Namaskar my name is Rupesh Jadhav and welcome to Rupeshfinancialexpert Where I unlock finance knowledge, in this Blog, we are going to read about the bill of exchange, Bill of exchange is a financial instrument, which is generally used in international trade, such as a letter of credit and bank guarantee, But the purpose of all these instruments is completely different. And the working of all of them is also different. I have already made many Blogs about Letter of credit and bank guarantee, if you haven’t read those Blogs, then you must read them. We will understand about Bill of Exchange working, and in which situation it is used, what are its essential elements? What else should we keep in mind when we issue a Bill of Exchange? Or when we accept it.

So, let’s check how the Bill of Exchange concept works. As I told you in the introduction, this concept is generally used in international trade. Meaning of Bill of Exchange, but it is also used in domestic trade. Suppose the buyer is A, and he wants to buy goods from seller B, And buyer A does not have the cash to pay immediately, Or maybe he has some cash cycle, He may get this money from somewhere after 2 months, after 3 months, or after 4 months, So in such a situation, the buyer pays the seller that I want to take the goods from you on credit. So, the seller says okay I will give you the goods on credit, but you have to sign a bill of exchange. So, seller B issues a bill of exchange, And the buyer accepts it.

Remember that when we saw in the promissory note, the buyer had issued the promissory note, but here the seller is issuing the bill of exchange. So, the bill of exchange will be accepted by the buyer. All the terms will be written in it that, by this date, you will have to make all the payments. Signatures of both parties will be done; the address will be mentioned. So we will know all these in details, So once the Bill of Exchange is signed, All the terms were written in it, So buyer A will pay the seller as per the terms, So this is the whole transaction, and because here the seller has given money on loan, So he will be the creditor, and because he is issuing a bill of exchange to A so he becomes a drawer, Because he has drawn the Bill of Exchange, we can also call him the maker And the buyer will be the debtor because he has borrowed, and he will be the drawee because the bill of exchange is issued on his name, So this is the transaction.

Now let’s check what is its technical definition, it is defined under the Negotiable Act 1881, So what is its definition according to this act? Bill of exchange is an instrument in writing, so first of all, this cannot be an oral agreement, this is done in agreement writing only. Containing an unconditional order This is an order, not a promise, we saw in the promissory note that the buyer promises, because here the seller is issuing the bill of exchange, He is giving orders to the buyer., That you pay me this much and the buyer is accepting it. and it must be an unconditional order, there should not be any condition in the payment. Promissory note, which is also written in my website blog. Signed by the maker, the maker will sign, it Means the creditor Directing a certain person to pay a certain sum of money only to, or to the order of, So here the exact sum of money should be mentioned, So the money will be either paid to a certain person, Or else that person can assign someone Or to the order of, So it can also be paid to any third party, And we call that endorsement.

I will also see in detail about the endorsement, so what happens in this is that the seller assigns to a third party, that you pay this money to a third party instead of paying me. Or to the bearer of the instrument, or you can make a payment to a person who is holding that bill of exchange. If such wordings are written inside the bill of exchange, or to the bearer of the instrument, So whoever has that bill of the exchange, you will give that money to him., So this is the definition according to the Negotiable Act 1881, so that’s kind of credit As we saw in the promissory note, on a promissory note also you are giving loans or lending in a way. And a bill of exchange is also a kind of credit Lending is being done through Bill of Exchange, so which parties are involved in this? Parties involved in Bill of Exchange, there are two main parties here.

The first one is a drawer, here a drawer is a creditor who makes it, so we can also call him maker. He is a creditor basically, or he is a payee because he will get payment, The second is the drawee in whose name the bill of exchange is issued. So here he is a buyer, and we can also call it an acceptor, because it accepts bills of exchange. He is a debtor because he is borrowing. Because he has to pay, we can also call him a payer. Sometimes a third party also comes in. Which is Endorsee. As I discussed with you about the endorsement, so here a third party joined, who can receive money upon endorsement by seller or drawer, so if the seller says that you make my payment to a third party. that instead of paying to B, pay to C. So, in this case C can be the creditor of B. Maybe B has borrowed some from C. It may also happen that C has also borrowed from D. So here D can be the creditor of C. So here we write C is a creditor. So, in such cases, B will endorse C and then C will endorse D. an endorsement can be done multiple times, And the endorsement can also be done unlimited time. Until the due date of the Bill of Exchange, So the holder of the final bill of exchange is called the holder in due course. We can call it HIDC in short form.

The final holder of the Bill of Exchange. He will go to buyer A and ask him for his payment. so, when buyer A produces that bill of exchange, and after checking it if there is an endorsement on his name, he will pay him, if normal payment is done then there is no problem. But if buyer A says I can’t pay you for any reason, and suppose if he dishonours the bill, either he says that I don’t know you, or says your endorsement is not correct. or because of some other reason, or he doesn’t have money, and he dishonours the bill, so in this case the holder of due course HIDC, so in such a case, the holder can make a case against buyer A.

Now I will check how it turns out. So first let us see how many types these are. Mainly these are two types of bills. Types of Bills of Exchange, the first is an on-demand bill, Demand bill means whenever the seller or the holder in due course will demand, So A has to pay, And the second one is the term bill. The term bill means a specified future date is given, it is also called Usance bill, so in that case on the particular date, at that date, the seller has to pay A, Or who is the final holder of the bill he has to pay, Suppose HIDC’s payment gets dishonored, So in such a case, the holder can use, He can file a suit against A Or he can also file against A B C, He also files against C, or he can also file a case against B, and he can directly file a case against A, so basically a HIDC can file a suit against all prior parties. So, all prior party, from where it has been endorsed. A case may also be filed against them. and the case can file directly against the drawee, this means the case against the buyer can be filed directly. So, this was the whole concept of the Bill of Exchange.

Now I will check what are the essential requirements of the Bill of Exchange, Requirement for Bill of Exchange, the first thing it should be in writing, an oral agreement is not considered. This must be an unconditional order. There should not be any kind of condition above the payment. Like if I get money from somewhere then only, I will pay you, or if someone will die, or if there is a marriage, then I will pay you. There should not be such conditions. A drawer is a certain person, its exact name and address should be mentioned. So, all the details of the seller come. Then how much is the Exact sum payable, that should be mentioned. The name of the drawee should be mentioned, He is also a person, so the exact name and address of a buyer or a creditor should be mentioned, the date of issue and place of issue is mentioned, the maturity date is written if it is a term bill, If it is an on-demand bill, it may not have a maturity date. But it is necessary to write the maturity date in the term bill, then it is necessary to stamp it whatever stamp is required. Either you can affix the revenue stamp of that number, or you can sign it on the stamp paper. And it has to be signed by the drawer, so whoever is issuing the bill, the seller’s signature will come. Along with this, the acceptance of the drawee will come, the buyer will accept it with signature Interest is generally not charged in the bill of exchange, so here it kind of acts like a post-dated cheque. So, you gave the bill of exchange. It is mostly given for a short period, so there is no interest charge on it.

But suppose if a particular date is given on the bill of exchange, and till that time the money is not paid, so after that interest can be charged. But it is necessary to mention this thing inside the Bill of Exchange. Bill of exchange can be endorsed an unlimited time as I told you earlier, so this can be endorsed by any number of parties. Two, three, four, five or six, But before the maturity date of the Bill of Exchange. All these endorsements should be done before it, so in this way an endorsement is made on the bill of exchange. And the party in whose name the endorsement is done, his signature is also required. and he accepts the bill, And the party who is endorsing the bill gets its signature too. So, these are all essential requirements of the Bill of Exchange.

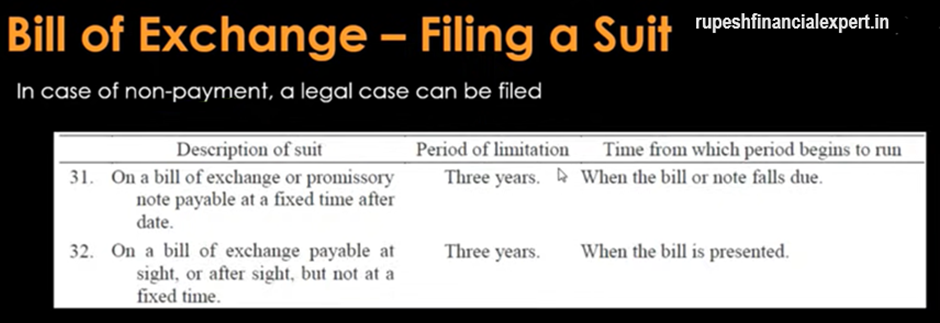

Suppose if the bill becomes non-payment or dishonoured, then what to do in case of non-payment? So, in such a case, you can file a suit and this suit can be filed for 3 years. Suppose if there is a fixed time bill of exchange, So the time till that bill of exchange is valid from there to 3 years, you can use. It is also clearly written here, When the bill or note falls the due, suppose if the bill of exchange is on-demand is then, At sight or after sight but not at a fixed time, so, whenever the bill is presented or demand from there to 3 years, you can file a case, this is as per the limitation Act law, And I have extracted the exact clipping from the Limitations law itself. So, if you want you can refer to the Limitation Act.

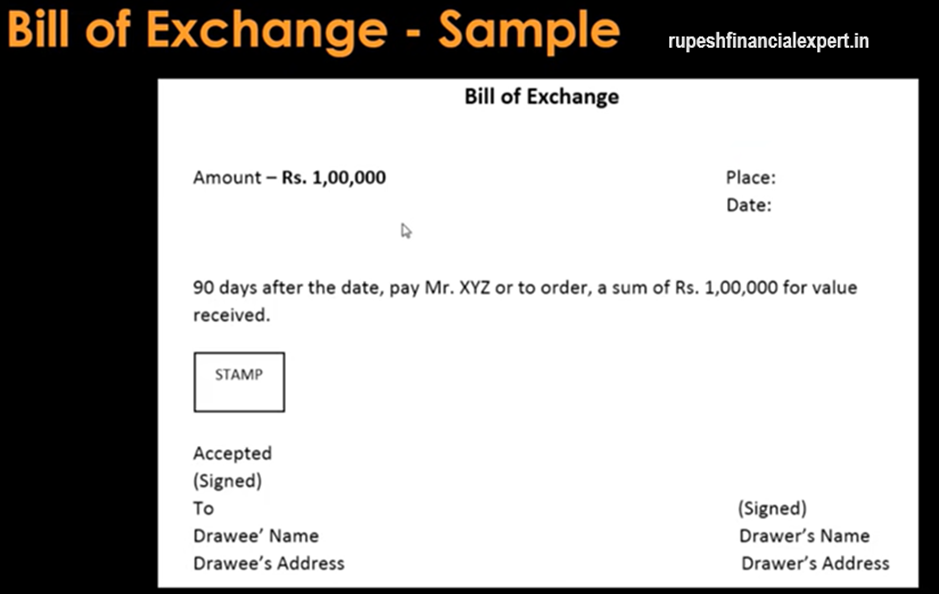

Now let’s check the samples of the Bill of Exchange, Bill of Exchange sample, Here I have given a sample of a very simple bill of exchange. Which you can use as a template. So here the exact amount is written. Suppose it is ₹ 1,00,000. So, the place of issue will be written, and the date of issue will be written. And it is clearly written 90 days after the date, so from the date which will be written, it is valid for 90 days. Pay Mr. XYZ, So whoever this has to pay the seller’s name will come, So it is called seller or drawer., So this is Rupesh he has to pay, Or to order, or its nominee, if he assigns to third party, So if someone Endorse, So he has to pay A sum of ₹1,00,000 for value received, So all the goods that have been received If ₹1,00,000 of goods are received. So that’s why the sum of ₹ 1,00,000 has to be given, All the stamps will be put. Whatever amount is to be stamped. the name and the address of the drawers came. Whoever has made the issue, his signature is done. And by writing accepted, the drawee signs. Whoever is accepting this bill of exchange means that the buyer, So the name of drawee is mentioned, The name of the buyer will came, And his address is will be mentioned, So this is how you can issue a bill of exchange, and I think I have covered all the major points of the bill of exchange, Still, if you have any doubt, then you can ask in the comment section below.

If you liked this Blog, then do comment and share it. If you have any suggestion if you want to suggest any topic for future Blogs, or if you want to share any thoughts with the community, then you can tell in the comment section below. So, see you in the next Blogs till then keep learning, keep earning and be happy as always.