Namaskar, my name is Rupesh Jadhav, Welcome to Rupeshfinancialexpert.

where we unlock the finance-related knowledge instead of locking it. I had done a complete Blogs series on CIBIL score, we’ve discussed the CIBIL score in quite a detail, how can you check the CIBIL score online? What is the meaning of the CIBIL score? how does calculation happen? how can you improve the CIBIL score? If you want to read all those Blogs, then you’ll visit the website on Finance category.

When you check the CIBIL score, then you get a complete credit report, in this Blog, we’ll see in that report what information you get, some abbreviations are used in that NA, NH, XXX, so what is the meaning of all of these? and whatever information you get, what is the meaning of that? how can you interpret that? So, you must read this Blog till the end.

Let’s go straight to the PDF CIBIL image.

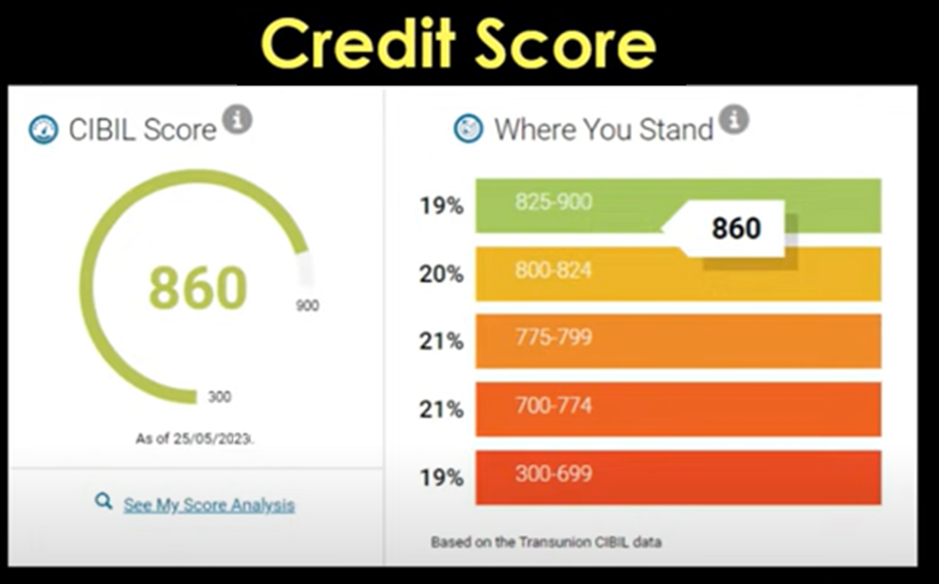

In this Blog, am going to show you the content of paid CIBIL report. So, when I bought this CIBIL report, after that, I’ve done login in the member section, and after that, you’ll see this kind of credit score. For example, my current score is 860, and I’ve told you before also in previous Blogs, it lies between 300 and 900, as high or as near 900 your score, will be your credit score would be considered that good. Here you’re seeing the bands, so top 19% people have their score between the range of 825 to 900. A score above 750 is considered a good score, you’ll get a loan quite easily. In fact, 80% of loans are disbursed to those who have a credit score above 750. It is possible that you don’t get a score, you may get to see NA.

The meaning of NA is no credit activity in the last couple of years. Maybe you haven’t taken any kind of credit, or loan in the last 3-4 years, then this score is not available, Then it may show NA. It can show you this NH also, if you never have taken any loan or you’ve used very less credit, or you’ve used a credit card for a very negligible time. then this may show you no credit history. So, if you’ve taken a loan or credit card for over a long period of time, which you’ve used. for 6 months or 1 year you’ve used any of them, then your credit history is stars to be created, and your credit score starts to build up. So, on the front page, you get this credit score, after that, you get this Credit Summary, here you can see, you’re getting these six things.

First of all, this shows your current balance. This shows your current balance here, I’ve hidden the current balance for now., So whatever are your total outstanding balances of active accounts, whatever loans you’ve taken, credit cards, or any kind of loan, be it a home loan, personal loan, gold loan any kind of credit you have. So, whatever is total outstanding that will be shown here. Then it shows your Late Payments here. The meaning of late payment is the count of your late payments. In the last three years, as many times you’ve done late payments in all accounts that number will be shown here. Then it shows a utilization ratio here. The meaning of utilization ratio is that whatever is your total credit limit.

Suppose in a credit card the limit is 50,000, then if you use all the 50,000, then your utilization goes very high, that means you are using a high credit very much. So now in my case, it is 0% which is fine. Then Account opened in last 3 years, so as I opened 2 accounts, so the meaning of 2 accounts is, either I’ve taken 2 loans or 1 credit and 1 loan., So in the last 3 years, how many new accounts I’ve opened? How many Enquiries have I’ve done? The meaning of enquiries is in the last 3 years, how many times the CIBIL score is asked by any banks or NBFC? So, if I generate credit enquiries many times, then that has a negative import on the CIBIL score. I’ve told you this in my previous Blogs. Then the meaning of Depth of Credit is that whatever oldest credit card or loan I had taken, when I had taken that? So, I had taken 9 years ago, and my credit history is maintained for 9 years. so you get a time period here.

Then here this shows you Available credit here. The meaning of available credit is, difference between high credit field for all active credit cards and total outstanding balances. That means if you are not doing your payments on time. Especially, of credit cards, then that will also have a negative impact, If you are using very much credit, The meaning of high credit is you’re using completely, whatever is your credit limit and your outstanding balances are also very high, that means you are using high credit and not doing payments on time, then this has a huge negative impact on your credit score. So now we talk about the credit report. When you log in you’ll first see the credit score, then you get a credit summary.

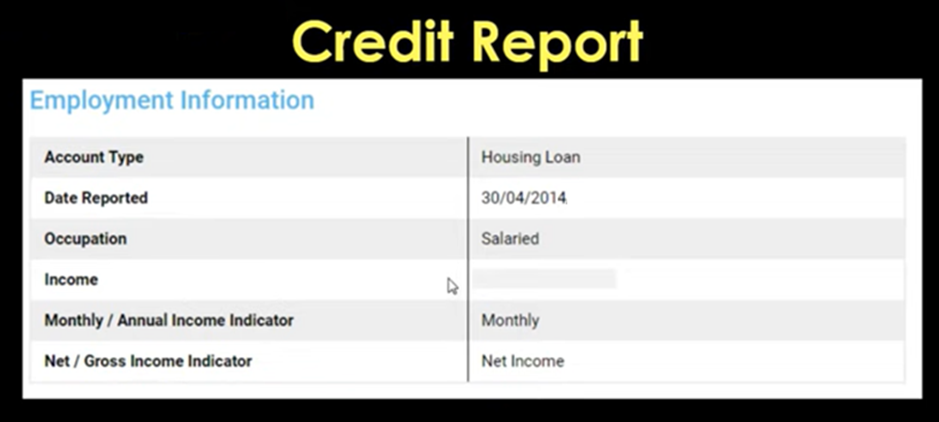

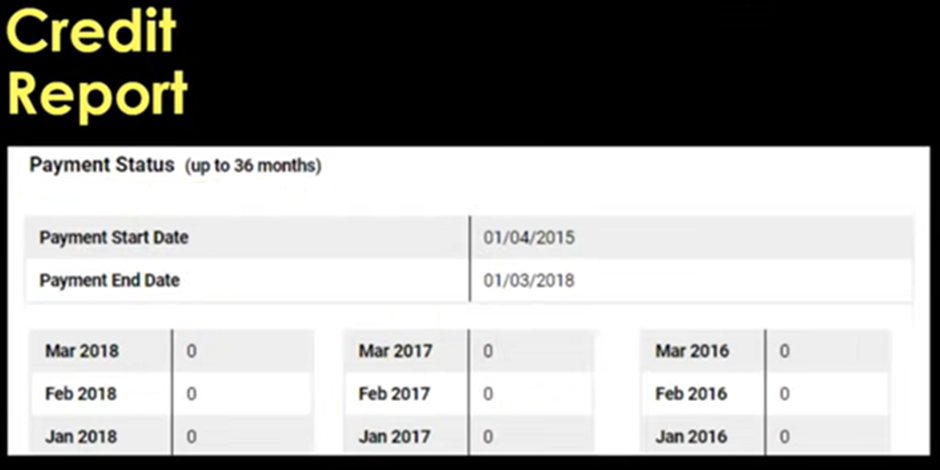

Comes quite a detailed credit report. First, you’ll get your credit score here, here you see a control number of every credit information report, we call it CIR, credit information report. It is a unique number of each information report, if you want to raise any dispute, then this becomes a reference number in a way. As I told earlier that credit score lies between 300-900, here also this information has been repeated. We already knew about NA and NH. Ahead of this, you get your personal information, in personal information comes your name, Date of Birth, Gender, your identity proofs comes here. basically, numbers for example my PAN number and voter id are mentioned here. Then after that, you get contact information, your latest 4 addresses are mentioned here along with the date of reporting. These may be residential or official addresses. Your office phone number and house phone number or mobile number also updated as well. So, this is the basic information which you’ll get in each report. Similarly, this is one more basic piece of information employment information, so you are from a salaried class, or you work on your own, whatever is your occupation is mentioned is here. The latest monthly income is also reported here. Then the next section comes account information This is the most important section. So, as I said you get detailed information in a paid credit report. Otherwise, if you only want a summary, that you can get in free, make a member login.

If you haven’t checked my blogs about how to check CIBIL score for free, then read that blog for sure. I hope you enjoyed the blog, so do like and share, if you have any suggestions or you want to suggest topics for future blogs, then you can do it in the comment section. I regularly read all of your comments, and I try to share maximum topics through my blogs. So do maximum comments and tell me which topics I should cover. I share interesting finance and investment-related topics daily.

Let’s meet in the next blog. Till then keep learning, keep earning, and be happy.