The Union Budget 2025 has introduced significant tax relief for middle-class taxpayers. If your annual income is below ₹12 lakh, you may no longer be required to file an Income Tax Return (ITR). But is it really that straightforward? Let’s delve into the latest tax changes and determine if you can legally skip ITR filing.

Who Can Skip Filing ITR Under the New Tax Rules?

With the revised tax regime, the basic exemption limit has increased, simplifying tax slabs. If your total taxable income is below ₹12 lakh, you may not have to file an ITR. However, certain conditions must be met:

- Your taxable income (after deductions) is below the exemption threshold.

- You have no foreign income or overseas assets.

- You haven’t deposited ₹50 lakh or more in a current account.

- Your foreign travel expenses didn’t exceed ₹2 lakh.

- Your bank hasn’t deducted TDS requiring a refund claim.

If none of these conditions apply to you, you can legally skip filing an ITR. However, voluntarily filing an ITR can still be advantageous.

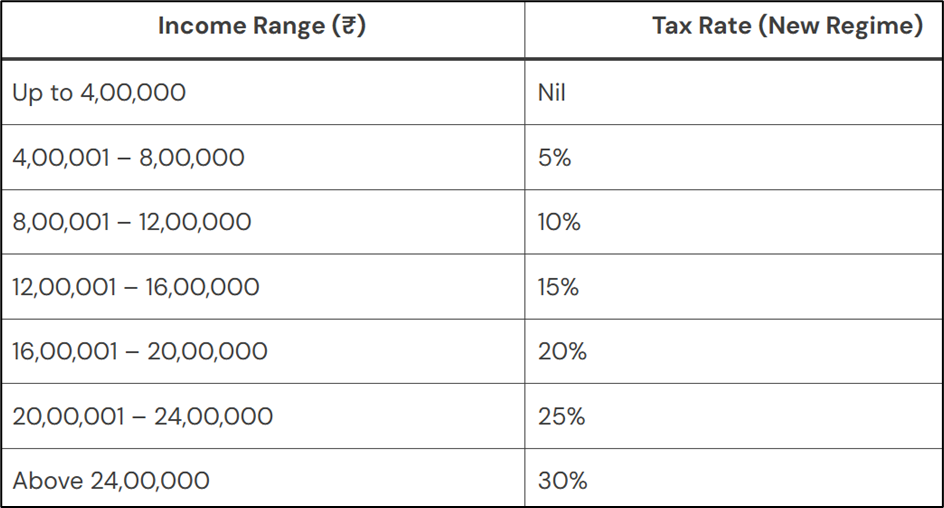

Revised Income Tax Slabs for FY 2025-26 (New Regime)

The government has introduced lower tax rates to encourage taxpayers to opt for the new tax regime. Here’s a breakdown of the latest slabs:

Additionally, salaried individuals benefit from a standard deduction of ₹75,000. This means that those earning up to ₹12.75 lakh may have zero tax liability.

Should You Still Consider Filing an ITR?

Even if you’re not legally required to file an ITR, doing so can provide various benefits:

- Tax refunds: If TDS was deducted from your income, filing an ITR allows you to claim a refund.

- Loan approvals: Banks often require ITR records for home, car, and personal loans.

- Visa applications: Many countries mandate ITR filings as part of their visa approval process.

- Loss carry forward: If you’ve incurred stock market or business losses, filing an ITR lets you offset them against future gains.

- Enhanced financial profile: A consistent history of ITR filings can strengthen your financial credibility for investments and tax planning.

Did You Know?

With effective tax planning, a ₹12 lakh salary can be brought down to a taxable income of ₹5 lakh, making you eligible for a 100% tax rebate under Section 87A. This means zero tax liability!

Final Takeaway: Should You Stop Filing ITR?

If your taxable income is below ₹12 lakh and you don’t meet any of the special conditions, you can legally stop filing an ITR. However, voluntary filing still offers financial and legal benefits. Evaluate your financial situation carefully and make an informed decision!

Disclaimer

This article provides general information and should not be considered legal, tax, financial, or professional advice. Tax laws are subject to change, and individual circumstances vary. Readers should consult qualified professionals or official government sources for personalized guidance. The author and publisher are not responsible for any decisions made based on this information.