KEY DECISIONS

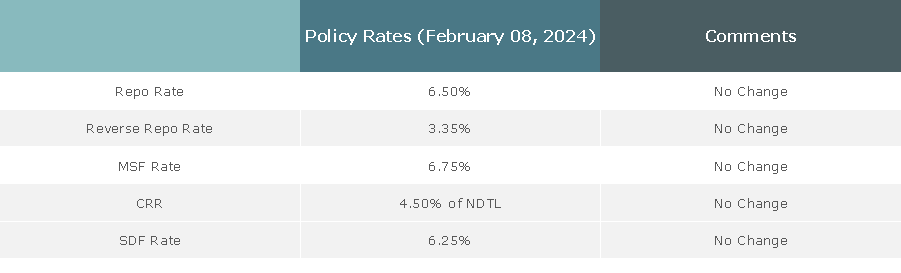

- At its meeting held today, the RBI Monetary Policy Committee (MPC) voted unanimously to keep key rates unchanged (Repo Rate at 6.50%, SDF rate at 6.25% and MSF rate at 6.75%). This is in line with our expectations from the policy

- MPC also decided with a 5-1 majority to maintain stance as withdrawal of accommodation

- Minutes to be published on February 20, 2023. Next policy meeting is scheduled for April 3-5, 2024

GDP GROWTH & INFLATION ESTIMATES

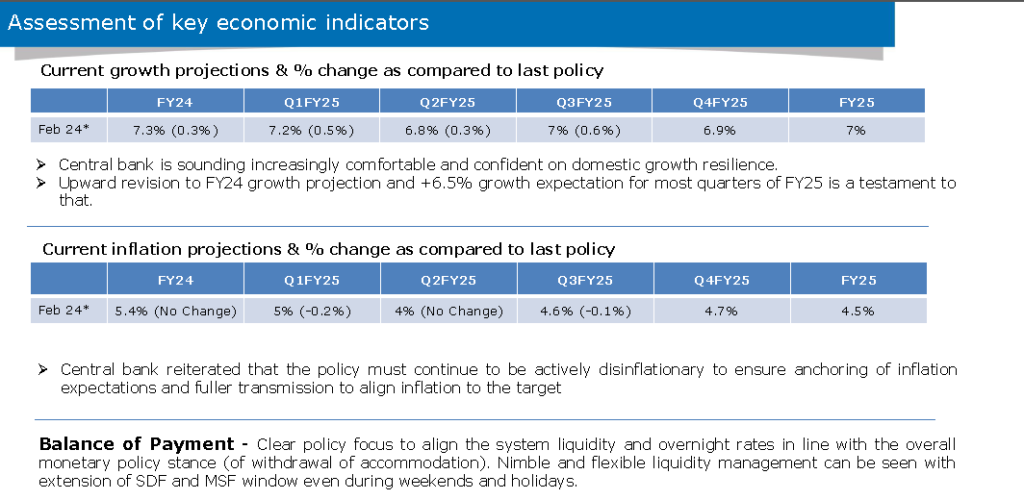

- Next year Growth is expected to be strong as economic activity is backed by the momentum in investment demand, optimistic business sentiments and rising consumer confidence. India integration with global supply chain should boost growth prospects.

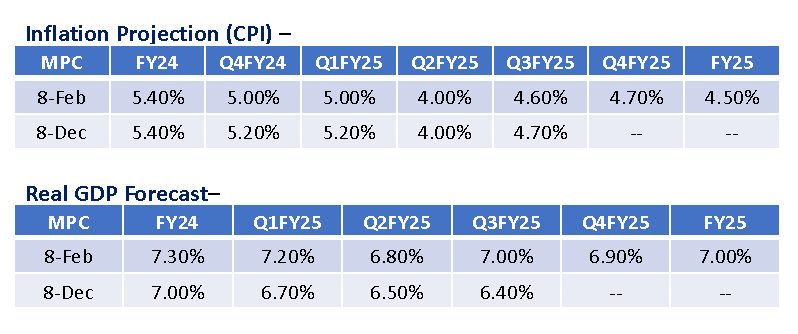

- Based on the above, RBI revised its FY25 GDP growth projections by 50 basis points to 7.0% from the previous policy. This is higher than finance ministry estimate of 6.5 percent for next year.

- On the inflation front, large and repetitive food price shocks are interrupting the pace of disinflation that is led by the moderation of core inflation. Geopolitical events and their impact on supply chains, and volatility in international financial markets and commodity prices are key sources of upside risks to inflation. The cumulative effect of policy repo rate increases is still working its way through the economy.

Source: RBI *Note: Numbers in brackets represent the percentage change in forecast as compared to last policy projections. Quarters where there are no changes mentioned are first time projections.

LIQUIDITY

- RBI Governor and deputy Governor stated in their press conference they want to keep operating policy rate at 6.5 percent, and they will proactively manage liquidity to bring overnight rates near policy rates.

- RBI has re-iterated its commitment to 4 percent CPI inflation target and monetary policy stance to be actively disinflationary.

- Liquidity situation is expected to be in slight deficit mode with call rates trading at MSF rates of 6.75 percent with rates periodical going towards 6.25 % levels.

Fixed Income Outlook post Monetary Policy

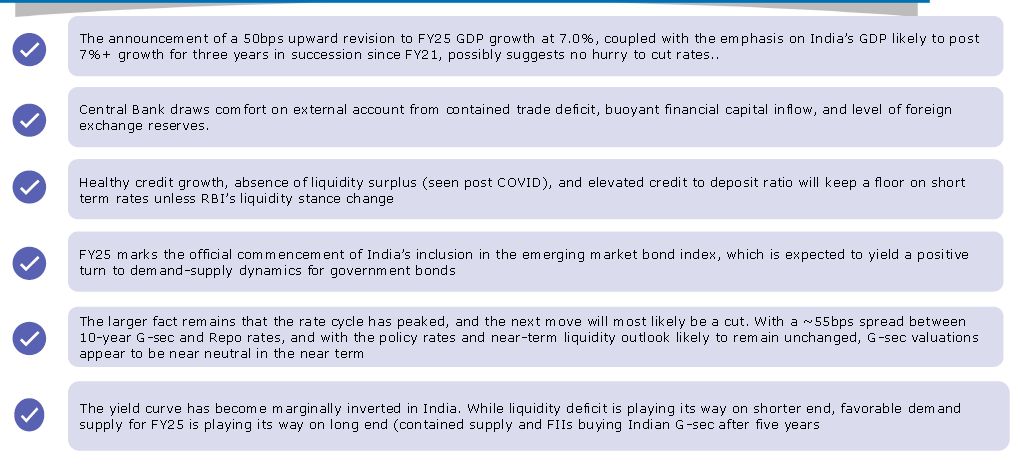

Monetary policy was on expected lines with no change in policy rates. RBI’s focus is on food inflation due to adverse weather events. Core inflation is muted but RBI is worried about the higher food inflation passing on to core inflation. Expect RBI to withdrawal of accommodation stance in the April policy with the expectation of stance change to neutral stance pushed back to June policy.

RBI has cumulatively hiked repo rates by 250 basis points. These rate hikes are working their way into the economy. As per the RBI assessment, the transmission is still incomplete into the lending rates. The credit growth in the banking system is at 16 percent versus deposit growth of 12 percent on a year-on-year basis. RBI has been trying to reduce systematic risk by increasing weightage to unsecured lending. Bank lending to NBFC has slowed down in December and expected to be muted in the coming months.

Fixed Income Outlook post Monetary Policy

Government budget is actively disinflationary with fiscal deficit targeted at 5.1% and capital expenditure of Rs 11.11 Lakh Crores. RBI and Government action, will lead to more money available for investment activity as corporate capex pick up. This should lead to core inflation remaining below 4 percent levels as Corporate capex cycle revives.

In the medium to long term, flows arising out of gradual increase in weight in global bond indices will act as an additional support to absorb the supply of G-sec by RBI and is positive for rates in general. The flow of capital from foreign investors would also be beneficial for the rupee in a strong dollar environment. We therefore remain constructive on rates in the medium to long term.

The Monetary Policy Committee (MPC) decided to maintain status quo on both policy rate and stance with a majority of 5 to 1. Thus, repo rate was kept unchanged at 6.5% and stance of focussed on “withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth” was retained. Consequently, SDF, MSF and CRR rates were also kept unchanged at 6.25%, 6.75% and 4.5% respectively. Notably, one of the external MPC member voted for reduction in repo rate by 25 bps and changing the stance to neutral.

On Growth: The current state of global economic activity across major economies presents a varied landscape. The odds of soft landing have increased with steady overall growth and inflation easing, although geopolitical risks have increased. RBI noted that elevated levels of public debt in a high interest rate environment poses a pertinent risk to global financial stability. In India, growth has been strong, evidenced by robust manufacturing and services PMIs, healthy construction activity, resilient external sector and buoyant services sector fuelled by both domestic and global demand.

The outlook is optimistic, with the RBI anticipating a 7% GDP growth in FY25 driven by the resilient services and urban consumption. The positive trajectory is further supported by signs of rural recovery strengthened by allied activities. Additionally, the uptick in residential housing, government focus on capital expenditure, and robust corporate profitability augur well for the investment outlook.

On Inflation: CPI has moderated in the FYTD24 aided by broad based easing in core CPI and fuel inflation. Food prices, especially vegetables, continue to remain volatile and keeping headline inflation high. The CPI forecast is clouded by substantial uncertainty, primarily stemming from the risk of disruptions in the supply chain and the potential price effects of the ongoing geopolitical crisis. Additionally, food prices remain vulnerable to weather-related events.

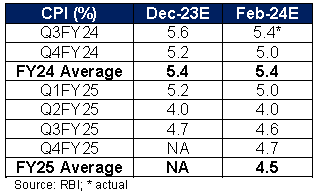

Although the RBI kept its average inflation forecast for FY24 unchanged at 5.4%, it adjusted its estimate for Q4FY24 downwards by 20 basis points to 5%. The RBI anticipates CPI to decrease to an average of 4.5% in FY25, contingent upon the expectation of a regular monsoon season.

Conclusion and Outlook

While the status quo policy rate was largely expected, no announcements to improve liquidity came in as a marginally negative surprise to the market. RBI highlighted that it would continue to actively modulate both frictional and durable liquidity through appropriate mix of instruments. Further, RBI emphasized the endeavour to achieve inflation target of 4% on durable basis and highlighted that rates transmission is still incomplete. Overall, the monetary policy was perceived marginally hawkish and led to yields rising slightly.

Notwithstanding today’s policy decision, we believe outlook for fixed income markets remains favourable over the medium term due to following key drivers:

- The lower-than-expected market borrowings and likelihood of robust Gsec demand due to India’s inclusion in the JP Morgan bond index – is likely to keep demand-supply favourable in FY25. Government’s commitment to fiscal consolidation in FY26 is likely to provide more confidence.

- Core CPI momentum remains subdued driven by lower input price pressure and benign global commodity prices. Further, headline CPI is likely to ease and Inflation expectations also remain well anchored.

- Major global central banks, especially the US Fed, have indicated the end of the rate hiking cycle and are likely to start easing in due course. RBI is also expected to eventually reduce the policy rate in the coming quarters.

- India’s external sector vulnerability remains low due to high foreign exchange reserves, rangebound oil prices, robust services exports and the likelihood of FPI inflows into the debt markets in FY25.

Key risks to the aforesaid outlook are:

- SLR holdings of the banking system are high and credit growth is robust. With interbank liquidity in deficit, the incremental demand for G-Secs is likely to remain muted.

- RBI’s policy rate can remain higher than expected due to multiple reasons including (1) food price shocks keeping headline CPI elevated, (2) rise in commodity prices due to escalation in geopolitical crisis, (3) monetary policy globally remaining tight for a period longer than expected, among others.

Overall, in our view, yields are likely to trade with a downward bias and the long end of the yield curve is likely to outperform over the medium term. Thus, as highlighted in past, for investors with a relatively longer investment horizon, it is a good time to increase allocation to longer duration funds in line with individual risk appetite. Further, given a flat yield curve and elevated short-term rates along with expectations of rate cuts in the coming year, one may also consider investment in short to medium duration debt funds.

The source for this document is the Bi-monthly Monetary Policy Statement, 2023-24, dated 8th February 2024 published by the RBI.

The information contained in this document is for general purposes only and is not investment advice.