A bank guarantee is a non-fund-based credit facility, let an example, if you want to buy some goods as a buyer let’s say a computer equipment, from India or you import it, maybe you have not funds immediately, Your payment has to come from somewhere. Let say there is a payment cycle of 1-2 months in your business, it bit difficult for a seller to trust you, in that case, bank guarantee come useful, here the bank gets involved in this, Bank guarantee are not only uses in buying and selling but, also used in contracts such as government contracts, contracts involving two private companies, there a bank guarantee comes in handy.

Let see what the bank guarantee is and how it wors,

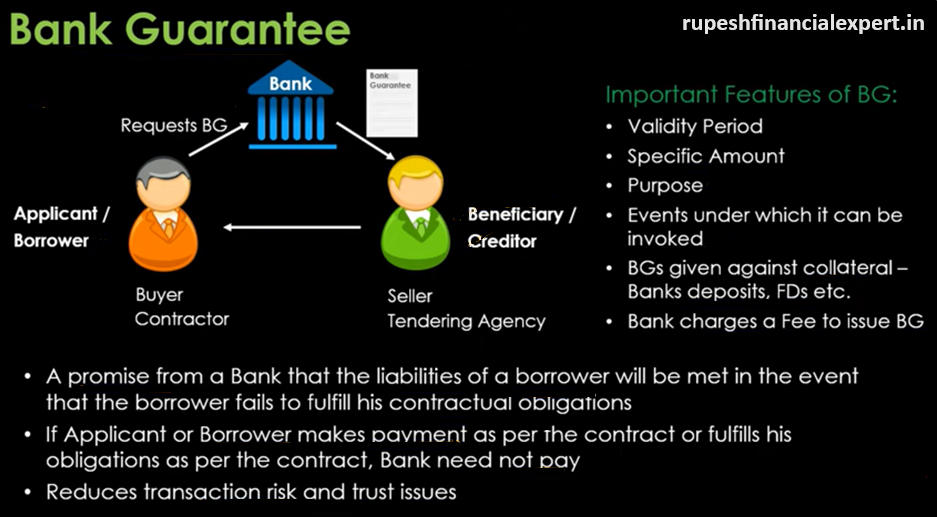

Assume a buyer who wants to buy some computer equipment and a seller who wants to sell it, let, the transaction is of 1 crore, buyer and seller agreed to deal of computer equipment of worth 1 crore, Maybe the buyer does not have 1 crore immediately, Maybe is unable to pay the seller immediately, but the seller cannot trust the buyer, trust issue are there, here two types of issues arise, First is an issue of trust, because a buyer in not know to the seller, second issue of the credit, buyer doesn’t have money now, but he may money in future, his payment has to come from somewhere, so he is unable to pay immediately, To solve issues of trust and credit a bank guarantee is a useful option, In this, a bank gets involved as the third party, the buyers tells the bank to give a bank guarantee of 1 crore, if you gave the guarantee of 1 crore to the seller, so, i get my goods, when the seller get a bank guarantee, the he will deliver the goods to the buyer, that the computer equipment he purchased, will be Delivered when the bank guarantee reaches the seller, bank guarantee, Is like a promise there banks promise the seller for payment if the buyer does not pay, The seller gets a bank guarantee and gave the goods (Computer equipment) on credit, But it is the responsibility of the buyer to pay 1 crore to the seller so, how he has so pay, Here it is the a bank guarantee, no transactions happened here, It is not a transaction, actual the transaction has to happen only between the buyer and the seller, When the buyer pays 1 crore to the seller then the transaction complete, Bank guarantee voids when payment completes, In this case, The buyer is an applicant / borrower in banking terminology, and the seller is called beneficiary / creditor. This is a simple transaction in this, the contract also can be done.

The buyer can be a contractor and the seller can be a tendering agency, For example, there are many government contracts where contractors are appointed, there also we can the guarantee, Because if the does not perform will agency can suffer a loss, Summarizing, a bank guarantee is a type of promise, that if borrower does not complete his liability as per contract, then the bank will fulfil contractual obligations means the bank will lend money if the buyer is unable, In case, if the borrower makes his payment of 1 crore the there will be no requirements for bank to pay, that time bank guarantee will null and void, it will ends transaction risk and trust issues, as we have mentioned earlier credit problem which will enhance the business, And the buyer can easily purchase things on credit, some important features of bank guarantee is that, Firstly is mandatory to mention validity period, If in the transaction of 1 crores with payment cycle of 90 days, Payment made be possible in 2 or 3 months, then it can order bank guarantee of 90 days, it depends on limit of the transaction, it can be of 3 months, 6 months or 12 months even it can be of 10 years also, In many infrastructures project, it required long bank guarantee, it can be up to 10 years validity period, it is necessary to mention specific bank amount like in this case guarantee up to 1 crore, in bank guarantee exact amount is necessary, exact purpose should be mentioned with details of the contract, the event under which it can be invoked at what events guarantee can be invoked that events should also be mentioned,

BG’s given against collateral means, the guarantee of 1 crore from any bank will not be given in free of cost, Secondly, they will need a security or a collateral, if a buyers BGs from a particular bank, he will give it against the deposit or against the FDs, or the kinds of mutual funds or the securities BGs are issued, Bank will always charge fee for issuing of BGs. So, on the 1 crore bank guarantee bank will charge a fees plus a collateral means with out security bank will not issue a BGs, This are working of BGs.

Understand type of BGs

When we talk about trading where buying and selling of goods and services takes place, We have seen financial guarantee of 1 crore. That if The buyer is unable to pay then the bank will pay on the behalf of the buyer, This normal guarantee is called financial or payment guarantee, In case of import export, Seller from Australia and buyer from buyer The India. The BGs can be issued in case of foreign currency such as dollar also in that case it is called foreign BG, In case of Deferred payment, The guarantee means if the buyer does not have immediate payment but I will lend you in under 6 months, And if seller allowed buyer to pay in under 6 months. The goods will be issued immediately but the payment will be given in 6 months, In this case, bank will give deferred payment guarantee, But in a case in under 6 months, you have to additionally pay 1.2 crores because I will charge interest also, In case of such deferred payment bank can issue BGs up to 6 month or up to 1 year, It depends on terms of bank, it is called deferred payment. When we talk about contracts for example govt. issue many contracts, Road projects, infrastructure projects and electrification projects, In fact, if govt. needs to procure things then there are contracts, Or if any big company needs goods from small company then also contracts are available , in such case. Bid bond or earnest money deposit, Advance payment guarantee and Performance bank guarantee.

Now lets understand contract BGs,

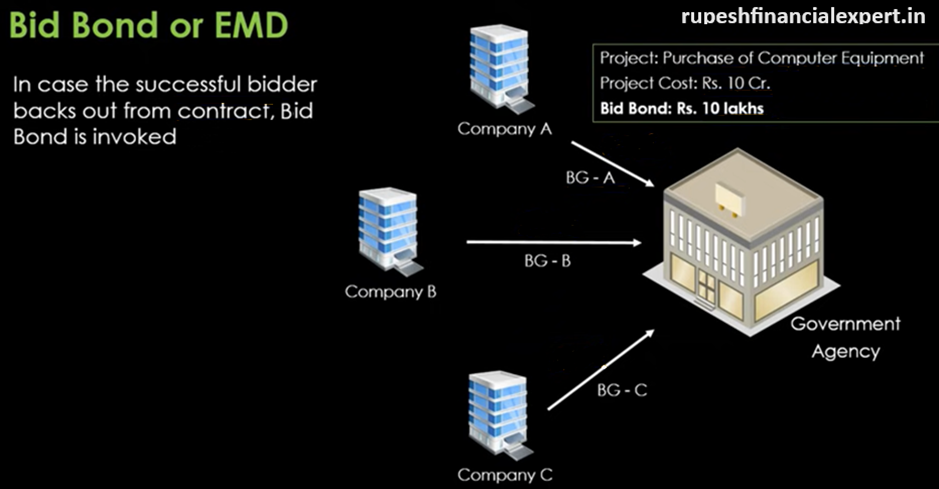

Firstly lets talk about Bid bond guarantee, Whenever any govt. agency or any company needs purchase item or to execute any contract, Then they will require some companies for Bid for example, If any govt. agency require computer equipment of rupees 10 crores budget, That cost will be estimated cost and real cost appears after The Bid, In this Bid Bond is kept, Bid Bond is generally upto1-2% of project cost, i.e. 10 lakh in this case. All companies will be asked to deposit their own Bid-Bond of 10 lakh. Company A will deposit its Bank guarantee of 10 lakh, Company B will deposit its Bank guarantee of 10 lakh, so C, Bid-Bond is kept for the successful bidder company A, If he backs out from the contract cause losses to govt. and time delay to the projects, govt. face loss of expenses in making and issuing of tender, Due to time delay, which escalates the cost, Bid-Bond is kept to prevent these losses, If company B won the contract and it backouts, then its Bid-Bond is invoked., Its 10 lakh lapsed. That’s why Bid-Bond is kept.

With that, there is also an advanced guarantee. Suppose that company B is awarded a contract of 10 crores. company B quoted the least. Suppose that company B is awarded a contract of 10 crores. company B quoted the least. He gets a project at 10 crores, generally received a 10-20% of the cost in advanced payment, the Company say that he does not have resources immediately to buy equipment for the project of 10 crore, And asked for some advanced, generally advanced is 10-20%, He asked advance of 1 crore, Govt. agency gave the 1 crore in advance, This is the actual transaction. The advance of 1 crore is given, Govt. gave advanced of 1 crore but also kept a bank guarantee of 1 crore, why a bank guarantee is kept. the Bank guarantee against mobilization advanced is taken. Generally 10-20% of the cost of the project, advanced payment guarantee is taken, If company B doesn’t full fill the contract, suppose company B run away with 1crore. To reduce that risk, a bank guarantee is taken. We called it Advanced payment bank guarantee.

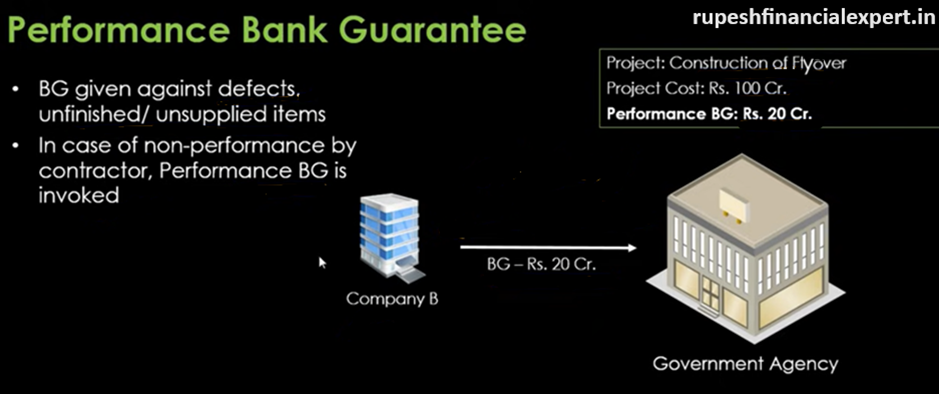

Then there is a Performance bank guarantee.

suppose construction of a flyover has to be done, And the project cost is 100 crores. Performance bank guarantee of 20% is taken, this project contract is awarded to company B, In that case, govt. say we will make payments to you, As you complete the contracts. Basically, it is a construction-linked payment. But there is a risk for government, Assume the company didn’t do proper work or there are defects in it, To reduce that risk govt is taken the Performance Bank Guarantee, So, company B has to deposit this performance bank guarantee of 20 crores, Performance bank grantee was given against the defects unfinished or for unsupplied items. If the company does not work well or leave unfinished, then his guarantee money will lapse. In case of non-performance by the contractor, performance BG is invoked, Does not work on time, leave unfinished, or maybe the company goes out of business, In that case, its bank guarantee is invoked, and 20 crores will be recovered from a bank, So, these are the types of the bank guarantees.

Simple sample of bank guarantee.