Introduction

I am pleased to share the Income tax related guidelines with you for your best knowledge. The

user must read the guidelines carefully and use own discretion while using the same.

Guidelines

This year Income Tax Department has added ‘New Tax Regime’ for employees to opt in for Income

Tax calculation, however they can opt in ‘Old Tax regime’ to get the income Tax calculated. The

employee can choose the Tax Regime only once in the financial year, hence the tax regime which

has already been chosen by you shall be used for ‘Actual’ investments. As a taxpayer, please check

the slab that is applicable to you.

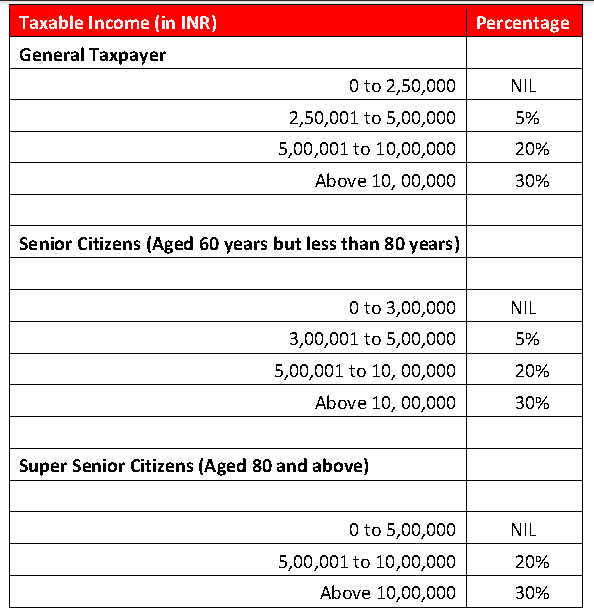

I. Income Tax Slabs

As per Old Tax Regime

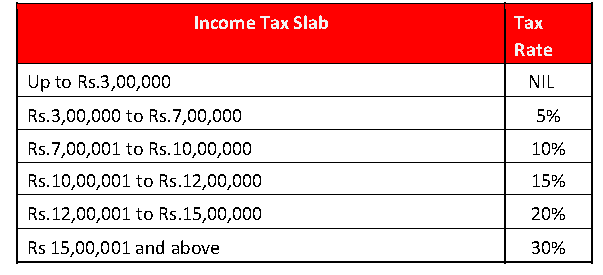

As per New Tax Regime F.Y. 2024-25

Standard deduction:

- A standard deduction of Rs.50,000/- for Old Tax Regime and Rs.75,000/- for New Tax Regime is allowed for all employees.

Surcharge:

- Surcharge: 10% of income tax, where total income exceeds Rs.50 lakh up to Rs.1crore.

- Surcharge: 15% of income tax, where the total income exceeds Rs.1 crore up to 2crore.

- Surcharge: 25% of income tax, where the total income exceeds Rs.2 crore to 5 Crore.

- Surcharge: 37% of income tax, where the total income exceeds Rs.5 crore. Cess: 4% on total of income tax + surcharge.

- Only Surcharge: 25% of income tax, where the total income exceeds Rs.2 crore. Cess: 4% on total of income tax + surcharge for new tax Regime and rest above all same.

Note:

Old Regime: – Finance Act 2021 has provided relief in the form of rebate to individual taxpayers,

resident in India, having total income not exceeding Rs. 5,00,000. The amount of rebate is

Rs.12,500 or the amount of tax payable, whichever is lower. It is deductible from Income-Tax

before calculating Education Cess.

New Regime: – Finance Act 2024 has provided relief in the form of rebate to individual taxpayers,

resident in India, having total income not exceeding Rs. 7,00,000. The amount of rebate is

Rs.20,000 or the amount of tax payable, whichever is lower. It is deductible from Income-Tax

before calculating Education Cess.

II. GENERAL GUIDELINES

- Incomplete forms shall not be accepted.

- Income tax benefit claimed through the declaration will not be approved if the proofs are not available.

- All investments and payments must be made between 1st April 2024 and 31st March 2025 to be eligible for tax consideration.

- Name, date, amount must be clearly visible in all the investment proofs submitted. Employee name and number is required on all the documents.

Exemptions U/S 10

There are no exemptions allowed under New Tax Regime. The exemptions allowed under

Old Tax regime shall be as follows:

(a) Leave Travel Allowance (LTA) – (If employee travelled in current F.Y.2024-25)

- LTA can be claimed twice in a block of 4 years. The current block of 4 years is calendar year i.e. Jan-2022 to Dec-2025.

- The travel must be within India.

- The tax exemption is limited to the journey from the place of origin to the farthest point reached by the shortest route.

- Where no public transport system exists, first class A/C rail fare would be considered as exemption for the distance of the journey by the shortest route.

- The Employee should be on leave in the period for which LTA is claimed.

- The LTA exemption shall be restricted to the extent of bills submitted or LTA payable to the employee whichever is the least.

- The bills provide must be in Original (No photocopies).

- Bills produced must match with your leave dates of current financial year.

- Boarding pass is a must in case of Air travel.

- The details of co-passengers must be provided so that to ensure that the family members travelled along with the employee.

- The bills must not be overwritten / altered.

(b) Housing Rent Allowance (HRA) Least of the following is exempt

- Actual HRA Received

- 40% of Salary (50%, if house situated in Mumbai, Kolkata, Delhi or Chennai)

- Rent paid minus 10% of salary

(Salary definition = Basic + DA (if part of retirement benefit) + Turnover based commission)

Proofs required and verified as follows:

- Notarized Leave & license agreement between the employee and the landlord for the period of house occupancy.

- Original rent receipts with the details mentioning below:

1. Name and address of the landlord and rented property

2. Date of rent receipt

3. Period for the rent received

4. Amount (In Figure and in Words)

5. Mode of payment (If cheque then details)

6. If paid in cash and above Rs.5,000/- then Revenue stamp is compulsory. - As per rule if annual rent paid by the employee exceeds Rs.1 Lakh per annum, it is mandatory for the employee to report PAN of the landlord to the employer.

- In case the landlord does not have a PAN, a declaration to this effect from the landlord along with the name and address of the landlord should be filed by the employee.

- HRA exemption cannot be claimed if the employee staying in own house OR does not pay rent even if HRA is part of Salary received.

Deductions Under Chapter VI-A

There are no Deductions allowed under New Tax Regime.

The following points are checked for all the documents submitted for chapter VI-A.

1. The documents must be in the employee’s name.

2. The document date must be within the current financial year i.e., 2024-25.

3. The documents should be not overwritten.

(a) 80C_Public Provident Fund

- Contribution made by an individual to a Recognized Provident Fund

- For Self, Spouse and Children

Proof required: Copy of the passbook which shows the name and account number of the

depositor and stamped deposit receipt.

(b) 80C_ Tuition Fees

- Tuition fees, whether at the time of admission or thereafter, paid to any university, college, school or other educational institution situated in India

- For the purpose of full-time education of any two children of the employee, full-time education includes play-school activities, prenursery and nursery classes.

- Except the amount representing payment in the nature of development fees, donation, capitation fees or payment of similar nature.

- For School going children

Proof required: Receipt issued by the educational institution.

(c) 80C_Life Insurance Premium

- Payment of insurance premium to effect or to keep in force an insurance on the life of the individual, spouse or any child of the individual.

- For Self, Spouse and Children

Proof required: LIP premium receipts. The receipt should pertain to current financial year i.e., 1st April 2024 to 31st Mar 2025. - Premium for Feb & March will be considered based on a declaration (form is available on Website).

- This declaration needs to be supported by receipts for the previous month, quarters, or the previous financial year, as the case may be. Declarations without these receipts will not be considered for exemption.

(d) 80C_Principal Repayment of Housing Loan

- Payments made towards any instalment or part payment of the amount due under any self-financing or other scheme of any Development Authority, Housing Board etc. for the purpose of purchase or construction of a residential house property.

Proof required: Certificate from the recognized body (Banks /Financial institutions / LIC Housing Finance etc.) giving the breakup of Principal and Interest repayment in the Financial Year.

Schedule of re-payment / Account Statement will NOT be considered as valid proof.

(e) 80C_ NSC and/or Interest on NSC

- Any sum paid or deposited during the year as a subscription to any such saving certificates.

Proof required: Copy of the NSC certificate.

(f) 80C_ Time deposits with Post Office

- Any investment as five-year time deposit in an account with Post Office.

Proof required: Copy of the certificate with remark that the deposit is eligible for tax benefit under the Income Tax Act.

(g) 80C_ Contribution in unit-linked insurance plan

- Any sum paid as contribution for participation in the Unit Linked Insurance Plan. – For Self, Spouse and Children

Proof required: Copy of the receipt or investment certificate showing the details of the Employee Name, Investment Date, Amount, Type of Investment. In case of SIP the number of instalments will be arrived at & considered up to March 2025. - Acknowledgement of the proposal/application form will not be considered as Proof.

(h) 80C_Contribution to notified Equity Linked Saving Scheme of Mutual Fund and Infra Bond

- Any subscription made to any units of any Mutual Fund or investments made in plans formulated in accordance with Equity Linked Saving Scheme.

- For Self, Spouse and Children.

Proof required: Copy of the receipt or investment certificate showing the details of the Employee Name, Investment Date, Amount etc. - In case of SIP the number of instalments will be arrived at & considered up to March 2024.

- Acknowledgement of the proposal/application form will not be considered as Proof.

- Copy of the infrastructure Bond certificate received from the recognized body with mentioning that the investment is eligible for benefit under the Income Tax Act.

(i) 80C_Sukanya Samriddhi scheme

- Any sum paid or deposited during the year as a subscription in the scheme.

- In the name of employee or a girl child of that employee including a girl child for whom the employee is the legal guardian.

Proof required: Copy of passbook which shows the name, account number, period of deposit and amount.

(j) 80C_Others

- Stamp duty & Registration

Proof required: Proof of Stamp duty & Registration payment of current year. - Term deposit for a fixed period of not less than five years with a scheduled bank Proof required: Copy of the certificate with remark that the deposit is eligible for tax benefit under the Income Tax Act.

(k) 80CCC_Life Insurance Pension Scheme

- Amount paid or deposited for any annuity plan of Life Insurance Corporation of India or any other insurer for receiving pension from the Fund.

- Section 80CCC of the Income Tax Act of 1961 provides deductions of up to Rs. 1.5 lakhs per annum for contributions made by an individual towards specified pension funds that are offered by a life insurance. The deduction is within the limit of section 80C.

Proof required: Submit pension scheme receipts or bank statement which shows the contribution to certain Pension Funds.

(l) 80CCD (1) Contribution to Pension Scheme of Central Govt.

Employee’s contribution to National Pension scheme or as may be notified as Central Government under section 80CCD.

Maximum deduction allowed is least of the following.

1. 10% of salary (in case taxpayer is employee)

2. Rs 1.5 Lakh (limit allowed u/s 80C)

Proof required: Submit pension scheme receipts or bank statement which shows the contribution to certain Pension Funds.

(l) 80CCD (1B) Contribution to Pension Scheme of Central Govt.

- Deduction allowed under section 80 CCD(1B) is an additional deduction over and above Rs.1,50,000 u/s 80C, in respect of any amount paid in the NPS up to Rs. 50,000/-.

Proof required: NPS Transaction Statement having PRAN (Permanent Retirement Account Number)

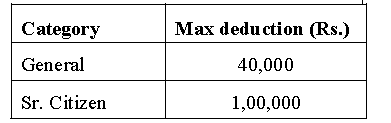

(a) 80D_Medical insurance for self, spouse and dependent children.

- Maximum limit – Rs.25,000/- (Rs.50,000/- for Sr. citizen) (The above limit includes amount paid towards preventive health check-up up to Rs.5,000/-).

80D2(B)_ Medical Insurance for Parents - Maximum limit – Rs.25,000/- (Rs.50,000/- for Sr. citizen)

- Proof required: Copy of the premium paid receipts of Mediclaim policy.

- Premium paid in cash is not eligible as deduction as per Income Tax rule.

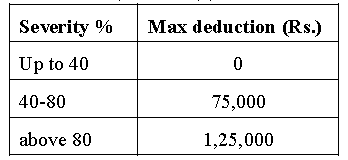

(b) 80DD_Medical treatment on Handicapped dependent

- Any expenditure incurred for the medical treatment (including nursing), training and rehabilitation of a disabled dependent.

Proof required: Copy of the certificate issued by the medical authority (Form 10-IA)

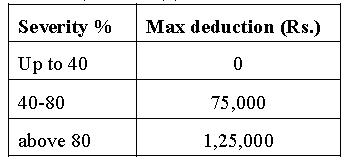

(c) 80U_Deductions in respect of a person with disability

Proof required: Copy of the certificate issued by the medical authority (Form 10-IA)

(d) 80DDB_Medical Treatment on Specified diseases and ailments for Self and Dependant

- Actual expenditure incurred for the medical treatment (including nursing), training and rehabilitation of a disabled dependent.

Proof required: A prescription from a specialist as specified in the Rules containing the name and age the patient, name of the disease/ailment along with the name, address, registration number & qualification of the specialist issuing the prescription would now be required. - Bills of actual expenditure incurred

(e) 80E_Deduction in respect of interest on loan taken for higher education

- The deduction allowed for the financial year in which the employee starts paying the interest on the loan taken and immediately succeeding seven financial years or until the financial year in which the interest is paid in full by the employee, whichever is earlier.

- For self, spouse, children or the student for whom he is the legal guardian.

Proof required: Certificate from bank or specified financial institutions.

(f) 80EE_Additional deduction of Rs.50,000 for Interest Home loan

- This deduction is over and above the Rs 2 lakhs limit under section 24 of the income tax act.

- The deduction allowed under this section is for interest paid on home loan up to maximum Rs 50,000 per financial year.

- You can claim this deduction until you have fully repaid the loan.

Main conditions: - This is the 1st house you have purchased (As on the date of sanction of loan no other houseis owned by you).

- Value of this house is Rs 50 lakhs or less.

- Loan taken for this house is Rs 35 lakhs or less.

- Loan has been sanctioned by a Financial Institution or a Housing Finance Company.

- Loan has been sanctioned between 01.04.2016 to 31.03.2017.

(g) 80EEA_Additional Rs.150,000 Home loan Interest Deduction

- This deduction is over and above the Rs 2 lakhs limit under section 24 of the income tax act.

- The deduction allowed under this section is for interest paid on home loan up to maximum Rs 1,50,000 per financial year.

- You can claim this deduction until you have fully repaid the loan.

Main conditions: - This is the 1st house you have purchased (as on the date of sanction of loan no other house is owned by you).

- The stamp duty Value of this house is Rs 45 lakhs or less.

- Loan has been sanctioned by a Financial Institution or a Housing Finance Company.

- Loan has been sanctioned between 01.04.2019 to 31.03.2022.

(h) 80EEB_ Purchase of Electric Vehicle loan Interest Deduction

- New section added this financial year onwards i.e., The loan should be sanctioned between the period from April 1, 2019, to March 31, 2023.

- The deduction allowed under this section is for, interest payable on loan taken by him from any financial institution for the purpose of purchase of an electric vehicle up to maximum Rs 1,50,000 per financial year.

- You can claim this deduction until you have fully repaid the loan.

Main conditions:

(a) “electric vehicle” means a vehicle which is powered exclusively by an electric motor whose traction energy is supplied exclusively by traction battery installed in the vehicle and has such electric regenerative braking system, which during braking provides for the conversion of vehicle kinetic energy into electrical energy.

(b) “financial institution” means a banking company to which the Banking Regulation Act, 1949 applies, or any bank or banking institution referred to in section 51 of that Act and includes any deposit taking non-banking financial company or a systemically important non-deposit taking non-banking financial company as defined in clauses (e) and (g) of Explanation 4 to section 43B.’.

(i) 80TTA_Interest on savings account (Applicable to individuals except senior citizens)

- Deduction in respect of interest on deposits in savings account (Maximum limit Rs.10,000)

Proof required: Copy of passbook / bank statement which shows the name, account number, period and amount.

(j) 80TTB_Interest on all kind of deposits (Applicable to senior citizens)

- Deduction in respect of interest on all kind of deposits (Maximum limit Rs.50,000)

Proof required: Copy of passbook / bank statement which shows the name, account number, period and amount.

(k) 80GG_Deduction in respect of house rent paid for own residence

Main conditions:

- Employee should not receive HRA from his employer as salary.

- The employee, his wife or his minor child should not have the ownership of the property where he resides.

- In case the employee owns a place other than his rented place of accommodation then he should not be claiming tax benefit on such property as self-occupied property. Such property would be deemed to be let-out.

Documents required: - Employee needs to furnish documents like rent agreement and rent receipts.

- If annual rental payment exceeds Rs. 1 lakh then also need to furnish PAN details of your landlord.

- To claim deduction employee needs to file Form 10BA. This form proves that the employee is not claiming benefit of self-occupied property in any other location or the location where he is employed.

Deduction Available (Least of the following): - Rs. 60,000 per year (i.e., Rs. 5,000 per month)

- An amount equal to the total rent paid minus 10% of the total income.

- 25% of total income of employee

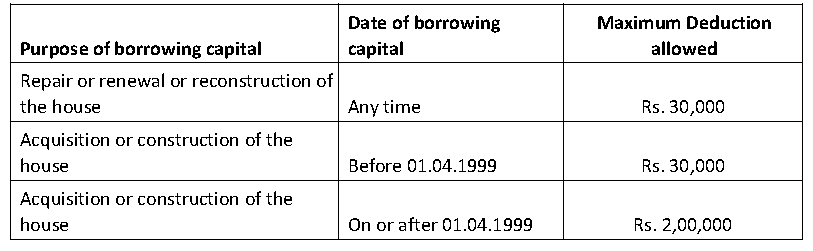

(a) Interest on Housing Loan for Self-occupied property -Sec 24(b)

- Deduction is allowed only in case of house property which is owned and is in the occupation of the employee for his own residence.

- However, if it is not occupied by the employee in view of his place of the employment being at other place, his residence in that other place should not be in a building belonging to him.

The quantum of deduction allowed as per table below:

- The acquisition or construction of the house should be completed within 5 years from the end of the FY in which the capital was borrowed.

- Hence, it is necessary to have the completion certificate of the house property against which deduction is claimed either from the builder or through self-declaration from the employee.

- Proof required: Home Loan Provisional Interest Certificate and joint home loan declaration form with Possession letter / last month light bill / property tax certificate/ completion certificate / letter or certificate from society or any other proof which show its self-occupied property with same address on Provisional Certificate.

- Further any prior period interest for the FYs up to the FY in which the property was acquired or constructed shall be deducted in equal instalments for the FY in question and subsequent four FYs.

- The employee has to furnish a certificate from the person to whom any interest is payable on the borrowed capital specifying the amount of interest payable.

- In case a new loan is taken to repay the earlier loan, then the certificate should also show the details of Principal and Interest of the loan so repaid.

(b) Income/loss from House (Let-out) Property

- Please Provide calculation of Income/Loss from house property in case the property is let out.

- Furnishing of the evidence or particulars in Form No. 12BB in respect of deduction of interest as specified in Rule 26C.

Perquisites

As per New Tax Regime, if the employer contribution to Provident Fund,

Superannuation Fund and Pension Scheme u/s 80CCD, exceeds Rs.7,50,000/-, then the amount

exceeding Rs.7,50,000/- shall be considered as perquisite.

Thanks…!!