The Finance Minister presented the 6th Budget – the Interim Budget, as India is scheduled to hold its Lok

Sabha elections later this year.

The Finance Minister redefined the meaning of GDP, to highlight the achievements of the government in

the past 10 years.

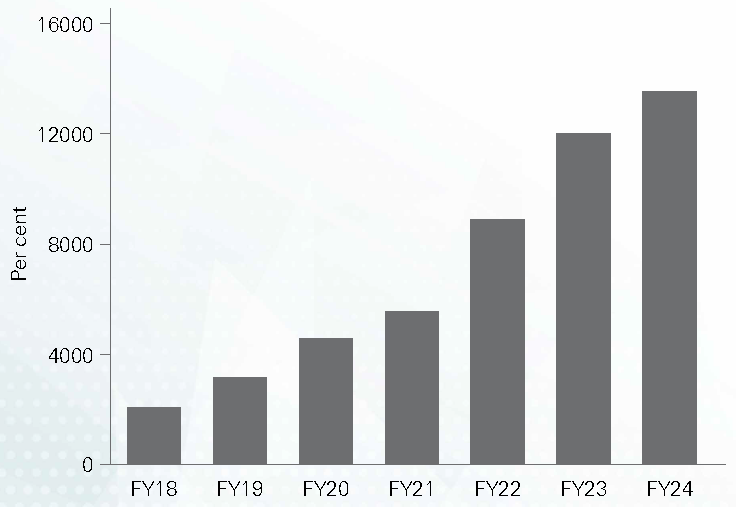

Substantive development of all forms of infrastructure – Physical, Digital and Social.

Digital Public Infrastructure (DPI) – Promoted formalization and financial inclusion.

Deepening and widening of tax base via GST.

Strengthened financial sector brought savings, credit and Investment back on track.

GIFT IFSC – A robust gateway for global capital and financial services for the economy.

Proactive Inflation management.

All parts of country becoming active participants in economic growth.

DBT has led to savings of Rs.2.7 lakh crore.

25 crore people moved out of Multidimensional poverty.

Credit assistance to 78 lakh street vendors under PM-SVANidhi.

Next five years will be years of unprecedented growth.

The government wants to make Eastern Region the driver of India’s growth.

Credit assistance to 78 lakh street vendors under PM-SVANidhi.

Over 22 crore Mudra loans disbursed in last 10 years.

Direct financial assistance to 11.8 crore farmers under PM-KISAN.

Crop Insurance to 4 crore farmers under PM Fasal Bima Yojana.

Integration 1,361 mandis under e-NAM, supporting trading volume of Rs. 3 lakh crore.

Government will promote private and public investment in post-harvest activities.

Application of Nano-DAP to be expanded in all agro-climatic zones.

Atmanirbhar Oilseeds Abhiyaan-Strategy to be formulated to achieve atmanirbharta for oilseeds.

Comprehensive programme for dairy development to be formulated.

Implementation of Pradhan Mantri Matsaya Sampada Yojana to be stepped up to enhance aquaculture

productivity, double exports and generate more employment opportunities.

5 Integrated Aquaparks to be set up.

Encourage Cervical Cancer Vaccination for girls (9-14 years)

Saksham Anganwadi and Poshan 2.0 to be expedited for improved nutrition delivery, early childhood care and development.

U-WIN platform for immunisation efforts of Mission Indradhanush to be rolled out.

Health cover under Ayushman Bharat scheme to be extended to all ASHA, Angawadi workers and helpers.

Pradhan Mantri Awas Yojana (Grameen) close to achieving target of 3 crore houses, additional 2 crore

targeted for next 5 years.

Housing for Middle Class scheme to be launched to promote middle class to buy/built their own houses.

1.4 crore youth trained under Skill India Mission.

Fostering entrepreneurial aspirations of Youth – 43 crore loans sanctioned under PM Mudra Yojana.

Implementation of 3 major railway corridor programmes under PM Gati Shakti – to improve logistics efficiency and reduce cost.

Promotion of foreign investment via bilateral investment treaties to be negotiated.

Expansion of existing airports and comprehensive development of new airports under UDAN scheme.

Promotion of urban transformation via Metro rail and NaMo Bharat.

30 crore Mudra Yojana loans disbursed to women entrepreneurs.

Increased female enrolment in higher education by 28 per cent in 10 years.

43 per cent of female enrolment in STEM courses.

1 crore women assisted by 83 lakh SHGs to become Lakhpati Didis.

States will be encouraged to undertake development of iconic tourist centres to attract business and promote opportunities for local entrepreneurship.

Long-term interest free loans to be provided to States to encourage development.

Long-term interest free loans to be provided to States to encourage development.

Projects for port connectivity, tourism infrastructure, and amenities will be taken up in islands, including

Lakshadweep.

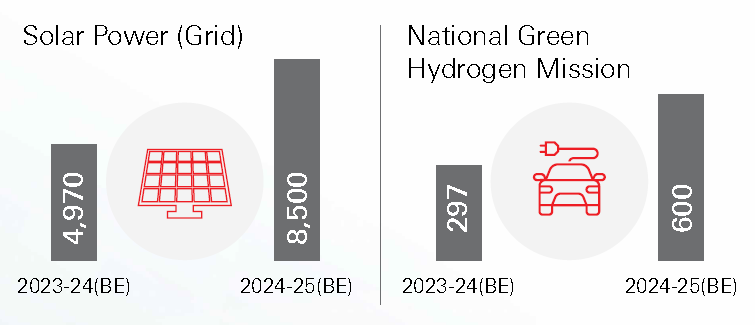

Viability gap funding for wind energy.

Setting up of coal gasification and liquefaction capacity.

Phased mandatory blending of CNG, PNG and compressed biogas.

Financial assistance for procurement of biomass aggregation machinery.

36.9 crore LED bulbs, 72.2 lakh LED tube lights, and 23.6 lakh Energy efficient fans distributed under UJALA.

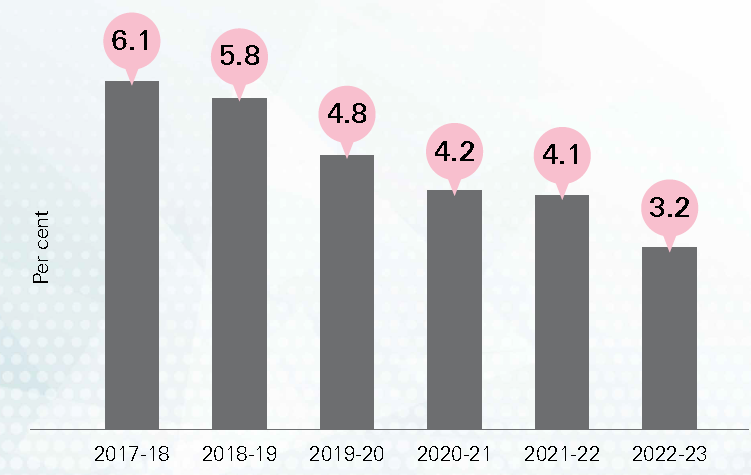

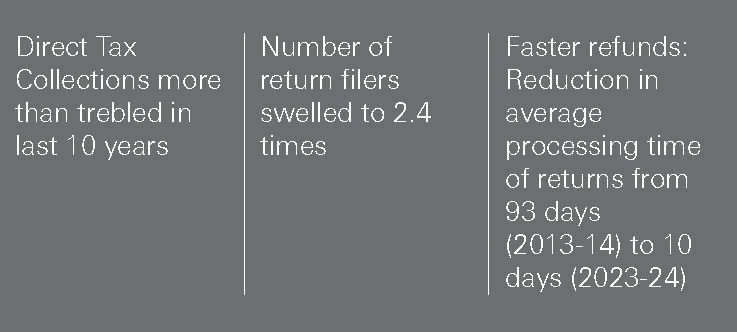

Average monthly Gross GST collections doubled to Rs.1.66 lakh crore in FY24.

Increase in tax buoyancy of State revenue from 0.72 (2012-16) to 1.22 in the post – GST period (2017-23).

Positive sentiment about GST

94% industry leasers view transition to GST as largely positive.

80% of respondents feel GST has led to supply-chain optimization.

(As per a survey conducted by a leading consulting firm)

Continuity in taxation: Certain tax benefits to Start-ups and investments made by sovereign wealth

funds/pension funds, tax exemption of some IFSC units earlier expiring on 31.03.2024 extended up to

31.03.2025.

Withdrawal of outstanding direct tax demand: –

Up to Rs. 25,000 pertaining up to FY10

Up to Rs. 10,000 for FY11-FY15

Expected to benefit approx. 1 crore taxpayers.

Retention of same tax rates: –

For direct and indirect taxes, including import duties.

For Corporate Taxes – 22% for existing domestic companies, 15% for certain new manufacturing

companies.

No tax liability for taxpayers with income up to Rs.7 lakh under the new tax regime.

Source: Union Budget Speech, www.indiabudget.gov.in