Nifty scales a new peak; FIIs witness the 2nd consecutive month of inflows

- The Nifty touched a fresh high of ~25k before ending 3.9% up MoM at 24,951 in Jul’24. The index closed higher for the second successive month and recorded the second- best MoM returns in the last seven months.

- Broader markets outperformed with Nifty Midcap 100 gaining +5.8% while Smallcap 100 was up +4.5%.

- Among sectors, Technology (+13%), Healthcare (+10%), Consumer (+9%), Media (+8%), and Utilities (+6%) were the top gainers, whereas Metals (- 2%), Private Banks (-1%), and Real Estate (-1%) were the only laggard MoM.

- FIIs turned buyers for the second consecutive month of Rs5407 crore while DIIs inflows remained healthy at Rs23,486 crore in Jul’24.

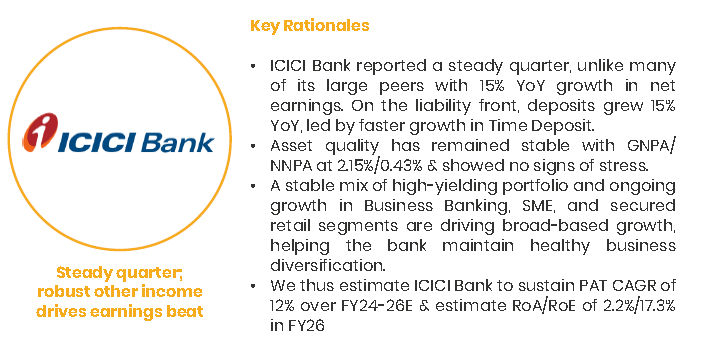

- The corporate earnings scorecard for 1QFY25 has been in line so far. growth has primarily been led by the BFSI and Automobile sectors. Earnings of the 39 Nifty companies that have declared results so far grew 5% YoY (vs. est. of +2% YoY).

- The corporate earnings scorecard for 1QFY25 has been in line so far. Growth has primarily been led by the BFSI and Automobile sectors.

- Earnings of the 39 Nifty companies that have declared results so far grew 5% YoY (vs. est. of +2% YoY).

- The Union Budget presented on 23rd Jul’24 focused on inclusive growth along with fiscal prudence.

- Global factors are inducing volatility in equity markets across the world.

- Recessionary fears in the US, liquidity concerns over unwinding of Yen carry trades, and escalating tensions in the Middle East have led to profit booking in Indian markets as well.

- India stands strong with the support of Healthy macros, strong inflow from DIIs and inline Q1FY25 numbers so far.

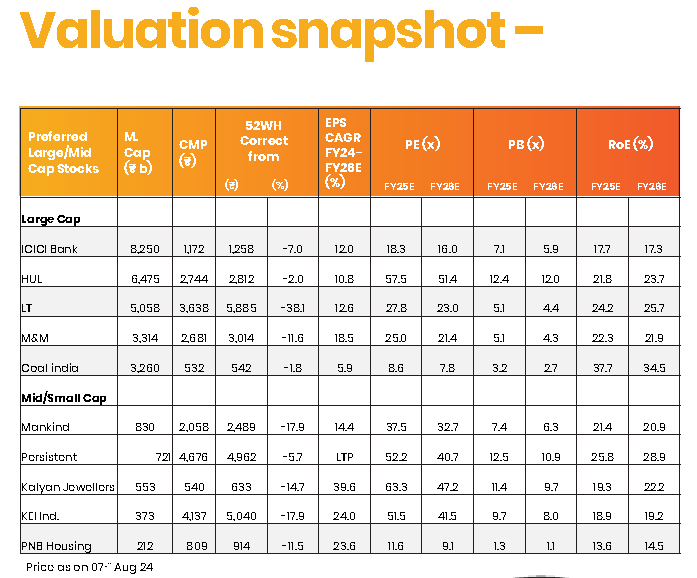

- Further, the Valuation for Nifty is comfortable near its 10-year average at 21x one-year forward P/E. Hence we believe that any correction in Indian equities should be an opportunity for long-term investors to accumulate good quality stocks.

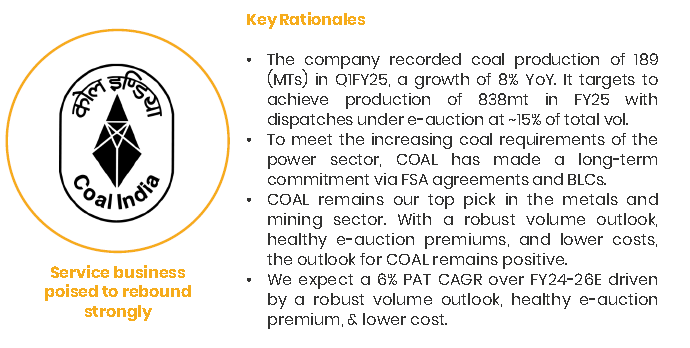

- From a sectoral perspective, we are positive on Healthcare, Telecom, Electronic manufacturing, Industrial, Consumption Discretionary, and capital market stocks.