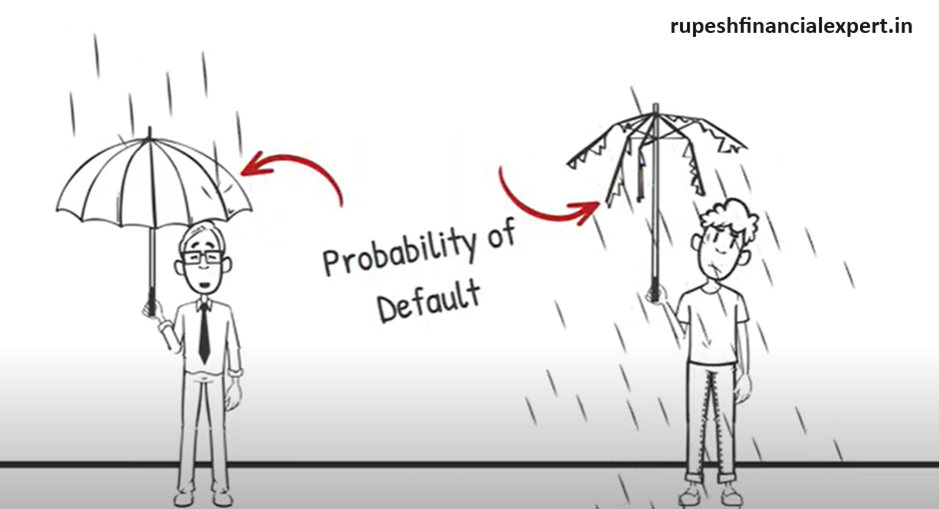

let us understand credit rating, credit rating is the probability of default on payment of interest and principal on any debt instrument. A measurement of a person or business entity’s ability to repay a financial obligation based on income and past repayment histories. Evaluating the credibility of individual and companies. Informs the lenders or an investor, weather the individual of companies will be able to pay back the loan. The poor Credit Rating indicates the high risk of defaulting loan, which may cause increase in interest rate. Also, Credit rating is an analysis of the credit risks associated with a financial instrument or a financial entity. It is a rating given to a particular entity based on the credentials and the extent to which the financial statements of the entity are sound, in terms of borrowing and lending that has been done in the past.

Types of Credit Rating

1) Bond/debenture rating: Rating the debentures / bonds issued by corporate government etc. is called debenture or bond rating.

2) Equity rating: Rating of equity shares issued by a company is called equity rating.

3) Preference share rating: Rating of preference shares issued by a company is called preference share rating.

4) Commercial paper rating: commercial paper are instruments used for short term borrowing. CP issued by manufacturing companies, finance companies, banks and financial institutions and ratings of these instruments are called Commercial paper rating.

5) Fixed deposits ratings: Fixed deposits programmes are medium term unsecured borrowings; Rating of such programmes is called as Fixed deposits ratings.

6) Borrowers rating: Rating of borrowers is referred as borrowers rating.

7) Individuals’ ratings: Rating of individual is called as Individual’s credit ratings. 8) Sovereign rating: Is a rating of a country which is being considered whenever a loan is to be extended of some major investment is envisaged in a country.

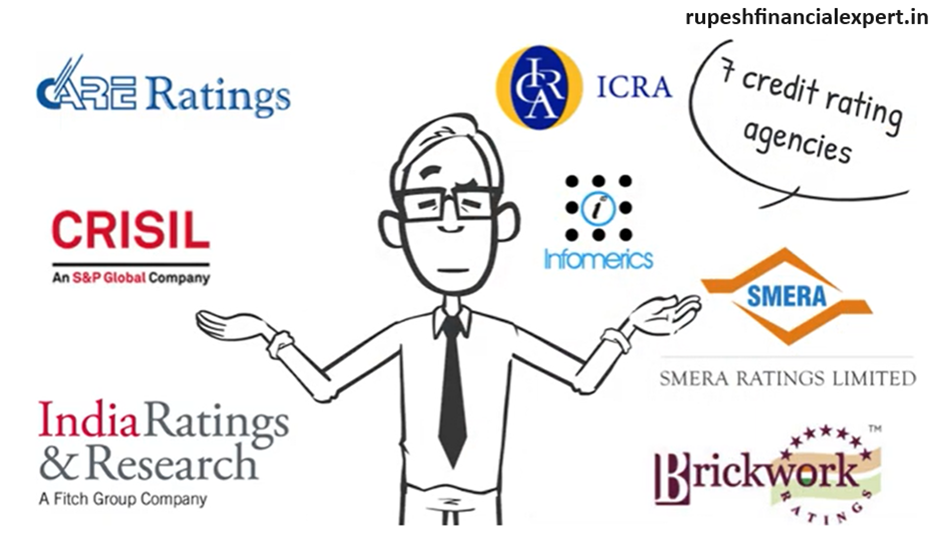

There are seven credit rating agencies in India. Care Ratings, Crisil Ratings, Indian Ratings & Research, ICRA Ratings, Informerics Valuation, Semra Ratings Ltd and Brickwork Rating.

These seven credit rating agencies are governed by the Securities Exchange Board of India or Sebi.

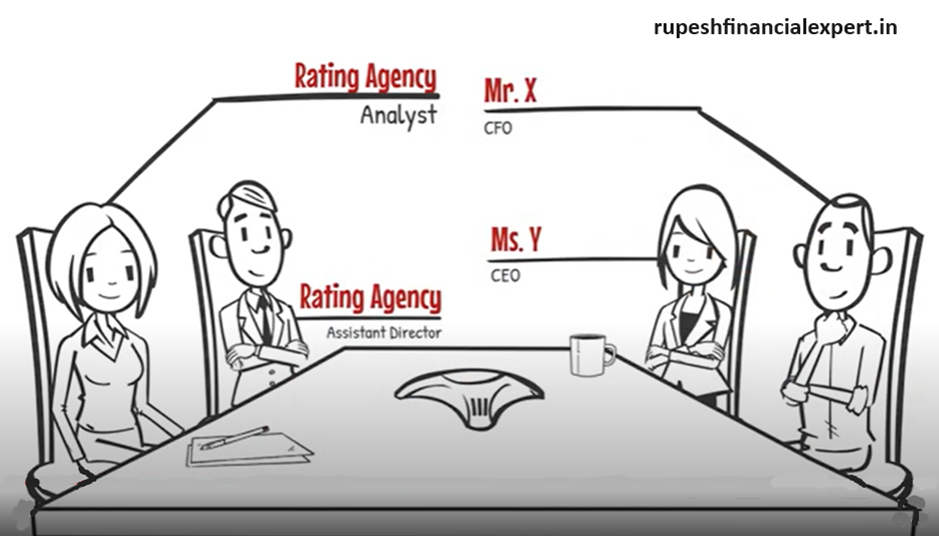

Credit ratings are based on a comprehensive evaluation of the strengths and weaknesses of the company fundamentals.

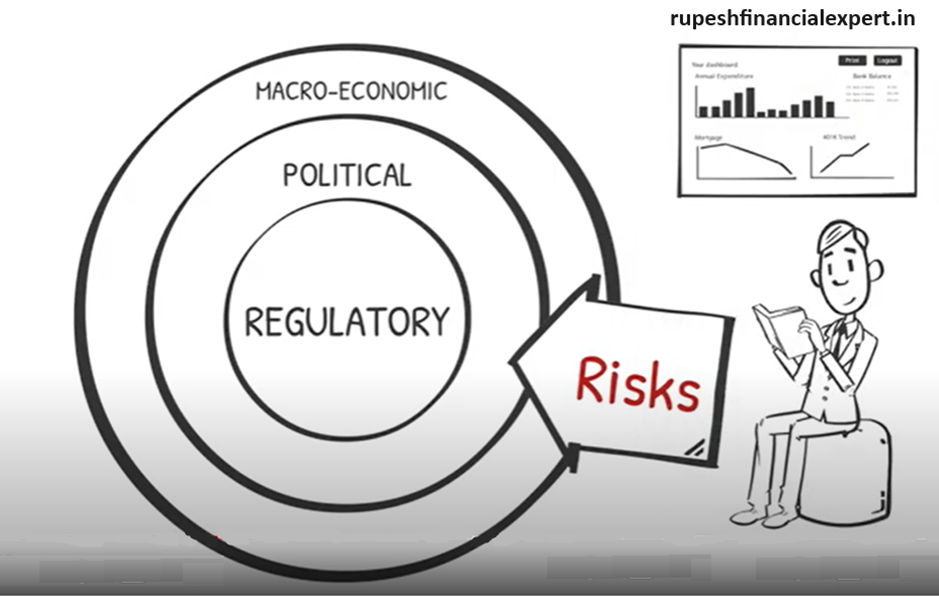

For this the rating agency analyses the financials of the company it also does an in-depth study of the industry and macroeconomic regulatory and political environment.

Credit rating is an exhaustive exercise which normally takes about three to four weeks to complete starting from the date of receipt of the adequate information.

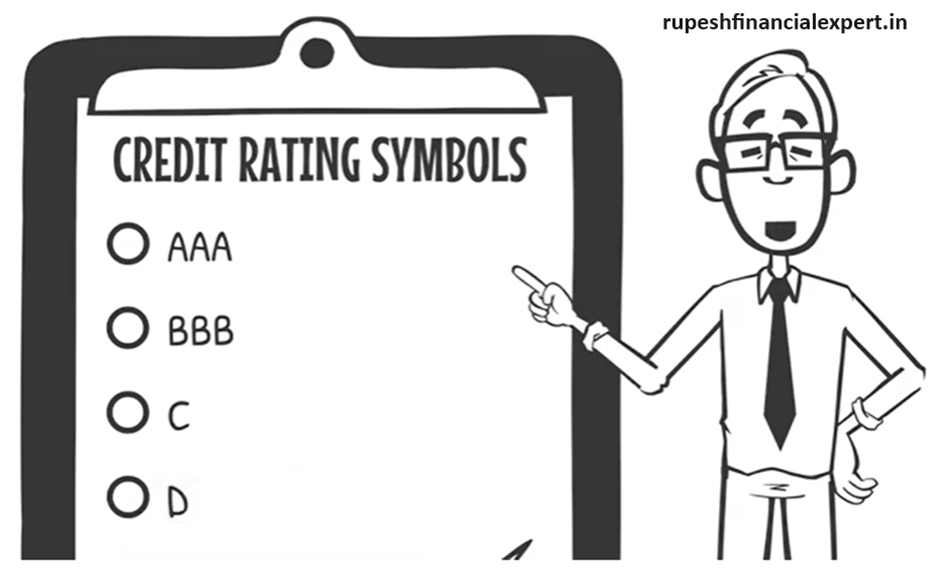

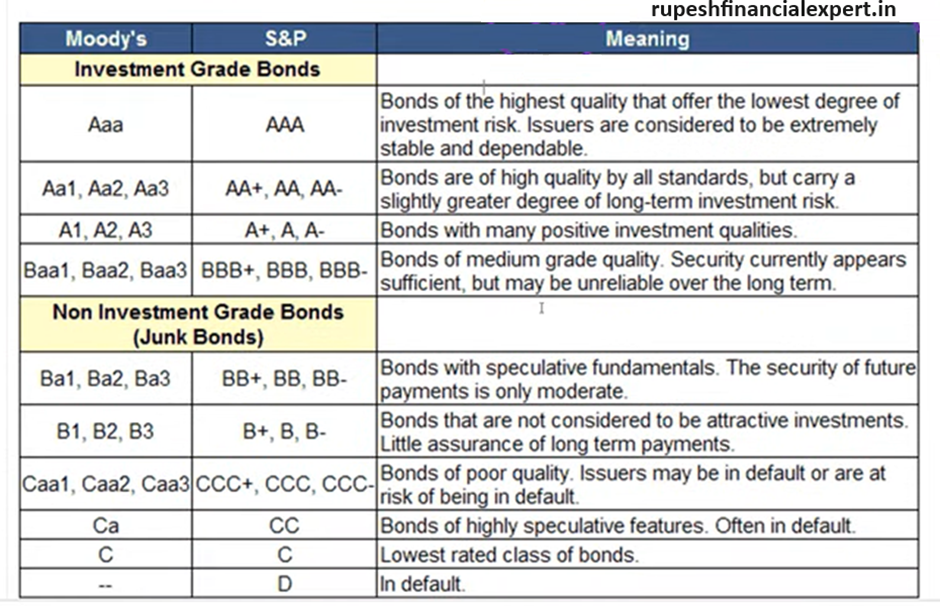

Ratings is denoted by a simple an alphabetical and alphanumerical symbol for example ratings are expressed in symbols triple A A A +, B B B -.

Each rating symbol represents degree of repayment to risk associated with debt instrument while a credit bureau provides info on the past debt repayments by borrowers called as credit score a credit rating.

Is an opinion on the future debt repayments by borrowers Sebi has mandated that every credit rating agency shall continuously monitor the rating of instruments rated by it and carry out periodic reviews of all published ratings an investment grade rating signifies the rating agency’s belief that the rated instrument is likely to meet its payment obligations.

In the Indian scenario debt instruments rated triple B – and above are classified as investment grade ratings on the other hand debt instruments that are rated double B+ in below are classified as speculative grade category ratings finally please note these two more points.

Features of Credit Rating.

Assessment of issuer’s capacity to repay. It assesses issuer’s capacity to meet its financial obligations, i.e., its capacity to pay interest and repay the principal amount borrowed. Based on data. A credit rating agency assesses financial strength of the borrower on the financial data. Credit rating is done by expert of reputed, accredited institutions. Guidance above investment -non recommendation. Credit rating is only a guidance to investors and not recommendation to invest in any particular instruments.