BNPL is full from is Buy now pay later, So how it works, that you go to any online website, and there nowadays there is a option when we do checkout, there is option of BNPL, Many companies provide this BNPL services, like if from Amazon and many more companies. there you’ll get one option, that if you want to pay through BNPL then click on it and this will take you to that company website. Suppose you’ve clicked on Amazon, it will take you to its website, there Amazon on basis on you credit history and on basis on your details, will tell and will give you approval that, yes this is approved, then you go back, and then that company pay of the behalf of you! That is BNPL in actual a short-term small loan.

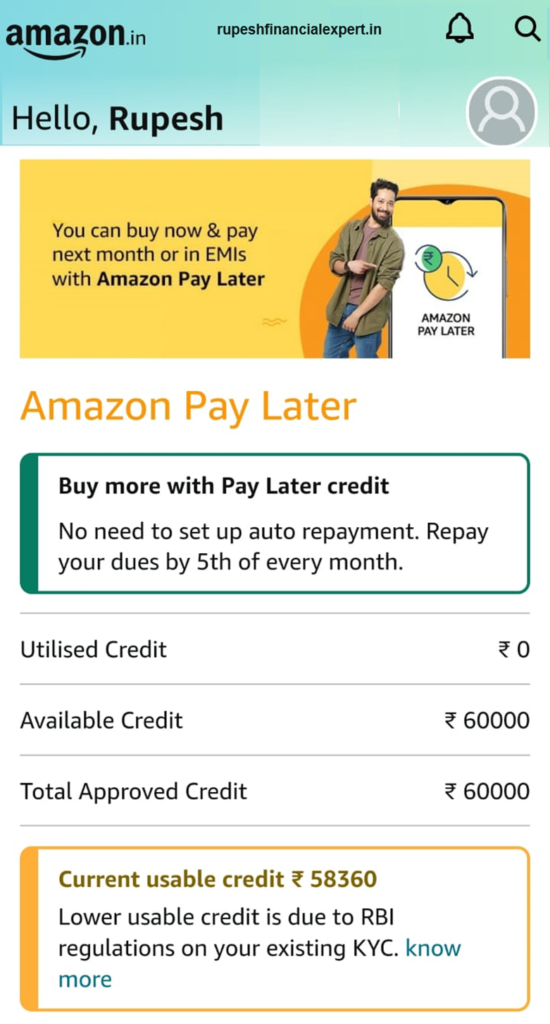

20k-40k or 60k based on your credit history, you get approval of a loan, Pre-approve loan type, On the basis of your credit history some get 10k some 20k some 30k and some get 35K, this type of a loan a company to you mostly at means 0% interest, like works like one month credit card, after one month of cycle you’ve to pay that money, like a credit card, in credit card also for one month, you don’t have to give any interest that is also a type of loan small loan. but within for one month, you don’t have to pay in that anything, after one month when you get that credit card bill, then you’ve to pay that, it work similarly like this, only difference is that In credit card mostly credit limits are higher,1lakh ,2 lakh, even 10 lakhs also so mostly limits are higher and here credit limits as which you can spend through this scheme, they are mostly smaller 10-20k mostly like this, these loans are smaller loans, so it works like this. What are benefits of this, Mostly benefits are obviously purpose is to help you, you get an immediate loan, very beneficial for retailers, as immediate approval is done, and immediately you get money also, very fast, everything happen on immediate basis.

If i want to buy new Mobile phone, and I don’t have money in my account, So I can through BNPL by taking approval, if phone is of 20k and after taking approval of 20k, I bought that phone, and I get my phone immediately, there was immediate approval, and I’ve pay after a month now. So, this is so beneficial for retailers, As if they get things on loan. so there is more chances of sale, and customers like us there purchasing power increases, and it is easier to use, immediate approval is there.

Nowadays for beneficial for both, actually for all three, if I’m buying thing from Amazon, so it is beneficial to Amazon, I don’t have money still I was able to buy.

beneficial to me, also as I don’t have money still, I purchased and company in between, company like Ola money postpaid and E Pay later, Amazon own pay-later, Zest money, Lazy pat, Paytm postpaid. so, all these are companies, that provide us service, So what benefits they’re getting is this that you became there customer, once you’re their customer so they can work as on regular customers.

This is BNPL (Non-Banking Financial Company), is beneficial to everyone, as we see we can see benefits to all. Is this is a loan or what is this exactly, so it is definitely a loan, Underwriting is done by NBFC.( Non-Banking Financial Company)

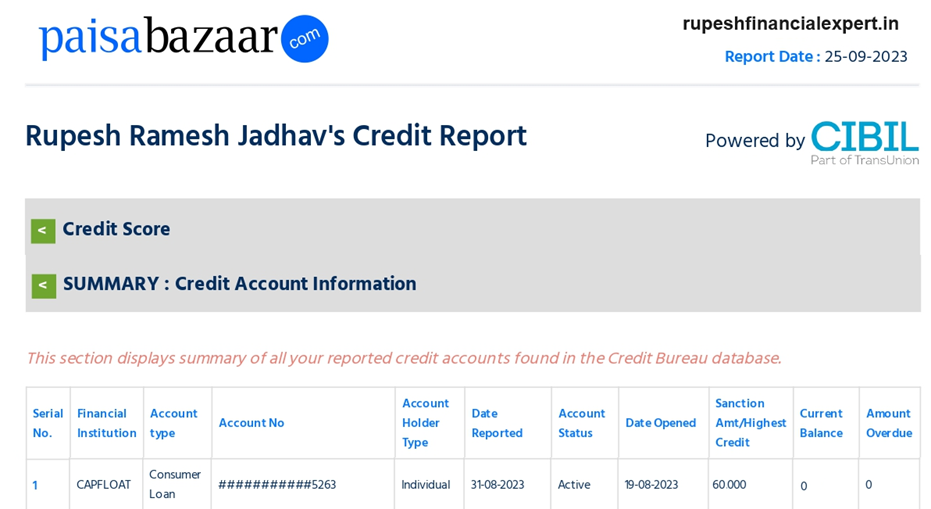

Example Paytm postpaid or Flex-money or Amazon pay later, and behind this they may have tie-up with any NBFC, so when your profile goes there, then that loan, that loan that company underwrites, Means they company take loan under them. Suppose there is Capfloat Financial Services Pvt Ltd, which is a NBFC, there tie up with Amazon pay later, you buy things from Amazon pay later and Amazon pay later send your profile to Capfloat Financial Services Pvt Ltd, and they have marked that loan for you. on your details of your PAN card and all and that loan is approved to you, and it works for you. So, this is a credit facility only, and there is very fast adoption of this.

If we see from numbers, so overall total loan disburses, that is 49% Y-0-Y in FY23 for NBFC. but the volume is very big as small loans are there, if value wise only 49% has NBFC given loan as BNPL, but if we see as number of loans, then BNPL is as high as 37%currently, NBFC so that 11.91% loan that they’re giving, they are giving through BNPL. as number of loan prospective as they are small loans and mostly loans are bigger loans, and that is why it is growing very fast, there are lot of start-ups, there business model is around this, means they are saying that this thing will work in future, and you can consider it as a part of consumer finance, So they are working very fast in these only, Is this a completion for companies like Bajaj-finance, for credit card companies, at certain level definitely it is, but of-course there loans are definitely bigger, in size these are very small, size loans that this is very small loans, that’s why there is fast approval and all, and that’s how things managed in this they don’t even have NPA (Non-performing loan), and all as these are small loans, so through profile and all little bit of your profile, and your credit history, that works very fast, So definitely it is pre-approved credit line, and it categorize like a loan only, in your credit history.

If you see your credit profile and your credit score, then you can see this loan on that, Whether you’ve taken it or not, this is very important, So if I I’ve applied for Amazon pay later services, then one loan will approve to me, based on my profile, I’ll add my PAN number, done my KYC and all they will tell me instantly, that suppose 60k loan is pre-approved, If I’m not even using it, still that loan will be seen on my profile. that he has this pre-approved loan, like in credit card, imagine you purchased a credit card of limit of 2 lakh, you’re not even using it still it will show there that this is given to you.

Now how credit history works you have to take care of this also that how credit history works, if you’ve taken loan, and didn’t use still it will negatively impact.

so, this is important, and if you’ve tied up with many BNPL services. I’ve taken loan from Paytm also and from easy pay also, and from Amazon also and applied at many places, that also negatively impact your credit history, that also decrease your credit score, and if you carry forward and all loan and didn’t pay on time, that risk always remains, that also impact your credit history that’s why you have to me more care full.

How in-between companies earn money, if they are giving you loan on 0% credit. then how to earn money, so this is your credit card concept, how credit card company earns, if you’re paying on time, then credit card companies are giving, points also to you, and how they earn, that system of three of you, companies of retailer and one who sales, they communicated with each other that, and the bank.

There are tie up like if it is through BNPL separate discount is given to them, Retailer has also benefit that through BNPL services, there is more chances of sale.

normally, it may not, so because of that they give extra benefits to the bank, suppose in this case Paytm pay-later or Amazon pay later, that take 1 or 2% more from me, and sale out of things through you, so like this they earn, In some BNPL services. there is processing fee also, not in everyone but still check that there can be processing fee, like you’ve purchases thing of 20k, so there may be 1% processing fee, So they earn from this, then late payment fee, obviously like credit card business if you paid late, there will charges for that, there will be according to interest rates, 14%-24-45% per year, 2.50% to 3.50 % per month interest in there, if you didn’t paid on time, and even if carry forward also like minimum balance, like I’ve taken loan of 60K and minimum, I have to pay 40k and after that 20k is left, that I carry forward that and will pay next month, then that 20k also, on 2.50% and 3.50% per month interest you may need to give, so like this various parties, Retailers service providers like Amazon pay later, and the NBFC, earns money like this.

Thus, this is how this whole BNPL services works, money that you have use that only and buy things from that money only, Debts is always a bad option, unless you are like home loans certain debts, at particular time can work, mostly i suggest avoiding all debts.