed light on its profitability, growth patterns, and overall stability.

Should You Invest in DMart?

The decision to invest in DMart ultimately rests on your individual circumstances and careful research. The company has a solid track record, but as with any stock market investment, there are no guarantees. Thoroughly assess your investment goals, risk tolerance, and do your homework on DMart and the Indian retail sector before making your move.

Get more information about D mart April stock 2024

Important Disclaimer: This blog post provides general information and is not intended as financial advice. Please consult with a financial professional before making any investment decisions.