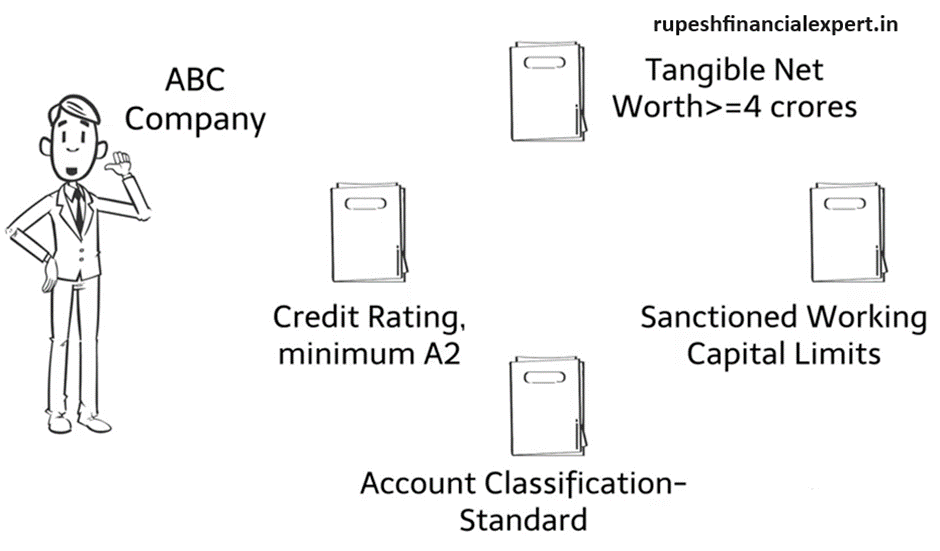

Commercial Paper emerged are as a source of short term an unsecured finance and negotiable money market instrument in our country in the early 1990, Cp is an unsecured it is issued in the Form of a Promissory Note, issued by firm to raise funds for a short period, Cp can only be issued by highly rated corporate organization, its regulation comes under the purview of Reserve bank of India. they office high interest rates due to the fact that they are unsecured, they are sold on discount & redeem at par or face value, a corporate can issue a commercial paper if he meets four conditions, first it’s eligible for Cp first it’s tangible net worth as per the latest audited balance sheet is not less than four crores, company has been sanctioned working capital limits from, its lenders its account with all its lenders as standard and finally there should be a credit rating of the commercial paper which should be minimum a to CPS.

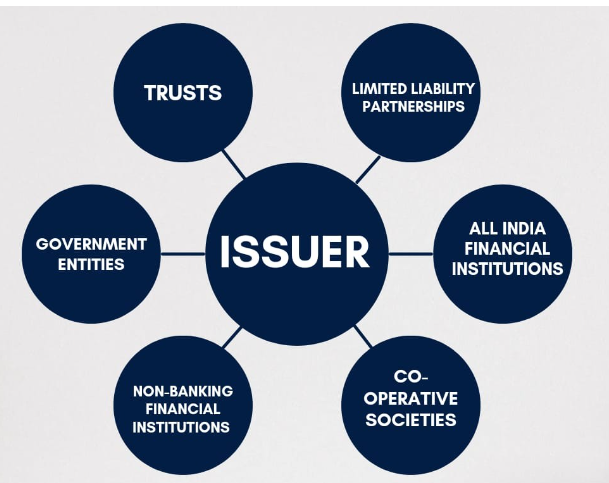

Working capital finance is normally provided by a bank or financial institution CP, on the other hand can be subscribed by general public FII on overseas investors CP in normally carved out form the working capital limit and its redemption as predetermined.

Cp’s are issued for a minimum period varying from 90 days and maximum period of 364 days, it is issued in denominations of Rs. 5 lakhs or multiple thereof, Cp’s are issued directly by organization or via merchant banks (Dealers) or issued by firm to other business firms, insurance companies, pension funds. As the dept is totally unsecured the firms having good A2 credit rating can issue the Cp.

Cp Important point.

Dematerialization similar to shares transfer of Cp similar to off market transfer, ant buying or selling of Demat debt instrument, the procedures involved for delivery or receipt of debt instrument in the same as that involved for equity shares. Redemption of the Cp upon maturity, IPA issuing & paying agent, IPA will open redemption account with the DP, BO transfer the securities before 3.00 PM, on the working day before the maturity to redemption account, IPA will make payment to BO. Scheduled bank can act as an IPA so there are four parties involved in any CP issuance an eligible corporate said the approved credit rating agency in IPA and finally, the CP.