This Children’s Day, I present a story every parent can relate to—a journey of dreams and ambitions for their child’s future.

In seen latest film, a young girl quizzes her dad with tricky abbreviations: MBBS, LLB, BFA, PGDM. But when it comes to understanding the cost of these ambitions, her dad is stumped! That’s when the real question comes to light: Have you planned for your child’s education?

Read the blog now and start planning by investing in SIPs.

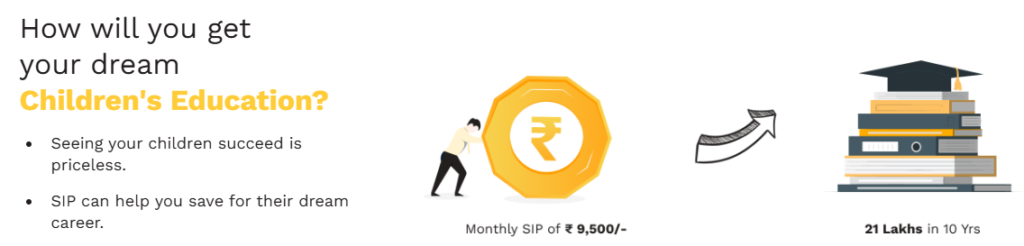

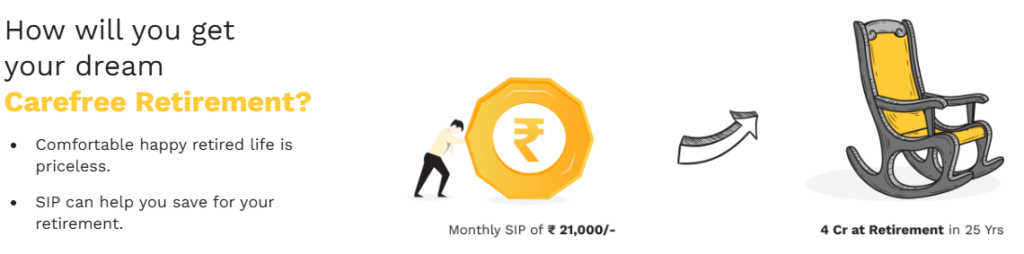

Invest in a SIP—another important full form that can help make your child’s dreams a reality. Small investments today can pave the way for big achievements tomorrow.

What can a SIP do for you?

- Build Habits: Encourage regular savings.

- Stay Disciplined: A structured approach to financial planning.

- Adaptable: SIPs offer flexibility based on your goals over time.

What is Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) lets you invest small amounts in mutual funds regularly, building wealth over time without a large initial investment.

Starting a SIP early fosters saving habits and utilises rupee cost averaging and compounding. Invest as low as Rs. 500 monthly to grow your wealth.

Use your investments to fulfil your desired goals” instead of use your investments for goals like buying house, a car, or planning for retirement.

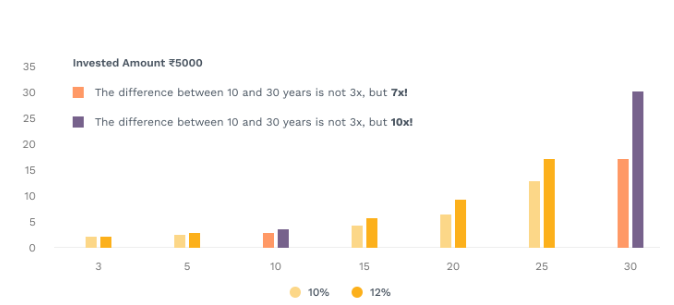

Power of Compounding

Source: Nifty Indices, MOIE, Ace MF. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for explanatory purpose only and should not used for development or implementation of an investment strategy.

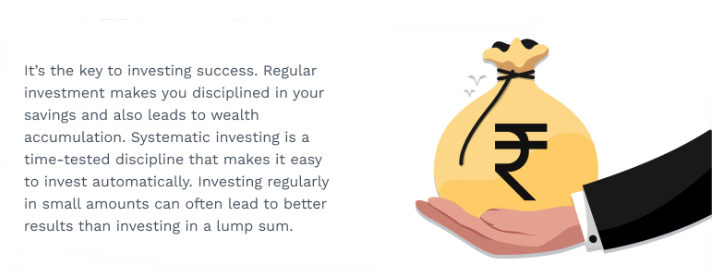

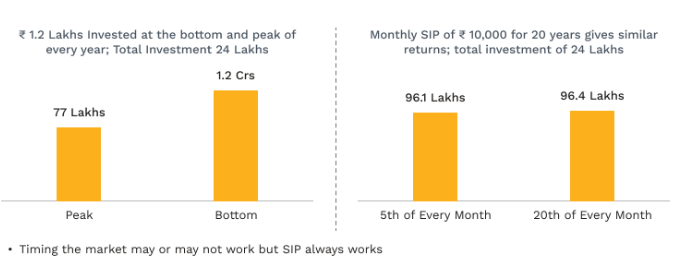

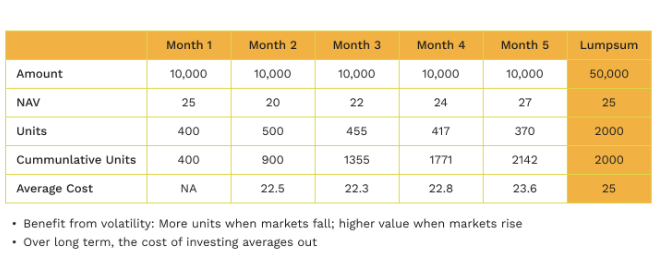

Rupee Cost Averaging

Source: Nifty Indices, MOIE, Ace MF. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for explanatory purpose only and should not used for development or implementation of an investment

Stay invested, don’t time market

Source: MOAMC internal research. Disclaimer: The above graph is an illustration of a stated example and not actual performance of any scheme. the above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

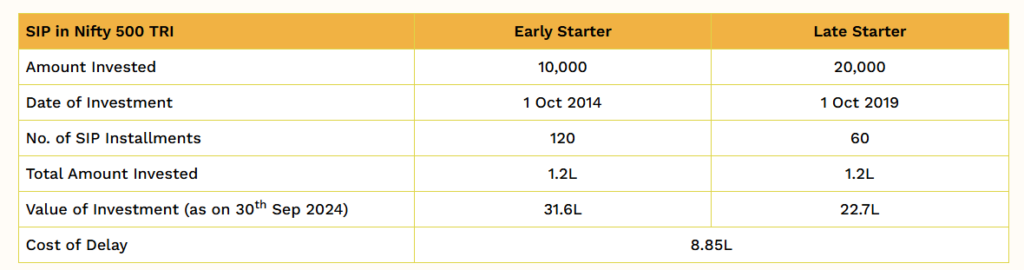

Built-in Discipline

Source: MOAMC internal research. Disclaimer: The above table is an illustration of a stated example and not actual performance of any scheme. the above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

- By starting early, the Investor’s wealth grew 3x times that of the Late Starter.

- Make Compounding work for you: Starting early even with a small amount goes a long way.

Source: MOAMC internal research. Disclaimer: The above is for representation purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

1.What is a SIP? How does it work?

A Systematic Investment Plan (SIP) allows investors to invest a pre-determined amount at regular intervals, in Mutual Fund schemes. It works by investing a fixed amount at a defined frequency.

2.What is the minimum amount to invest in SIP?

The minimum amount differs according to the chosen scheme.

3.What is the benefit of SIP?

Systematic Investment Plan (SIP) allows you to invest a certain amount of money at regular intervals in a mutual fund scheme. There many benefits of investing in a SIP are:

SIPs are flexible – You may choose the amount, duration and the interval of your SIP, in addition to changing the amount, pause or stop the SIP.

Experience disciplined investing – SIPs help inculcate disciplined investing which is essential in long term wealth creation.

Leverage the power of compounding – SIPs allow you to invest regularly in a scheme, leading to a compounding effect on the interest you earn. This is very beneficial for long term wealth creation.

Benefit from Rupee cost averaging – SIPs enable the benefit of rupee cost averaging, earning you more units when the Net Asset Value (NAV) of the scheme is low and vice versa. This brings down average cost of units over the long term.

4.How to automatically renew the SIP?

Renewal is possible by filling out a fresh form, starting a new SIP, & choosing the duration.

5.Can you increase the duration of SIP?

To increase the duration, you may have to start a fresh SIP and choose the desired duration by filling in a fresh SIP enrolment form.

6.What happens if I miss an SIP instalment?

Missing an instalment does not lead to any penalty, however, missing 3 consecutive instalments will lead to cancelling of the SIP.

7.Can I withdraw SIP anytime?

Yes. You can withdraw your SIP investments anytime, both partially and completely. However, mutual funds schemes like ELSS (Equity Linked Savings scheme) come with a lock-in period of three years and do not allow premature withdrawal of funds. Before withdrawing your SIP investment, keep in mind factors like exit load, tax implications, etc.

This publication is pursuant to Investor Education and Awareness Initiative,This shall not be construed as offer to invest in any financial product or Scheme. The objective of this publication is restricted to informational purposes only.

Get in Touch – Rupesh Jadhav – 9867237784.