The Indian government has introduced the Income Tax Bill 2025 to modernize and streamline tax laws, replacing the outdated Income Tax Act of 1961. This reform is designed to enhance transparency, simplify compliance, and make tax provisions easier to understand for individuals and businesses alike.

Major Changes in the Income Tax Bill 2025

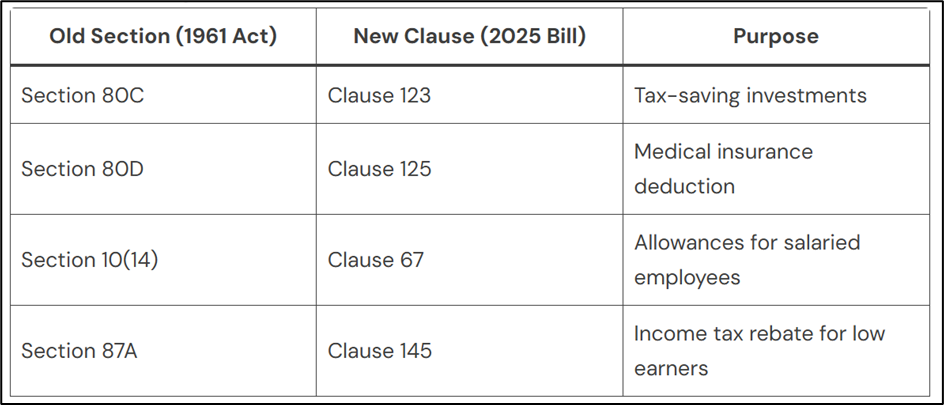

The bill brings several significant updates, including the renaming and restructuring of key sections. One of the most notable changes is the renumbering of frequently used provisions, such as the well-known Section 80C, which is now Clause 123.

New Section Mapping – Then vs. Now

The renumbering aims to provide clarity and simplify the tax code. Below is a comparison of some major changes:

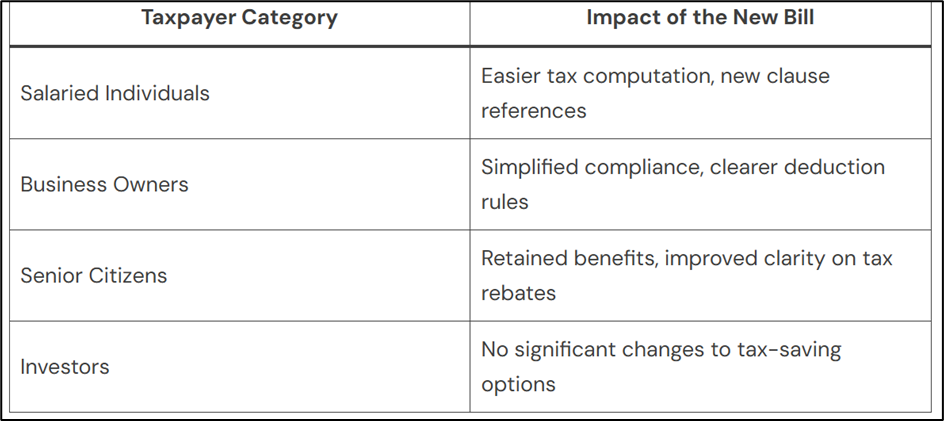

What This Means for You

Taxpayers Must Adapt to New Numbering

With the restructuring of sections, taxpayers need to familiarize themselves with the updated clause references to ensure compliance.

Same Deductions, Different Codes

While the numbering has changed, most tax-saving benefits and deductions remain intact, ensuring continuity for taxpayers.

Introduction of the ‘Tax Year’ Concept

The bill introduces the term ‘tax year,’ replacing the previously used ‘assessment year’ and ‘previous year,’ reducing confusion in tax filing.

Impact on Different Taxpayer Categories

Interesting Fact

The 2025 tax bill is more concise than the 1961 Act! The new law consists of 536 sections across 622 pages, whereas the previous law had 298 sections spanning 823 pages.

Final Thoughts

The Income Tax Bill 2025 represents a crucial reform aimed at simplifying tax laws and ensuring better compliance. While the changes may initially require some adjustments, they ultimately intend to make tax filing more straightforward. Taxpayers should stay updated on the new clauses and consult professionals if needed to avoid any filing errors.

Disclaimer

The information in this article is intended for general informational purposes only and does not constitute legal, tax, financial, or professional advice. Tax laws may change, and individual circumstances vary. Readers are encouraged to consult qualified professionals or official government resources for personalized advice. The author and publisher disclaim any liability for actions taken based on this information.