In this Blog, we are going to talk about, Bill Discounting Or we can also say discounting of the bill of exchange, I have already made a detailed Blog on what is a bill of exchange, if you haven’t read that Blog, then read it. Then also if we want to summarise the bill of exchange.

So, it is a type of a financial instrument, which is used in international trade. Assume the buyer doesn’t have sufficient funds to pay the seller, In the situations like these, it is a type of credit facility, which is given by the seller to the buyer through Bill of Exchange, but sometimes the seller himself faces problems related to the funds, until he doesn’t get money from the buyer.

How will he manage his expenses till then? In this case, a concept of bill discounting is introduced, through which the funds can be raised. The seller can raise his funds, so in this Blog, we will understand this concept in detail, and we will see what type of interest is charged, and how does this whole concept work?

Understand the concept of bill discounting with the help of an example, we have already discussed this example in the Blog of the bill of exchange, so if you haven’t read that Blog of mine then read it. I have explained the bill of exchange in a detail.

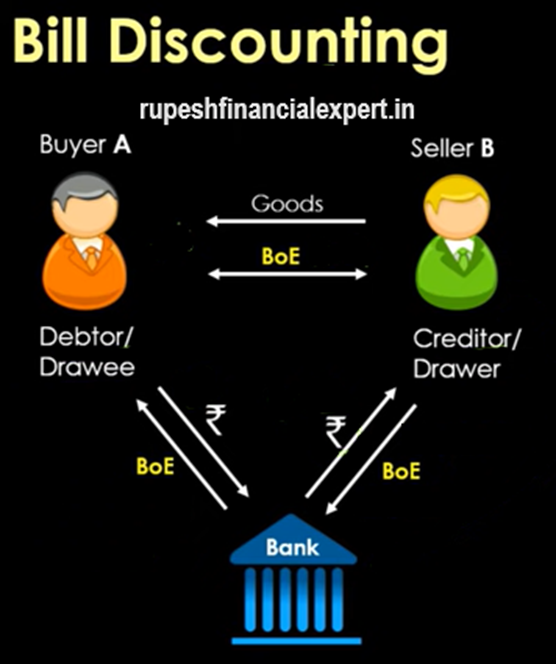

Let’s review it quickly, Assume there is a buyer A and he wants goods from the seller B, So he says that I don’t have funds right now, Give me the goods on the credit, So the seller gives him the goods on credit, in point of view of the old relationship, And says to sign a bill of exchange, So the seller issues the bill of exchange in the name of buyer A, And the buyer accepts the bill of exchange, after signing it. Because the seller is giving the money on credit or providing the goods on credit. So, he becomes the creditor. And because he is drawing the bill of exchange, so we also call him a drawer or maker. Because buyer A is taking the credit, so becomes the debtor or we can also call him a drawee, Because the bill of exchange is being issued in its name. And along with that, he is accepting the bill of exchange, so we can also call him acceptor. So, this was the working of the bill of exchange.

In short Assume the validity of the bill of exchange is of 90 days, Buyer A will give the money to the seller B after 3 months, during these three months, seller B’s requirement of the working capital, He will require the funds in his business, He may require the fund immediately. In such cases, seller B can go to the bank, and he will say to the bank that, this is my bill of exchange, I will endorse it in your name., So this bill of exchange will be endorsed in the name of the bank. And the seller will say that collect the payment of a bill of exchange from the buyer A, Assume the value of the bill of exchange, Let’s take it is Rs. 10 lakhs, the bank will not give the exact Rs.10 lakhs to the seller. It will give a little bit less money, we call this bill discounting. Because the full amount of money is not given, it is given after discounting.

How is the discounting done?

The banks say that the Rs. 10 lakhs, that I am giving you immediately, I will charge an interest of 90 days from you on this, so assume the total value is Rs. 10 lakhs, Let’s say the interest rate the bank says, that it will charge 10%, So this interest rate is also called discounting charge, so this interest will be calculated for 90 days. Let’s calculate, how much will be the interest for 90 days? So, for 90 days, it will be 3 months, 3/12, we will do 3/12, because it is 10% for 12 months, 3/12×10, because it is 10%, so we will write 0.1, So we will write 3/12×0.1×1000000. So, this value will be 25000 and it is being calculated on Rs. 10 lakhs, one zero is extra here. So, the value is 25000, The interest will be charged. So here, if we subtract 25,000 from 10,00,000 The creditor will get this much amount, or the seller will get it. So, the value here is 975000, So Rs. 9.75 lakhs.

The bank will give it to the seller, and it will collect the money from the buyer., So the bill of exchange will be presented to the buyer. And he will get Rs.10 lakhs here after 90 days, So the bill of exchange on the date of maturity, I will write it down here. So whatever day will be the maturity date, the bill of exchange will be presented to buyer A, and the bank will get Rs.10 lakhs. And the fees of 25000 Rs of the bank, the bank will earn this money as interest., Because the seller doesn’t get the full amount, He gets it after discounting which are basically the discounting charges., We call this bill discounting.

The different banks can set different conditions, it’s not like they give money to the seller after discounting, the bill of exchange or the promissory notes. For example, some banks may have certain conditions, like the bill should be the Usance bill which has fixed maturity date, so basically the demand bill doesn’t have a fixed date, we don’t know when the seller will present it. Sometimes the bank does not discount such bills. After this, the bill should be accepted, by the drawee.

We talked about acceptance here. Until the bill doesn’t get accepted, it cannot be financed. This means it cannot be discounted. Drawer, drawee, or any other endorsee. Assume the drawer endorse it to the third party. It’s another party C is involved here, And C would approach the bank. So, all the parties whether it is seller, buyer, or endorsee. All these should be reputable individuals, companies, or banks. Otherwise, if they are not reputable individuals or known individuals, then it will be a quite big risk for the bank. So maybe the bank will not discount such individuals. Some banks can set the condition that the bill should be a trade bill. So, the bank can set these types of conditions.

Mainly the bill discounting means the money that the seller is not getting immediately, He will get it after 90 days. so, if he wants the money immediately. Then he can approach the bank and can get the money by discounting the bill.

If you liked this Blog, then like it and share it with your friends and family members. So that they will also get the benefit of this Blog. If you have any suggestions or you want to give any feedback, regarding the Blog or the website or if you want to suggest any topic for the future blogs. Then you can comment below. Till then keep learning, keep earning and be happy.

![Simplify Your Trade Finance with [Your Bank]'s Letters of Credi](https://rupeshfinancialexpert.in/wp-content/uploads/2023/11/Add-a-heading-17.png)